“Oil prices largely shrugged at President Joe Biden’s release of 50 million barrels of crude from America’s strategic reserve but news of the Omicron variant of COVID-19 is weighing on the black stuff, and that raises the stakes for the latest meeting of OPEC+,” says AJ Bell Investment Director Russ Mould. “Unlike the White House, the OPEC+ cartel can move oil markets, as its 2020 production cut and then gradual subsequent increases in supply testify. OPEC and Russia are still producing less than they were before the pandemic and the latest oil price wobble will be a test of their plan to gradually increase output by some 400,000 barrels per day each month.

“The failure of the Biden plan was hardly a shock. Fifty million barrels a day may sound a lot. But in global terms it is half a day’s demand and America’s entire SPR would meet worldwide oil demand for less than a week.

“That puts the onus back on OPEC+, as it contemplates the possible hit to demand should the new viral variant hit consumer confidence and demand for travel, even assuming trips are permitted by government – and the number of restrictions is already growing again.

“COP26 made quite clear the political and public will to move away from hydrocarbon as our prime source of fuel. You can therefore hardly blame Saudi Arabia, Russia and other leading producers for looking to monetise their oil assets while they can still do so.

“Equally, Riyadh, Moscow and their allies will not want to overdo it.

“High energy prices are a tax on consumers and a source of margin pressure for many corporations. If oil and gas rocket, there remains the chance that the indebted global economy could wobble under the strain, virus or no virus, just as it did when oil reached $147 a barrel in 2007.

“In addition, alternative, renewable sources are not yet ready to take up all of the slack from oil and gas. Demand for energy could therefore outstrip supply, with the result that hydrocarbon prices could remain firm, or even keep rising – at least unless COVID-19 rears its head again and depresses economic activity and oil demand in the process.

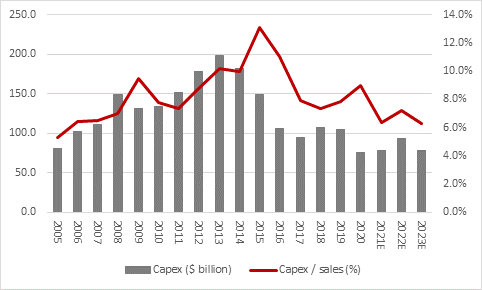

“Unlikely as it may seem, oil and gas companies are listening to the political and public call for a shift to a greener, less carbon-intensive world. The combined capital investment budgets of the seven Western oil majors – BP, Chevron, ConocoPhilips, ENI, ExxonMobil, Shell and TotalEnergies – looks set to drop to a its lowest mark since 2005, as a percentage of sales. In many cases, those budgets include renewable projects, too, so spending on oil production and exploration is by implication lower still.

Source: Company accounts for BP, Chevron, ConocoPhillips, ENI, ExxonMobil, Shell and TotalEnergies, Marketscreener, consensus analysts’ forecasts

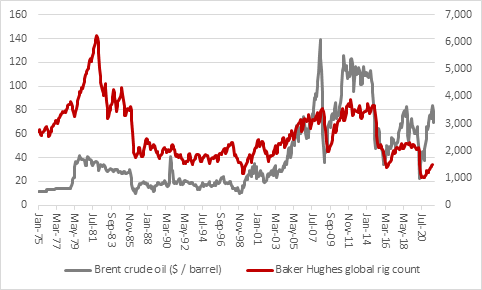

“This can also be seen in the global rig count data provided by Baker Hughes. On the previous occasions when oil traded above $80 a barrel, over 3,000 rigs were active. The current figure is barely half that.

Source: Baker Hughes, Refinitiv data

“In the absence of a COVID-inspired setback, that again points to a possible supply/demand squeeze, especially as banks, insurers and many pension funds and many managers continue to publicly declare their unwillingness to finance new oil and gas exploration projects.

“Whether the Omicron variant delivers that very setback remains to be seen, but OPEC+ may decide to tread warily when it comes to sanctioning changes in output, especially as geopolitical factors must also be considered. President Biden does have some options available to him, as he seeks to manage the energy transition in the world’s largest economy and keep hard-pressed consumers on board as he and the Democratic Party prepare for the mid-term elections in 2022.

• The President could encourage oil and gas exploration with tax breaks or at least grant permission to pipelines that his administration has previously blocked, such as the $8 billion Keystone XL project. This does not seem likely, given his and his party’s commitment to the Paris Agreement and COP26.

• President Biden could look to thaw relations with Venezuela and Iran, both of whom are currently locked out of global markets by US sanctions. Granted, it is hard to get a handle on potential Venezuelan output given the chaos that prevails there, but Caracas has produced two to three million barrels a day in the past. It is thought that Iran could double output fairly quickly from two to four million barrels a day if given the chance. But geopolitics may rule out this option, as those sanctions are in place for a reason and the President will not want to look dovish on foreign policy ahead of those mid-term polls either.

“Omicron and OPEC+ therefore look set to exercise greater influence over oil than Washington and both are difficult to forecast.

“If the oil market were left to its own devices, the scene would be set for higher prices for oil and gas, as demand is recovering as supply remains constrained for a host of ethical, political and financial reasons. But OPEC+ can decrease or increase supply as it sees fit (at least in theory) and the viral variant could suppress demand, if its proves to be more transmissible, more deadly and less susceptible to current vaccines that previous strains of COVID-19.”