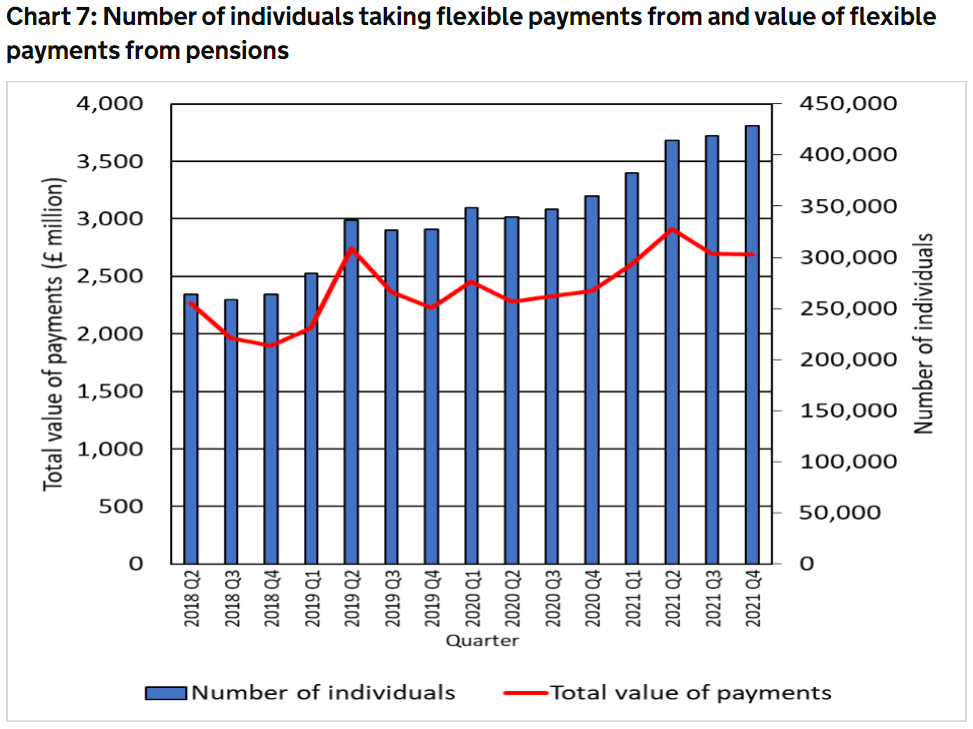

• Savers are expected to access record amounts from their retirement pots in the next three months

• The start of a new tax year is traditionally peak pension withdrawal season in the UK, as savers take advantage of a fresh set of allowances

• The only exception to this was in 2020, when uncertainty caused by the pandemic saw savers pause or reduce withdrawals

• With Brits facing higher living costs as inflation spikes, withdrawals will almost certainly hit new highs in April, May and June 2022

• Savers urged to ‘stop and think’ before accessing their pension

• Sustainability of withdrawals, investment growth and pension tax allowances among key considerations for those considering dipping into their retirement fund

Tom Selby, head of retirement policy at AJ Bell, comments:

“The start of the tax year is traditionally peak pension withdrawal season, with hundreds of thousands of savers dipping into their retirement pot – many for the very first time.

“This year is likely to see record numbers accessing their hard-earned pension pot. Spiralling inflation is already hitting household budgets and as eye-watering gas bills land at millions of Brits’ doors, it is inevitable more people will turn to their pensions to ease the immediate financial pain.

“Anyone thinking about accessing their pension for the first time or hiking withdrawals to cope with rising living costs should stop and think before making a rash decision. Accessing your retirement pot early or withdrawing too much, too soon could have disastrous consequences over the long-term.

“What’s more, the generous tax treatment on death of pensions means it often make sense for your pension to be the last asset you touch.”

Source: HMRC

Five reasons to ‘stop and think’ before accessing your pension pot early or hiking withdrawals during the cost-of-living crisis

1. Early access increases the risk of running out of money in retirement

“Pensions can now be accessed flexibly from age 55 - but for most people the aim of the game remains providing an income to support their lifestyle throughout retirement.

“Withdrawing too much, too soon from your fund means you’ll increase the risk of running out of money early – and potentially being left relying on the state pension.

“In 2022/23, the full flat-rate state pension will pay just £185.15 per week, a long way below the spending needs of most people.

“Take a healthy 55-year-old with a £100,000 pension pot. If they withdraw £5,000 a year, increasing annually in line with inflation at 2%, and enjoy 4% annual investment growth their fund could run out by age 80.

“Given average life expectancy for a healthy 55-year-old is in the mid-80s – with a decent chance of living well into your 90s – such an approach would clearly create a serious risk of draining your pot early.

“Put simply, if you raid your pension pot early, you’ll either need to keep your withdrawals very low – potentially harming your quality of life later in retirement - or face up to the prospect of your pot running out sooner than planned.”

2. Early access could also see you miss out on investment growth

“The sustainability problems created by taking an income early from your pension will be compounded if you miss out on investment growth at the same time.

“While savers have total freedom over how to invest their retirement fund, it usually makes sense to take a bit less risk when you start taking an income from your pot.

“At the very least you will need to sell some of your investments to make a withdrawal, meaning you might have somewhere between 12-24 months of income held in cash. This lower risk portfolio will inevitably have lower return expectations over the long-term.”

3. You could trigger a 90% cut in your annual allowance

“Anyone considering withdrawing taxable income from their retirement pot for the first time needs to be aware of the severe impact it will have on their ability to save tax efficiently in a pension in the future.

“Taking even £1 of taxable income from your pension flexibly will trigger the money purchase annual allowance (MPAA), potentially reducing the amount you can save in a pension each year from £40,000 to just £4,000.

“Furthermore, if you trigger the MPAA you will lose the ability to ‘carry forward’ unused pensions allowances from up to 3 previous tax years, meaning in some cases the impact will be a £156,000 reduction in the potential annual allowance in the current tax year, from £160,000 to £4,000.

“If you are struggling to make ends meet and your pension is the only asset available to support you, consider just taking your tax-free cash (or a portion of your tax-free cash) as this won’t trigger the MPAA.

“Alternatively, it is also possible to access up to three defined contribution (DC) pots worth £10,000 or less then without triggering the MPAA, provided you exhaust the entire pot in one go.”

4. Hiking withdrawals risks hurting sustainability

“It is not just those accessing their pension early who could be at risk during this cost-of-living crisis – a period of high inflation presents a major challenge to anyone drawing a retirement income.

“Most people will want their pension withdrawals to increase in line with inflation in order to maintain their living standards. However, if inflation runs hot for an extended period of time, this will have a big impact on the sustainability of a withdrawal plan.

“Consider a healthy 66-year-old with a £100,000 fund who wants to withdraw £5,000 a year from their pension, rising in line with inflation.

“If inflation is 2% a year throughout their retirement their fund could last until age 91. If inflation is 4% a year, however, then the fund could run out by age 85 – a full 6 years earlier.

“Inflation is unfortunately entirely out of our control. However, anyone planning to increase their withdrawals to maintain their spending power during the current period of high inflation should think about the impact on the sustainability of their plan.

“It’s also worth taking a step back and thinking about your own personal inflation rate. The figures produced by the ONS are an average based on a weighted basket of goods, but your own inflation may be higher or lower depending on what you spend your money on.

“Sit down, tot up your costs and income sources, and try to design a sustainable retirement income strategy that meets your needs.”

5. Don’t forget about Inheritance Tax

“Pensions are no longer just about providing an income in retirement. Since 2016, savers have been able to pass on leftover pensions tax-free if they die before age 75. Where the pension holder dies after age 75, the remaining funds will be taxed at their recipient’s marginal rate when they make a withdrawal.

“For those who want to leave assets to loved ones, it therefore often makes sense to leave as much of your pension untouched as possible in order to minimise your tax bill.

“This means when you come to flexibly access your pension for the first time, you should think not just of your retirement income strategy but also your IHT plans. If you have money held in an ISA, for example, this will count towards your estate on death.

“For those who want to pass their pension on to loved ones, it’s also important to ensure your nominated beneficiaries are up-to-date so the right people inherit your pot.”