“The world of jump racing is still reeling from the news that Ryanair’s Michael O’Leary is to stop buying horses and wind down his Gigginstown Stud bloodstock empire and William Hill’s trading statement today shows that the bookmaker is still trying to recover from impact of the regulatory reduction in maximum stakes for Fixed Odds Betting Terminals,” says Russ Mould, AJ Bell Investment Director.

“The cut on 1 April in the maximum wager on the machines in shops from £100 to £2 has eaten into William Hill’s retail takings, which fell 7% year-on-year.

“A second consecutive triumph for Mr O’Leary’s valiant gelding Tiger Roll in the Grand National, the hot favourite at 4-1, and a season-ending string of victories for Manchester City and Liverpool in football’s Premier League, will have had something to do with the 0.4 percentage-point drop in the bookie’s gross win margin too, as the punters got the better of their old enemy.

“However, online revenues rose 8%, thanks in part to the acquisition of Sweden’s Mr Green, although again favourable result for the punters weighed on margins.

“Better still, the US showed tremendous progress.

“Total net revenues rose 48% Stateside as William Hill began to capitalise upon 2018’s repeal of 1992’s Professional and Amateur Sports Provision Act, which permitted the legalisation of sports betting on a state-by-state basis.

“So far nine US states have taken the plunge and legalised sports betting – Nevada, Delaware, Indiana, Iowa, Mississippi, New Jersey, Pennsylvania, Rhode Island and West Virginia. William Hill is already active in seven of them, thanks in part to the bridgehead into the US market built via three acquisitions in 2011 and a relationship with New Jersey’s Monmouth Park racetrack.

“The exceptions are Indiana and Iowa, which have just passed legislation and William Hill’s partnership with Eldorado Resorts should mean the British firm is up and running there very quickly.

“More states look likely to follow soon, including Montana leading the race and fierce debate over constitutional change underway in Tennessee, Colorado, New Hampshire and Tennessee.

“For all of the potential of the US business – where Nevada is already very profitable – Hills’ shares have plunged by 40% since America began to deregulate, thanks to much tighter betting rules in Australia and then the UK, which have crimped profits and forced a dividend cut.

|

|

William Hill, 2018 |

|||

|

£ million |

Online |

US (existing) |

US (expansion) |

Retail |

|

|

|

|

|

|

|

Net revenues |

634.4 |

79.7 |

11.8 |

895.2 |

|

Adjusted operating profit |

130.2 |

32.6 |

(33.2) |

150.3 |

Source: Company accounts. Excludes £47 million in group overhead and corporate costs

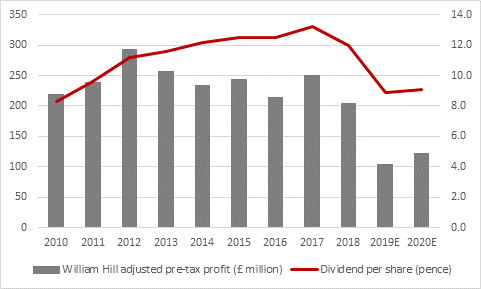

“Further pressure on income and the dividend is possible as the FOBT stakes cut and investment in the USA bring further pressure to bear. Start-up costs in the USA came to £33 million in 2018. The issue for Hills now is whether online can compensate for weak retail income in the UK and how quickly investments in America can pay-off as a huge market starts to open up, because the trend in the bookie’s profitability this decade is a depressingly downward one.

Source: Company accounts, Sharecast, consensus analysts' forecasts for 2019 and 2020

“If the US really does take off that could still be the catalyst for William Hill’s share price to raise a gallop once more.

“And don’t forget that the bookmaker has had a string of different owners since the death of William Hill himself in 1971, starting with retail group Sears, and then Grand Metropolitan’s Mecca Bookmakers organisation (1988), Brent Walker (1989), Nomura (1997), a private equity consortium (1999) and then the great British public after the 2002 stock market listing.

“A joint bid from 888 and Rank failed back in 2016 but if Hills does hit the jackpot in the USA, that could just attract another predator, given the wave of consolidation which continues to sweep across the gambling industry.“

APPENDIX: BRITISH BOOKMAKING: MAJOR EVENTS TIMELINE

1998

Ladbrokes buys Coral from Bass but is forced to sell it by the Monopolies and Mergers Commission

1999

After a management buy-out, Coral merges with Eurobet

BetFred buys Demmy Racing

Victor Chandler moves its HQ to Gibraltar, having obtained a licence there in 1996

2000

Bet365 begins trading

Betfair begins trading

Betandwin floats on the Vienna stock exchange, three years after its launch

2001

SkyBet begins trading

2002

William Hill floats on the London Stock Exchange

888 Holdings is established

2003

Candover-Cinven private equity consortium buys Gala

2004

GVC lists on London’s AIM market

Done Bookmakers renames itself Betfred

2005

Gala buys Coral-Eurobet

William Hill buys Stanley Leisure

PartyGaming floats on the London Stock Exchange, eight years after its launch

2006

Betandwin changes its name to bwin

2007

Stan James acquires Betdirect from 32Red

2008

Stan James acquires Betterbet

2010

Betfair floats on the London Stock Exchange

2011

Betfred buys the Tote (and a seven-year exclusive licence for pool betting)

William Hill buys American Wagering and two other US businesses

Bwin Interactive mergers with PartyGaming

2012

Rank acquires Gala Coral’s casinos

William Hill and GVC jointly acquire and break up Sportingbet

2014

BetVictor is acquired by Michael Tabor

Sky sells a stake in SkyBet to CVC

2015

Unibet (Kindred) buys Stan James’ online business

William Hill makes an unsuccessful bid for 888

2016

Ladbrokes mergers with Gala-Coral to form Ladbrokes-Coral

Paddy Power merges with Betfair

GVC acquires bwin.party

888 and Rank make a failed bid for William Hill

Amaya makes a failed bid for William Hill

2017

Kindred acquired 32Red

2018

GVC acquires Ladbrokes-Coral

Stars Group acquires SkyBet

William Hill acquires Sweden’s Mr Green

2019

888 acquires BetBright