Russ Mould, investment director at AJ Bell, comments:

“Third-quarter and nine-month profits both jumped strongly, helped by the absence of fresh payment protection insurance (PPI) provisions, any further litigation, only modest increases in loan impairments and restructuring costs and the absence of the £790 million expense relating to its own debt from last year.

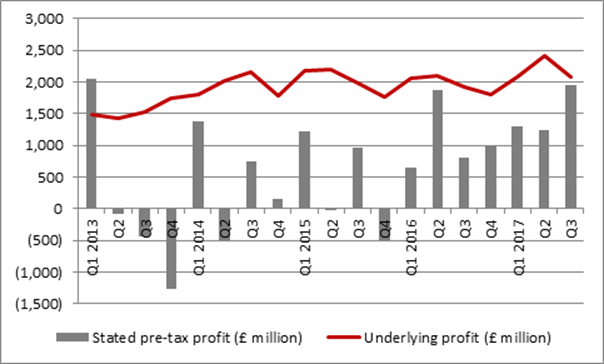

“The reduction in these numbers means that the gap between stated and “underlying” (or Earnings Before Bad Stuff) profits will be a source of particular satisfaction to investors, as it means the quality of earnings is improving, while the quantity is becoming more consistent – on an underlying basis, Lloyds is now regularly churning out profits around the £2 billion-a-quarter mark.

Source: Company accounts

“What is undeniably missing in the underlying figure is growth [see the red line above] and Lloyds is still showing minimal increases in customer deposits, its loan book or risk-weighted assets.

“This may not unduly concern investors in the stock, who would probably rather like owning a dull bank which can earn £8 billion a year pre-tax if it keeps its nose clean, avoids further regulatory scrutiny, treats its customers well and manages its loan book in a sensible fashion. This is because those healthy earnings will sustain healthy – and increasing – dividend payments.

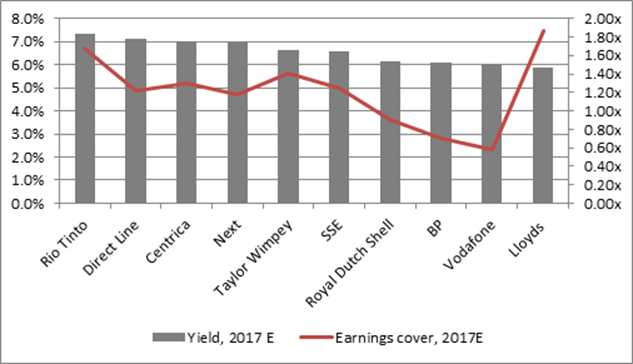

“Based on consensus analysts’ forecasts for 2017, Lloyds is forecast to be the ninth single biggest payer of dividends in the FTSE 100 and the tenth highest yielding stock – it also has the best earnings cover for its forecast dividend of any of the top ten yielders:

Source: Digital Look, consensus analysts’ forecasts

“Yet management seems to be readying itself for an end to Lloyds’ own era of austerity, judging by the plan for a Strategic Review next February.

“The bank has already acquired MBNA so it can push more aggressively into the consumer credit market and purchased Zurich’s UK workplace pensions and savings business, so it can makes its presence felt more strongly in the world of insurance and savings – there are already rumours that Lloyds’ Scottish Widows is a potential bidder for Standard Life Aberdeen’s corporate pensions arm.

“While the bank cannot shrink for ever, and the need for a solution to the UK’s savings crisis is acute, shareholders may be wary of this dash for growth, especially at this stage of the credit and economic cycle, which is now getting long in the tooth. All acquisitions bring risk, especially if they are funded by debt, as very few actually deliver the targets, while the Bank of England and Financial Conduct Authority both continue to warn about rapid growth in unsecured consumer borrowing.

“Add such concerns to Lloyds’ valuation – the shares trade at 1.2 times tangible net asset value per share of 53.2p – and it is perhaps understandable that the stock is finding it hard to make much fresh progress, ahead of the February announcement, even if income seekers will warm to the dividend yield.”