The Department for Work and Pensions has today published data on retirement income trends for pensioners since the mid-1990s.

You can read the full data bulletin here: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/789465/pensioners-incomes-series-2017-18-report.pdf

Highlights

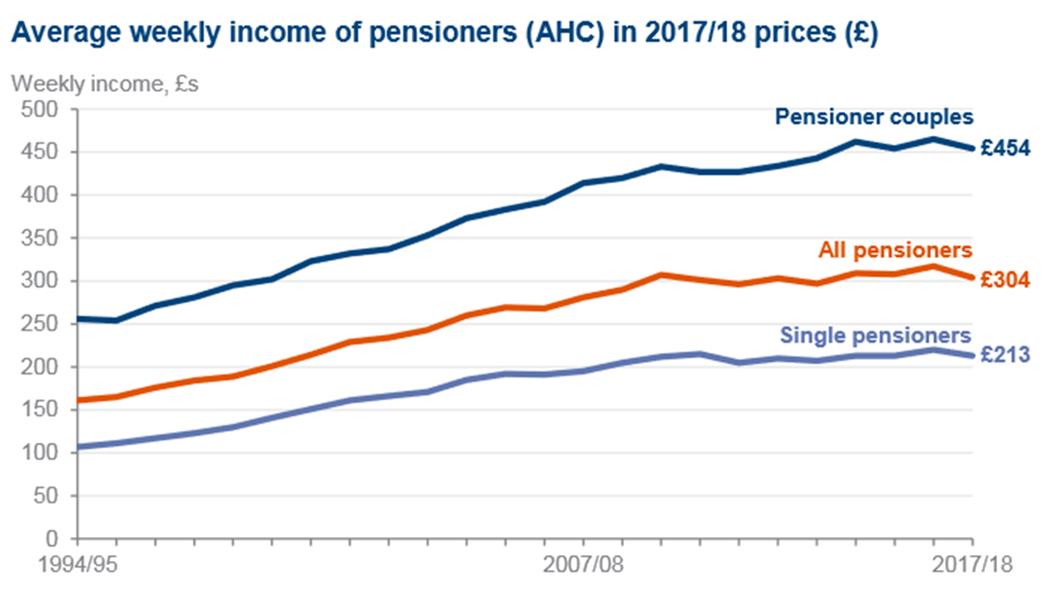

• Average weekly income for all pensioners was £304 in 2017/18, almost twice the level recorded in 1994/95 (£161) but down from £317 in 2016/17

• Benefit income including the state pension is the single biggest component, accounting for 59% of income for single pensioners and 35% for couples

• Older pensioners (aged 75 or over) on average have £82 a week more in retirement income than younger pensioners

• Auto-enrolment has boosted pension coverage but death of defined benefit and scaling back of state pension mean younger savers risk having lower retirement incomes than their parents

Tom Selby, senior analyst at AJ Bell, comments:

“After decades of rapidly rising retirement incomes the good times may be coming to an end.

“The last of the Baby Boomers are now approaching retirement, with many lucky enough to have built up generous defined benefit (DB) entitlements. Those who have already retired have also enjoyed boosts in the value of their state pension since 2010 through the triple-lock.

“The next generation, on the other hand, will likely experience a scaling back in state pension provision, with DB now almost exclusively the preserve of the public sector.

“While automatic enrolment has been hugely successful in increasing the number of people saving in a pension, at current levels it is unlikely to be enough to continue the trend of rising retirement incomes.

“The scale of this shift in society is hard to overstate. Workers will be required to sacrifice more of their income today to provide a decent retirement later in life, or face working into their 70s or even beyond.

“Anyone who wants to enjoy a retirement as good as the Baby Boomers will need to take responsibility themselves, saving more from an earlier age and making the most of the incentives on offer.”

Source: DWP/ONS Pension Income Series analysis