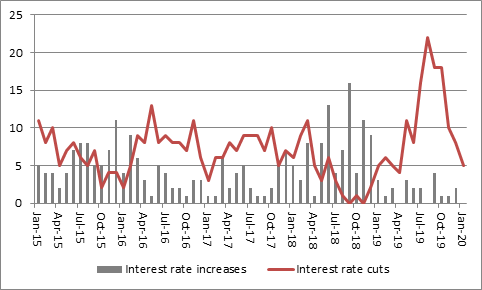

“After 131 interest rate cuts from central banks around the world in 2019 (against just 21 increases) markets have already seen five monetary authorities reduce headline borrowing costs in their countries in January,” says Russ Mould, AJ Bell Investment Director. “While the US Federal Reserve and the Bank of England are not facing the sort of difficulties which have prompted Kenya, Malaysia, North Macedonia, South Africa and Turkey to cut rates, neither is expected to give any indicator that borrowing costs are going to rise in a hurry when they make their latest monetary policy decisions on Wednesday and Thursday respectively.

Source: www.cbrates.com

USA

“With regard to the Fed, the CME Fedwatch survey currently puts an 87% chance on no change in interest rates from the US central bank at this meeting but the same survey puts a 75% chance on at least one cut (and just a 3% chance of at least one increase) by year end.

|

|

Upper Band of Fed Funds target rate by December 2020 |

||||||

|

|

Five cuts |

Four cuts |

Three cuts |

Two cuts |

One cut |

No change |

One increase |

|

Rate |

0.50% |

0.75% |

1.00% |

1.25% |

1.50% |

1.75% |

2.00% |

|

% chance |

0.3% |

2.5% |

10.6% |

26.2% |

35.7% |

22.1% |

2.5% |

Source: CME Fedwatch

“As such the outlook statement may be telling, especially as the Fed’s apparent plan is to leave rates unchanged all year at 1.75%.

“Economists will also be watching for comments on the central bank’s intervention in the overnight bank funding (repo) market since the autumn. Fed Chair Jay Powell continues to swear blind that this is ‘Not QE4’ but whether it is Quantitative Easing or not share prices appear have feasted on the cheap cash that the Fed has been injecting into the markets since the autumn.

“However, we may now be reaching an interesting inflection point, as the Fed has started to gently throttle back its intervention in the repo market and its balance sheet has just started to shrink again. The Coronavirus scare is a more likely culprit but it may or may not be a coincidence that the S&P 500 index has become more volatile and suffered a couple of stumbles just as the Fed withdraws some liquidity.

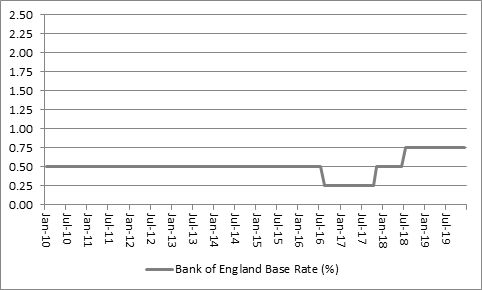

UK

“In the UK, some members of the Monetary Policy Committee (MPC) have raised the prospect of a cut after recent weak GDP, purchasing managers’ indices (PMIs) and retail sales readings. However, it is possible to argue that all of these were still affected by the former Brexit deadline of 31 October and the General Election of 12 December and the CBI business optimism survey, latest bank mortgage approvals data and ‘flash’ PMI readings for January all showed signs of improvement.

“With the Budget due in mid-March, the Bank of England might decide to wait and see if there really is a bounce post-Brexit and how much extra money the Government is going to spend.

“If the Bank does stand pat, then economists and investors will look to how close the vote was. In December the Monetary Policy Committee voted 7-2 to leave interest rates unchanged at 0.75% and 9-0 to leave Quantitative Easing at £435 billion but a third member of the Monetary Policy Committee, Gertjan Vlieghe, now seems to be leaning toward joining Jonathan Haskel and Michael Saunders in calling for a cut.”

Source: Bank of England, Refinitiv data