“No-one, but no-one, knows what the ultimate ramifications of Russia’s invasion of Ukraine will be, looked at from the broad perspective of international politics or the much narrower – and less important – one of investments,” says AJ Bell Investment Director Russ Mould. “Commodity prices are in foment and share prices are in a tizz but if investors really want to get a feel for what might be coming then their best steer could just come from the bond market and high-yield – or ‘junk’ – bonds in particular.

“High yield is the technical term is non- or sub-investment grade debt. These tradeable bonds are issued by companies that carry a rating of BB or lower from agencies Standard & Poor and Fitch or Ba or lower from Moody’s.

“Generally, these are firms with a lot of debt and potentially troubled operating models where there is a higher risk of default, either through the non-payment of a coupon (or interest) at the pre-agreed time in the pre-agreed size or the failure to return the investor’s principal (or initial investment) in full once the bond, or loan, matures. The poor state of the bond issuers’ finances therefore inspires the pejorative term ‘junk.’

“Owing to this risk, ‘junk’ debt tends to come with a higher coupon than investment grade corporate debt or sovereign (Government) debt, as potential buyers demand higher rewards to compensate themselves for the greater dangers.

“High-yield debt also tends to trade more like equity, since an economic upturn will be good news, in the shape of more profits, improved cash flow and a reduced risk of default. A recession is usually bad news indeed for high yield debt prices, as investors flee, thanks to the prospect of lower profits, less cash flow and the increased risk of default.

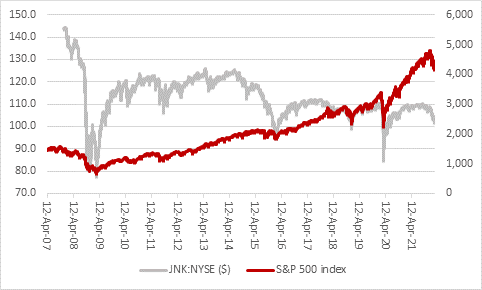

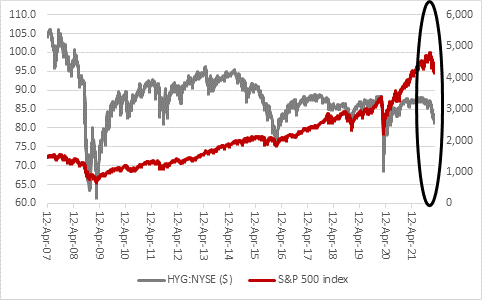

“As a result of that, high yield is often seen as a lead indicator for equities. The asset class can be followed quickly and easily – and for free - by checking out the prices of two US-listed Exchange Traded Funds, the SPDR Bloomberg High Yield ETF, which comes with the ticker JNK, and the iShares iBoxx High Yield Corporate Bond ETF, whose ticker is HYG.

“The good news is that neither ETF is collapsing. The iShares tracker is down by just 7% from its high, the SPDR Bloomberg tracker by just 8% from last year’s highs.

“The bad news is that these relatively minor moves have still wiped out more than a year’s yield for holders of the trackers.

“The worse news is these instruments seem to have peaked last autumn. In addition, both are reaching key thresholds on their price charts.

“If history is any guide – and there are admittedly no guarantees on that front – there could be trouble ahead if iShares iBoxx High Yield Corporate Bond ETF goes below $80 (and it closed on Thursday at $81.50).

Source: Refinitiv data

“They key pressure point for the SPDR Bloomberg High Yield ETF seems to be $100, judging by the equity market ructions which have followed prior dips below that mark.

Source: Refinitiv data

“A break down in the price of these junk-bond ETFs could signal trouble ahead for the economy and share prices, either in the form of a recession or even stagflation.

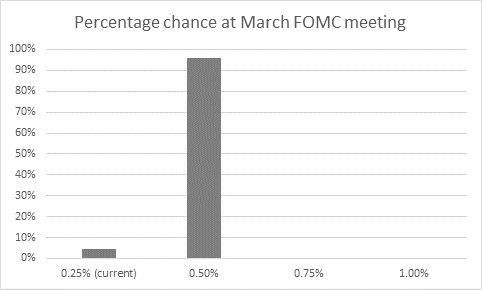

“This is all raises the stakes for Wednesday’s monetary policy meeting at the US Federal Reserve, not least because markets still seem to feel (or at least hope) that Western central banks have their back.

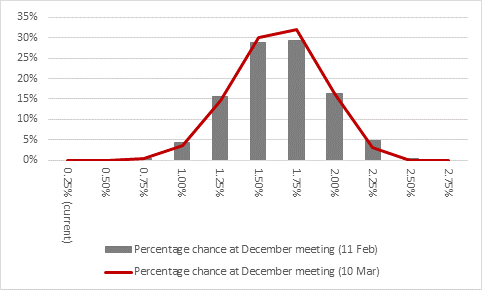

“Why that would be when central banks cannot print oil or copper or wheat is an interesting question (and is itself an explanation for why those commodities are soaring). But markets are beginning to reduce their expectations for the number of interest rates that the US Federal Reserve may push through in 2022.

“Any expectations of a half-point interest rate have long since been abandoned and markets have even begun to put a tiny chance on the US central bank doing nothing, even though chair Jay Powell has more or less confirmed that a quarter-point rise is the plan. The latest US inflation figure of 7.9%, another 40-year high, seems likely force the Fed’s hand

Source: CME Fedwatch, Thursday 10 March 2022

“The latest US inflation figure of 7.9%, another 40-year high, seems likely force the Fed’s hand but some investors are now wondering whether the US central bank will move more slowly than perhaps previously planned.

“The view may be that higher energy and commodity prices will bump up inflation and in turn hit consumers’ (and corporations’) ability and willingness to spend. That will slow the economy and take out some of the heat from inflation, with the result that rates will not need to go up as far or quickly as expected.

Source: CME Fedwatch, Thursday 10 March 2022 and Thursday 11 February 2022

“An end to the fiscal stimulus so liberally applied during the pandemic and the withdrawal of monetary stimulus surely makes some kind of slowdown inevitable anyway, after the sharp bounce back as lockdowns ended. The question now may be how abrupt that slowdown becomes – with the Russian invasion getting the blame. The Atlanta Fed’s GDP Now forecast suggests potentially very, as the service’s estimate for Q1 GDP growth in the USA is just 0.5% - although that is at least up from precisely zero a week ago.

“That may leave central banks with a dilemma, as they face a choice of letting their economies take a hit from inflation or a hit from higher interest costs.”