“The retail group Sears bought the bookie back in 1971, as part of a diversification plan, and the UK’s second-biggest High Street operator by number of shops has since been acquired by Grand Metropolitan, when it merged with the rival Mecca Bookmakers organisation (1988), Brent Walker (1989), Nomura (1997) and finally a private equity consortium (1999).

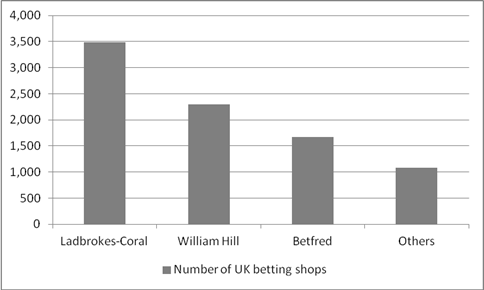

Source: The Gambling Commission

“William Hill then floated on the stock market in 2002. Its first spell as a member of the FTSE 100 lasted from 2004-05 and its last stint in the UK’s corporate top flight ended with demotion in 2014.

“Since then, the company has unsuccessfully tried to buy 888 and also had to fend off two approaches

“Canada’s Stars Group tried and failed to merger with William Hill back in 2016, ultimately contenting itself with the purchase of Hill’s Australian business back in March, after a joint bid from Rank and 888 also came to grief.

“A series of profit warnings, prompted by operational miscues with its online business, where Hills had failed to keep up with the times, led to the departure of chief executive James Henderson and left the firm open top attack.

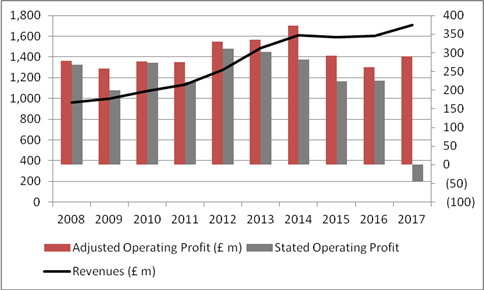

“Mr Henderson’s successor, Philip Bowcock, seems to have steadied the ship, even if Hills’ 2017 results were marred by a write-down on its Aussie business, which has since been sold.

“Revenues are growing, the Australian problems have been dealt with, the Fixed Odds Betting Terminals (FOBTs) review looks like it will end with the worst-case for the bookies being avoided and Mr Bowcock has appointed Ulrik Bengtsson as the firm’s new chief digital officer.

“In addition, Hills has a terrific foothold in the USA, helped by a trio of acquisitions it made in 2011. If the US Supreme Court decides to open up and legalise sports betting in the USA then William Hill could find itself in pole position. The firm is already the leading regulated player in Nevada and it could look to build on that, if sports betting is legalised, as many expect.

“A cut in FOBT stakes could hit near-term earnings but the High Street business should remain cash generative – just at the weekend at 33-1 shot won the Coral-sponsored Scottish Grand National at Ayr, the fourth-biggest betting race of the whole year according to data from the Horserace Betting Levy Board, to remind people of just why so many individuals and firms still want a piece of the betting market action.

“After all, Cyril Stein famously decided he wanted in when he was taken to a Ladbrokes shop in London and noticed there were three counters in the shop which said ‘bet here’ and only one that said ‘pay out.’

“The internet, smart phones and changes in tax legislation may mean the route to customers is now different, but the principle stays the same and the annual gross yield in the UK betting business is £13.8 billion, according to Gambling Commission statistics, of which some £8 billion goes to the bookmakers.

Source: Company accounts

“If any trade buyer does fancy a flutter by buying Hills now may be their chance, before Mr Bowcock’s turnaround plan really gathers momentum, the online business starts to click and the US betting rules are changed. Hills already generates 43% of its net revenues online and 18% from overseas.”

APPENDIX: BRITISH BOOKMAKING: MAJOR EVENTS TIMELINE – LAST 20 YEARS

1998

Ladbrokes buys Coral from Bass but is forced to sell it by the Monopolies and Mergers Commission

1999

After a management buy-out, Coral merges with Eurobet

BetFred buys Demmy Racing

Victor Chandler moves its HQ to Gibraltar, having obtained a licence there in 1996

2000

Bet365 begins trading

Betfair begins trading

Betandwin floats on the Vienna stock exchange, three years after its launch

2001

SkyBet begins trading

2002

William Hill floats on the London Stock Exchange

888 Holdings is established

2003

Candover-Cinven private equity consortium buys Gala

2004

GVC lists on London’s AIM market

Done Bookmakers renames itself Betfred

2005

Gala buys Coral-Eurobet

William Hill buys Stanley Leisure

PartyGaming floats on the London Stock Exchange, eight years after its launch

2006

Betandwin changes its name to bwin

2007

Stan James acquires Betdirect from 32Red

2008

Stan James acquires Betterbet

2010

Betfair floats on the London Stock Exchange

2011

Betfred buys the Tote (and a seven-year exclusive licence for pool betting)

William Hill buys American Wagering and two other US businesses

Bwin Interactive mergers with PartyGaming

2012

Rank acquires Gala Coral’s casinos

William Hill and GVC jointly acquire and break up Sportingbet

2014

BetVictor is acquired by Michael Tabor

Sky sells a stake in SkyBet to CVC

2015

Unibet (Kindred) buys Stan James’ online business

William Hill makes an unsuccessful bid for 888

2016

Ladbrokes mergers with Gala-Coral to form Ladbrokes-Coral

Paddy Power merges with Betfair

GVC acquires bwin.party

888 and Rank make a failed bid for William Hill

Amaya makes a failed bid for William Hill

2017

Kindred acquired 32Red

2018

GVC acquires Ladbrokes-Coral

Stars Group acquires SkyBet