“A sub-index of the headline GfK figure is the Major Purchase score, which asks survey respondents whether now is a good time to make a large outlay. That reading has slipped to zero, down from one in the prior month. Investors may have to ask themselves whether this gloomy outlook could start to affect the housing market, if hard-pressed consumers really do start to pull in their horns. After all, there is no more major financial commitment than taking out a mortgage to buy a property.

“This makes Friday’s UK mortgage approvals form the Bank of England all the more interesting.

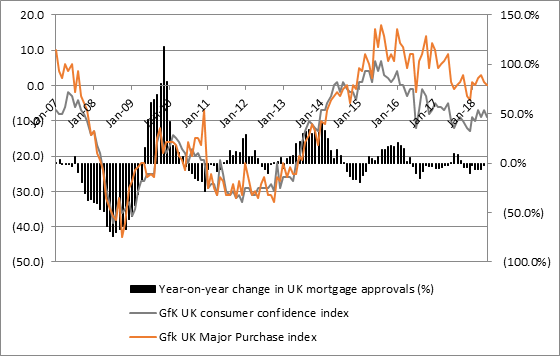

“The results of the past decade suggest that a sustained drop in consumer confidence – and therefore plans to make big purchases – can eventually start to weigh on mortgage approvals.

“Encouragingly, mortgage approvals in May came in higher than economists had expected after a 3% month-on-month increase to 64,526.

“However, that still represented a year-on-year decline of 2.4%, the eighth consecutive year-on-year decline.

Source: GfK, Bank of England

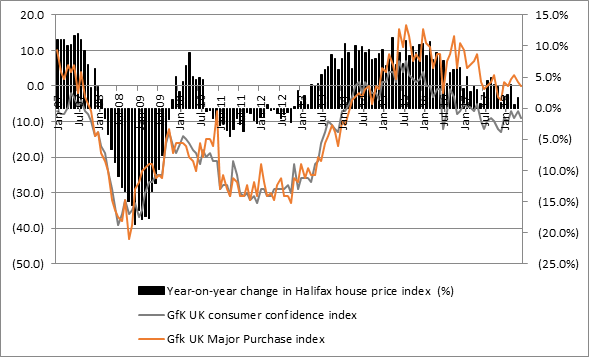

“That softness is in turn starting to show up in house prices. Although the last monthly Halifax survey did offer a little encouragement on this front, a sustained low in consumer confidence and reluctance to commit to a major purchase could start to hit home here as well.

Source: GfK, Halifax Building Society

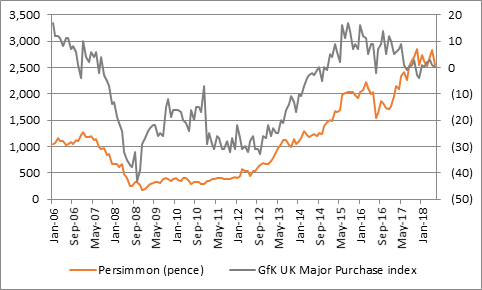

“This has potential implications for the share prices of the FTSE 100 and FTSE 250 house builders, which are still riding high, helped by strong demand and a strong pricing environment, both of which are in turn receiving help from a series of Government initiatives, including stamp duty land tax relief for first-time buyers, the Lifetime ISA and the Help to Buy scheme.

“Using Persimmon as just one example, a historic relationship between its share price and the GfK Consumer Confidence and Major Purchase indices has begun to reassert itself, given the sudden bout of share price weakness at the house builder.

Source: GfK, Thomson Reuters Datastream

“Given the cautionary outlook statements provided by Crest Nicholson and Berkeley, this makes the first-half trading statement due from Persimmon on Thursday 5 July all the more interesting. Shareholders will be looking for reassurance on cost pressures, the forward order book, reservation rates and average selling prices from the York firm’s boss, Jeff Fairbairn, and he will surely be keen to please, given the ongoing row over his pay packet.”