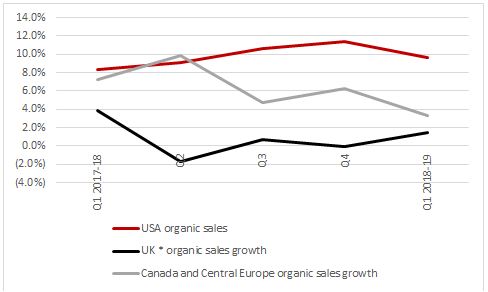

“A weak performance from the UK operations at Ferguson, the company formerly known as Wolseley, may be no great surprise to shareholders but a slowdown in the all-important US operations seems to be weighing on the share price,” says Russ Mould, AJ Bell Investment Director.

“This may seem a bit harsh when first-quarter sales grew by 9.6% year-on-year in the USA, but that still reflected a slight deterioration on the fourth quarter’s double-digit run rate and America does represent more than 80% of the company’s revenues and more than 90% of its profits.”

Source: Company accounts. *UK figures adjusted for disposals and restructuring. Financial year to July.

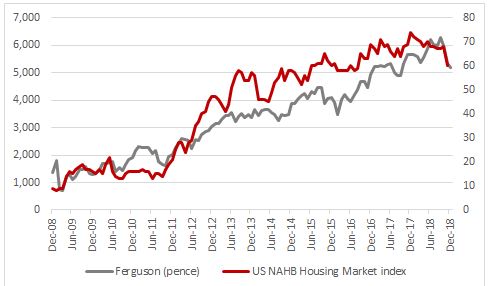

“This may explain why investors are a bit windy, especially as there are some signs of a slowdown in the US housing market.

“A sequence of nine, one-quarter-point increases in interest rates from the US Federal Reserve leaves the headline American mortgage rate at 4.81% and within touching distance of the 5% level for the first time since early 2011.

“Add higher borrowing costs to record-high house prices, as measured by the S&P/Case-Shiller house price index and you can see why buying a home is more of a financial challenge than it was for Americans one, two or three years ago.

“As a result, the headline National Association of House Builders (NAHB) Housing Market index has retreated a little from its December 2017, post-financial-crisis high.

Source: Refinitiv data

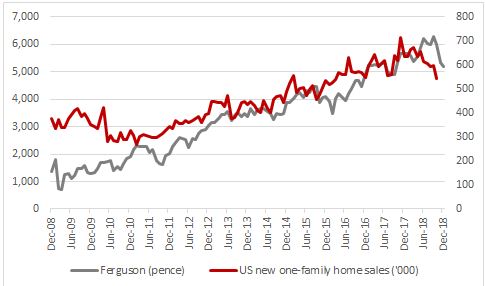

“This slightly more cautious outlook may in turn reflect how sales of new, one-family houses fell 12% year-on-year to 544,000 dwellings, the lowest mark since March 2016.

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

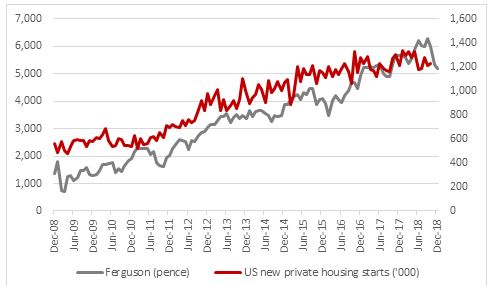

“This is then having a knock-on effect upon new housing starts. They were down 3% year-on-year to 1.23 million in October, and 8% below the post-crisis high figure of 1.33 million seen in May.

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

“These figures must be kept in context as the housing starts and housing sales numbers are still close to record-high levels. In addition, Ferguson supplies industrial and commercial properties too and today’s statement emphasises that trading remains strong here, as well as in the residential construction market, so management does not seem unduly concerned by the tentative signs of a US housing slowdown.

“But investors will be following these trends closely in the coming months, just in case, as Ferguson’s share price will is likely to respond more favourably to positive earnings surprises than numbers that are ‘only’ meeting expectations.

“Investors with shares in Ferguson may therefore find themselves keeping watch on US Federal Reserve policy.

“The US central bank, led by chair Jay Powell, seems to be softening its stance on interest rates a little, noting the future path of policy may become a little more data dependent, and a weaker housing market could be one possible trigger for the Fed to slow down, or even halt, its plan to ‘normalise’ US monetary policy – and such a reversal could be welcomed not just by President Trump but those investors who fear the Federal Reserve could tighten policy by too much, too quickly, smothering both the US economy and the equity bull market.”