“With both Treasury Secretary Janet Yellen and her successor as Federal Reserve chair Jay Powell up before Congress on Tuesday all eyes are again on US fiscal and monetary policy and if either official needed an excuse to continue to leave policy ultra-loose then the latest variant of the COVID-19 virus is surely it,” says AJ Bell Investment Director Russ Mould. “The aggregate US deficit sits at a new all-time high, the Fed still has its pedal to the metal, given how modest is the tapering of Quantitative Easing, and markets are already pricing in a delay to the long-awaited first hike in interest rates.

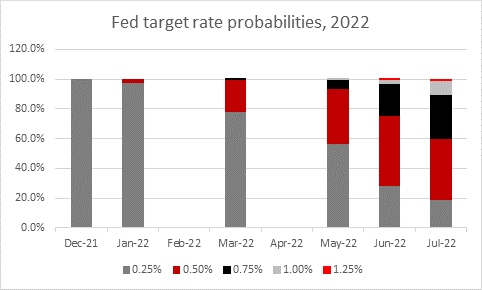

“Just one week ago, US markets were pricing in a near-70% chance of the first increase the Fed Funds Target Rate by June 2022 (itself hardly a breakneck pace of movement), according to the CME Fedwatch service.

Source: CME Fedwatch, 23 November 2021

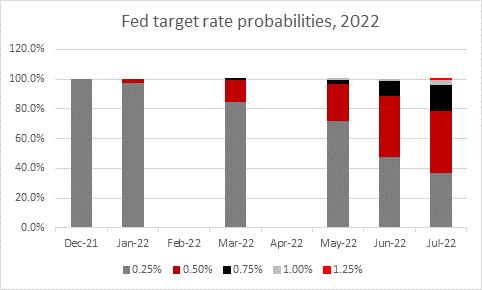

“That percentage has now dipped to 48%, making June a coin toss, and even July is only seen as a 60-40 chance that the Federal Open Markets Committee will act to tighten policy.

Source: CME Fedwatch, 30 November 2021

“It is ultimately too early to tell what the new viral variant may mean, and whether it is more of less transmissible, more or less treatable using current vaccinations or more or less dangerous to anyone unlucky enough to catch it. But on past form policymakers are unlikely to take any chances and leave policy alone, especially as the central banks currently seem to view unemployment as a greater risk than inflation, given the Fed and Bank of England’s seemingly constant quests for more data and visibility on the jobs market.

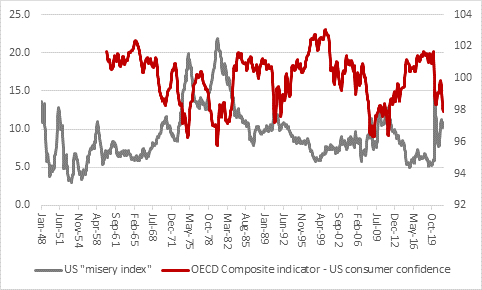

“Yet there is a balancing act here, as Arthur Okun’s misery index makes clear. This indicator simply adds together the rate of unemployment and the prevailing rate of inflation and its impact upon consumer confidence can be clearly seen. If either unemployment or inflation starts to gallop higher, consumers quickly feel the pinch, one way or the other and as such central banks have a difficult balancing act.

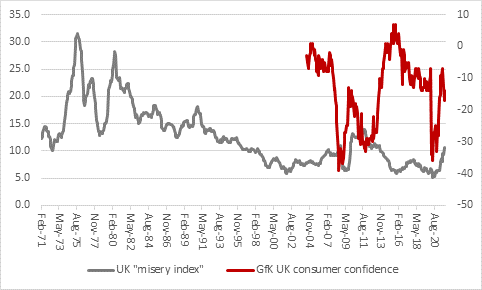

“This can be seen in the US and the UK, even if in the latter case there is a shorter dataset when it comes to consumer confidence readings.

Source: M&G Bond Vigilantes, FRED - St. Louis Federal Reserve database, OECD, "Main Economic Indicators - complete database", Main Economic Indicators (database), http://dx.doi.org/10.1787/data-00052-en (Accessed on 30 November 2021)

Source: GfK, Office for National Statistics, Refinitiv data

“However, central banks have two other factors of which they seem to be mindful.

“The first is global indebtedness, which continues to go through the roof. Central banks have tried to keep debt cheap and credit flowing to keep the economic show on the road since the 2007-09 Great Financial Crisis, but they may have trapped themselves as a result. The world is now much more sensitive to even minor changes in interest rates and any rate hike could therefore have a greater effect than previously.

“The second is financial markets and asset valuations. The Fed and Bank of England have openly talked of trying to create a wealth effect by boosting asset prices, in the view that this will stoke spending and keep the economy going. That may, or may not, be the case – and the consumer confidence charts suggest the misery index’s components of unemployment and inflation have a far greater say.

“But even if it is the case, what happens if asset prices fall, especially when so many individuals have borrowed so heavily to buy that house or, in some instances looking at US margin debt, pile into the stock market? That implies the wealth effect snaps into reverse, something which cannot be allowed to happen, applying central bank thinking.

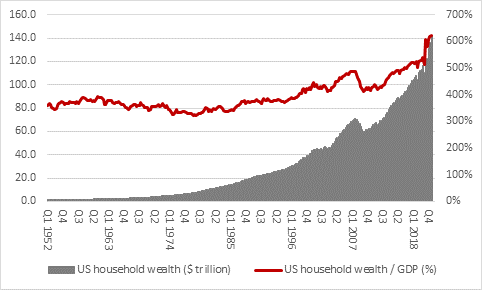

“US household wealth has never been higher, thanks to booming prices for houses and shares and cryptocurrencies and non-fungible tokens and collectibles goodness knows what else.

Source: M&G Bond Vigilantes, FRED - St. Louis Federal Reserve database

“The Fed may be reluctant to do anything that risks a reversal of fortune there, including raising rates too quickly, so the central bank may therefore be prepared to let inflation run hot in exchange, even if history suggests that would have a potentially negative impact on consumer sentiment, consumer spending and therefore the economy in the long run.”