“A pair of exchange-traded funds (ETFs), quoted trackers designed to deliver to investors the performance of a basket of marijuana-related stocks both fell heavily in response to Sessions’ policy initiative.

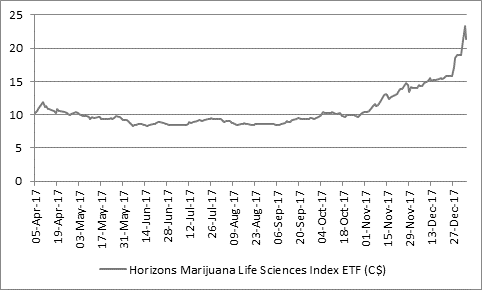

“The Horizons Life Sciences Index ETF, launched in Canada in April 2017 with the ticker HMMJ, fell nearly 9%.

Source: Thomson Reuters Datastream

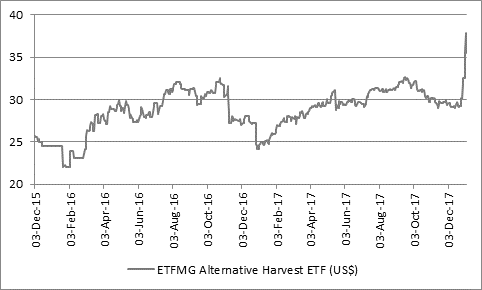

“The ETFMG Alternative Harvest ETF, which began trading in its current form only on 26 December in New York (ticker MJX) after switching focus from being a Latin American real estate tracker, fell 6%, to erase some of the strong gains it had made since becoming a pot-focused fund.

Source: Thomson Reuters Datastream

Note that MXJ traded as Tierra XP Latin America Real Estate ETF, with the ticker LARE, from 3 December 2015 to 25 December 2017

“The ETFMG Alternative Harvest ETF had done particularly well owing to California’s legalisation of recreational marijuana sales on 1 January, to follow similar moves in five other states. The Sessions plan is therefore an unexpected and unwelcome development for investors in the fund and a hard crackdown cannot be ruled out, given that overdose death rates in the US reached a record high in 2016 of 52,404 (with two-thirds of those attributed to opioids by the National Center for Health Statistics) and looked set to surge again in 2017.

“However, the Attorney General has yet to make public the details of his proposed policies and holders of the fund may be inclined to take a more relaxed stance, in the view that law enforcement agencies do not have the resources to aggressively pursue and prosecute users and that medical research is certain to continue.

“Perhaps the biggest lesson to learn is how the Sessions plan emerged barely a week after Wall Street unveiled a new product to play the cannabis theme.

“This brings echoes of legendary investor Warren Buffett’s warning from his 2000 letter to shareholders about technology stocks:

‘The line separating investment and speculation, which is never bright and clear, becomes blurred still further when most market participants have recently enjoyed triumphs. Nothing sedates rationality like large doses of effortless money … But a pin lies in wait for every bubble. And when the two eventually meet, a new wave of investors learns some very old lessons: First, many in Wall Street - a community in which quality control is not prized - will sell investors anything they will buy. Second, speculation is most dangerous when it looks easiest.’

“It remains to be seen whether Wall Street’s quality control has gone astray again with the launch of cannabis-related ETFs, but this week’s regulatory and stock market price action is another reminder than investors should only invest when they understand the potential dangers – and the share price downside – as well as the opportunities and the potential upside.”

Appendices

The Horizons Life Sciences Index ETF is quoted on the Toronto Stock Exchange in Canada. It is designed to replicate the performance of the North American Marijuana Index and deliver that performance to investor, net of its own running expenses. It owns a basket of the 28 stocks that form the index, of which the UK’s GW Pharmaceuticals is the sixth-largest holding, behind four Canadian firms – Aurora Cannabis, Canopy Growth, Aphria and Medreleaf – and one American one, Scotts Miracle-Gro.

The ETFMG Alternative Harvest ETF is quoted on the NYSE Arca exchange in America, which specialises in trading stocks, options and exchange-traded funds. The instrument is designed to deliver the performance of 30 the globally-quoted stocks which form the Prime Alternative Harvest Index, adjusted for the ETFs annual running costs. All of the stocks could benefit from increased medical research into the use of marijuana and a broader drive to increase its scientific and recreational use. One UK stock features in the fund’s 10 largest holdings, namely GW Pharmaceuticals, although Imperial Tobacco and British American Tobacco represent 4.5% of the managed assets. Other portfolio names include the Canadian stocks Cronos, Aurora Cannabis and Medreleaf. Note that all 30 names operate entirely legally and no pot shops or retailers feature as they do not have federal authorisation.