• The number of people saving in a workplace pension scheme remained stable during lockdown, new data shows (Workplace pension participation and savings trends of eligible employees: 2009 to 2020 - GOV.UK (www.gov.uk))

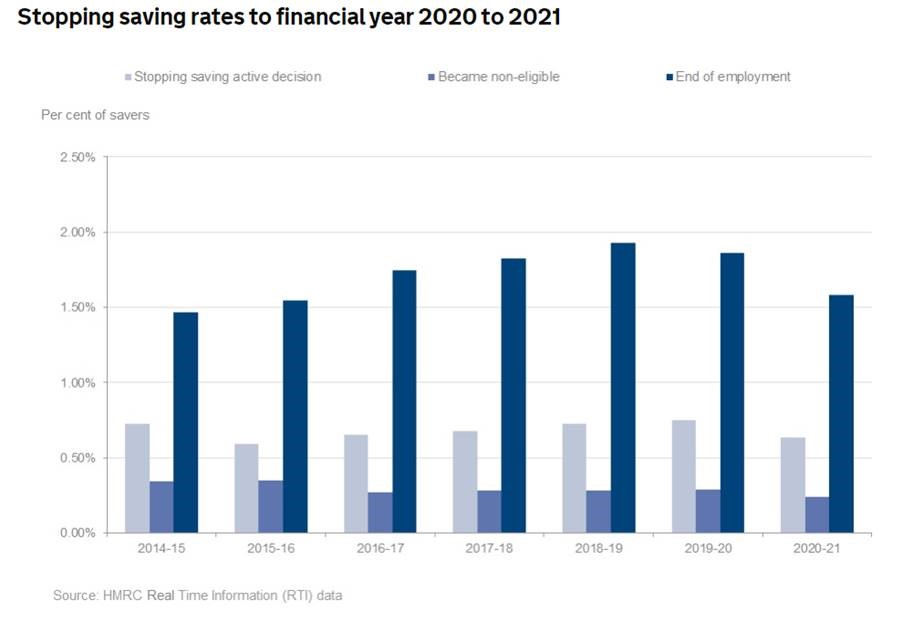

• Encouragingly, there was a small drop in the proportion of workers opting out of their workplace scheme per month, from 0.75% in 2019/20 to 0.63% in 2020/21

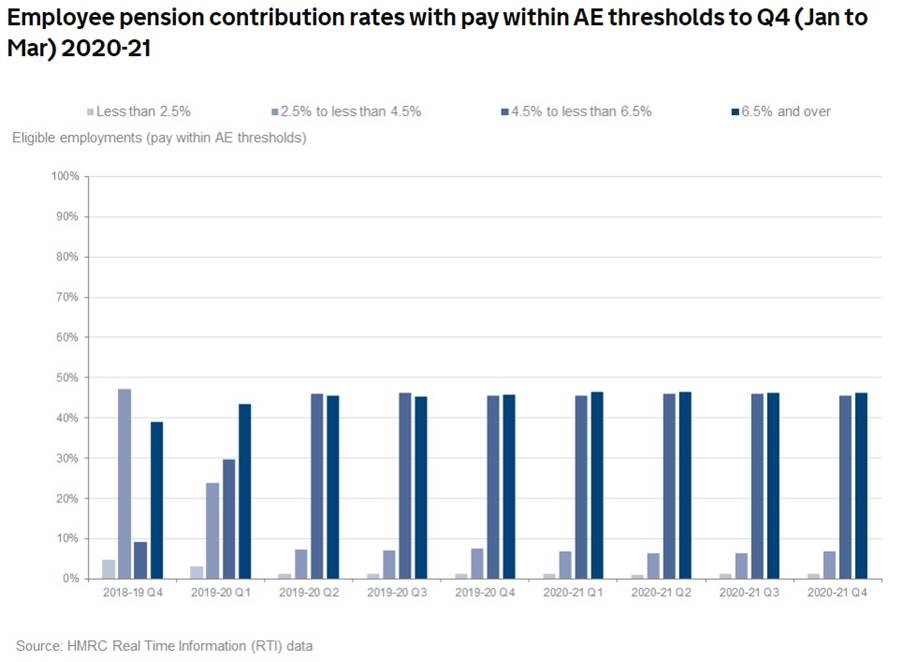

• Contribution rates also held firm, with most employees contributing more than 4.5% of relevant earnings to their retirement

• However, some of those most affected by the pandemic – including the self-employed – aren’t eligible for automatic enrolment

Tom Selby, head of retirement policy at AJ Bell, comments: “There was a fear that the financial pressures caused by the pandemic and subsequent lockdown would blow a hole in people’s retirement plans.

“Despite the uncertainty facing millions of savers in 2020/21 the majority have stuck with their workplace pension, benefitting from both upfront tax relief and matched employer contributions in the process.

“Although overall many are still saving too little to enjoy a comfortable retirement, the fact automatic enrolment held firm during the most turbulent 12-month period in living memory is hugely encouraging.

“The challenge is not over, however. The UK economy has been held together by hundreds of billions of pounds of state support, primarily provided through the furlough scheme. As this support is withdrawn, policymakers will need to keep an eagle eye on both the unemployment rate and any knock-on impacts on retirement saving.

“It’s also worth remembering there are millions of people, including the low paid and self-employed, who are not part of auto-enrolment, with many saving little or nothing for their financial future.

“Ensuring as many people as possible understand the importance of saving both for the short and long-term – and the potential consequences of failing to do so - must be an absolute priority for Government, regulators and the wider pensions industry.”