“The oil price is broadly unchanged on where it was a year ago, despite concerns over global economic weakness, and OPEC’s output cuts are one reason why. The cartel’s latest meeting in Vienna next week represents its next chance to keep its discipline and exercise some control over the market for crude,” says AJ Bell investment director Russ Mould.

“The 14-nation group’s production plans will be important for those investors who do not own oil stocks and funds that are dedicated to energy, as well as those that do, for two reasons:

• Oil firms are forecast by analysts to generate 17% of the FTSE 100’s total profits and 20% of its dividends in 2020, so anyone with exposure to UK equities through a tracker fund or exchange-traded fund will have exposure to hydrocarbon producers, whether they are aware of it or not

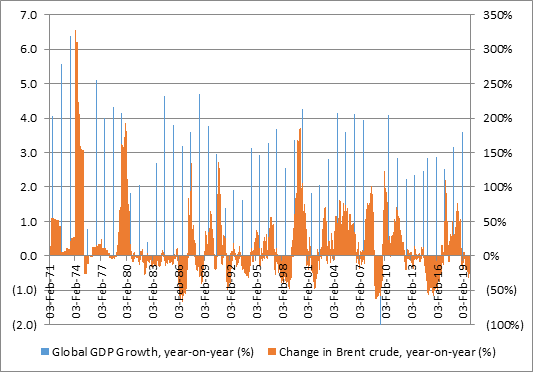

• History shows that if oil jumps by more than 50% year-on-year the global economy tends to slow and if it doubles then a recession is rarely far away, because of the hit to consumer spending power and companies’ cost base. The good news here is that oil is basically flat on where it was a year and it would need to get to $95 to rise 50% and $125 to double, compared to the current $63 a barrel for Brent.

Source: Refinitiv data

“There will be three things to look for in the cartel’s communiqué:

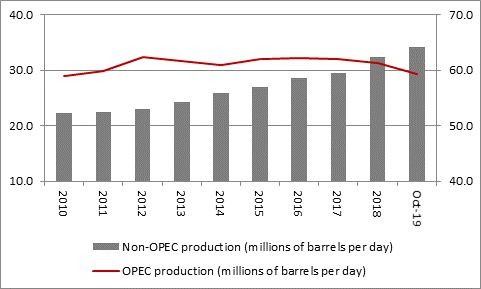

• Comments on production, relative to the 0.8 million barrel a day cut and overall OPEC production, which is running at just under 30 million-barrels-a-day right now

• Any comments on the time line for any production targets, as the current cut only runs until January

• Any pointers on the intentions of non-OPEC members, particularly Russia, which has supported output discipline in the past

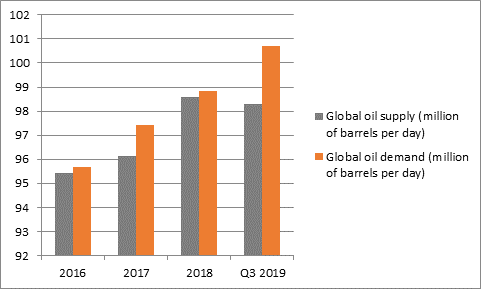

“Demand looks set to grow by around 2% this year to just over 100 million barrels a day, so supply looks to the key to the oil market right now, as it has been since December 2016, when OPEC agreed to cut its output by 1.2 million barrels of oil a day to around 32.5 million, with Saudi Arabia leading the way. Non-OPEC members, spearheaded by Russia, joined in as they trimmed output by some 0.6 million barrels a day.

“That helped to fuel a recovery in the oil price from lows of barely $30 to around $80 a barrel, using Brent crude as a benchmark.

“By in December 2018, the cartel was on the back foot again. Concerned by talk of a slowing world economy, and also rising US output, OPEC cut production by 800,000 barrels a day. It then stuck to that cut at April’s meeting in Vienna.

“Total OPEC output averaged around 29.4 million barrels a day in the third quarter of this year, way down from the levels of three years ago, thanks in part to

• American sanctions on Iran, where production is down to 2.2 million barrels a day from 3.8 million in 2017

• A collapse in activity in Venezuela, which is now producing just over 700,000 barrels a day compared to 1.9 million two years ago

• Saudi Arabia’s outputs, which represent to bulk of OPEC’s latest reduction in volume

“The net result, based on OPEC’s latest monthly report, is that global oil output is running at 98.3 million and demand at 100.7 million barrels a day – so in theory there is a supply shortfall.

Source: OPEC

“But oil is not making much progress, either, presumably because the market knows that Saudi Arabia is holding back and that Iranian supply is being kept out of the market.

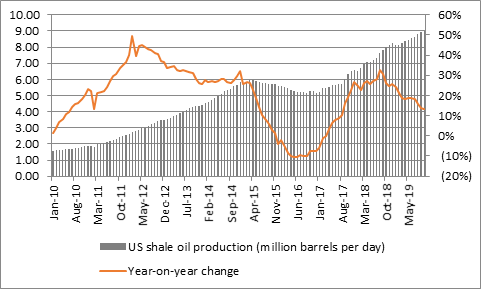

“In addition, US output continues to surge, thanks to shale and OPEC has no influence here. American oil output from shale has just cracked the nine-million-barrels-a-day level, up from 5.2 million a day at the time of OPEC’s first big round of production cuts in December 2016 and a 1.5 million a day at the start of the decade.

Source: US Energy Information Agency

“If there is any good news for OPEC, it is that US shale production growth is slowing, at least for the moment, with output up ‘just’ 13% year-on-year (or one million barrels a day), thanks in part to financial distress at some of the debt-funded shale drillers.

“The HaynesBoone Oil Patch Bankruptcy Monitor reveals that 33 US oil and gas drillers have filed for bankruptcy so far in 2019, up from 28 in the whole of last year, thanks to the sector’s $100 billion in borrowing, which mean even a flat oil price is straining some balance sheets.

“A weak oil price could lead to a further shakedown in America, although that would inflict pain on OPEC, too. An even bigger potential wildcard would be a victory for Democratic Party candidate Elizabeth Warren in the 2020 Presidential election, since one of her leading policies is to ban fracking altogether.”