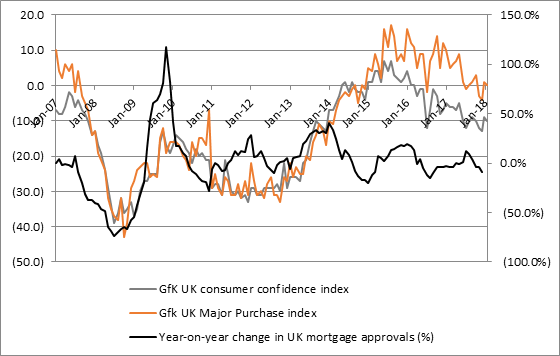

“But investors with exposure to house building stocks in particular might need to pay closer attention to a sub-index of the headline GfK figure, namely the Major Purchase score, which asks survey respondents whether now is a good time to make a large outlay.

“That reading slipped from one to zero in February (below the score of five from a year ago) and investors may have to ask themselves whether this gloomy outlook could start to affect the housing market, if hard-pressed consumers really do start to pull in their horns.

“After all, there is no more major financial commitment than taking out a mortgage to buy a property.

“This will make Friday’s UK mortgage approvals form the Bank of England particularly interesting.

“The results of the past decade suggest that a sustained drop in consumer confidence – and therefore plans to make big purchases – can eventually start to weigh on mortgage approvals and the last available data, for December 2017, showed a 9% year-on-year drop to 61,039, the lowest mark since February 2015.

Source: GfK, Bank of England

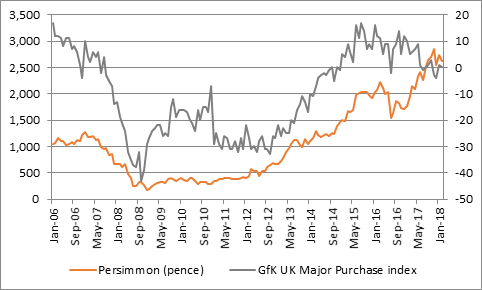

“This has potential implications for the share prices of the FTSE 100 and FTSE 250 house builders, which are still riding high, helped by strong demand and a strong pricing environment, both of which are in turn receiving help from a series of Government initiatives, including stamp duty land tax relief for first-time buyers, the Lifetime ISA and the Help to Buy scheme.

“Using Persimmon as just one example, a historic relationship between its share price and the GfK Consumer Confidence and Major Purchase indices looks to have broken down of late, so it will be interesting to see if it re-establishes itself – either because confidence picks up or the shares move lower, despite Persimmon’s enhanced cash-return programme for shareholders announced earlier this week.”

Source: GfK, Thomson Reuters Datastream