• AJ Bell FTSE 100 forecast for the end of 2020: 8,000

• The 20 cheapest FTSE 100 stocks on a price / earnings basis – all have a P/E ratio of less than 10

• 33 FTSE 100 firms are forecast to yield of over 5% in dividends next year

• Five stocks to consider for 2020:

o Cautious: Severn Trent

o Balanced: TI Fluid Systems

o Adventurous: IP Group

o Income: Imperial Brands

o One to avoid: Compass

“The FTSE 100 is barely any higher than three years ago and the pound is still way below where it was in summer 2016, so it is relatively easy for value-seeking contrarians to make a case for a UK stock market which has underperformed, feels unloved (judging by fund flow data) and looks potentially undervalued on the basis of earnings and yield. As such, the FTSE 100 may have a better chance of making it to 8,000 by the end of 2020 than many suspect,” says Russ Mould, AJ Bell investment director.

“Granted, the issue of Brexit must still be resolved and doubts continue to hover over the health of the global economy. However, were the UK to strike a trade deal with the EU, Washington and Beijing to settle their differences once and for all and governments around the world abandon austerity and launch looser fiscal policies then the world could look very different.

“Even if the FTSE 100 fails to challenge the 8,000 mark, investors may still be able to prosper through careful stock selection, as the index is packed with companies which either look cheap on an earnings basis, offer a fat dividend yield, or both.

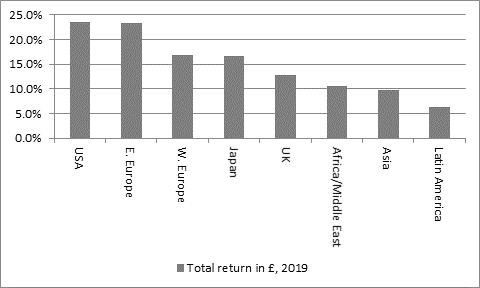

“In total return, sterling terms, the FTSE 100 has underperformed again, relative to its global peers in 2019. It has done less well than the other developed market options, America, Western Europe and Japan and even lagged Eastern Europe, while it has managed to fare better than only the Africa/Middle East region, Asia and Latin America.

“Ongoing fund flows also suggest the UK equity market is unloved, with data from the Investment Association showing that nearly £15 billion has fled the asset class since the EU referendum in 2016.

Source: Refinitiv data. Total returns in sterling terms from 1 January to 9 December 2018.

“Unloved often means undervalued and the UK is not expensive relative to its international peers or its own history on an earnings basis, with the FTSE 100 trading on around 12.5 times consensus earnings estimates for 2020.

“In total, 20 FTSE 100 firms trade on a price/earnings ratio of 10 times or less for 2020. Even if some of the earnings forecasts upon which those multiples are based prove optimistic, it is still possible to argue that you can buy good quality UK-listed firms cheaply, especially if you are an overseas investor, with sterling still relatively depressed.

Twenty cheapest FTSE 100 stocks, based on 2019 price/earnings ratio (PE)

|

|

|

2020E Price/earnings ratio |

202E Earnings per share growth (%) |

|

1 |

International Cons. Airlines |

5.5 x |

7.3% |

|

2 |

M & G |

5.7 x |

(14.3%) |

|

3 |

Evraz |

6.2 x |

(10.8%) |

|

4 |

Imperial Brands |

6.2 x |

0.6% |

|

5 |

Aviva |

6.7 x |

(0.7%) |

|

6 |

3i |

7.1 x |

15.1% |

|

7 |

Barclays |

7.2 x |

14.7% |

|

8 |

Centrica |

8.4 x |

33.9% |

|

9 |

BT |

8.5 x |

2.6% |

|

10 |

Taylor Wimpey |

8.5 x |

0.9% |

|

11 |

Legal and General |

8.5 x |

0.3% |

|

12 |

British American Tobacco |

8.6 x |

6.3% |

|

13 |

Lloyds |

8.7 x |

(1.8%) |

|

14 |

Prudential |

9.1 x |

5.7% |

|

15 |

Barratt Developments |

9.2 x |

(1.1%) |

|

16 |

Royal Bank of Scotland |

9.3 x |

4.7% |

|

17 |

Persimmon |

9.4 x |

(0.5%) |

|

18 |

WPP |

9.8 x |

(1.4%) |

|

19 |

Standard Chartered |

9.9 x |

15.7% |

|

20 |

TUI AG |

9.9 x |

39.8% |

Source: Digital Look, Refinitiv data, consensus analysts’ forecasts

“It is also possible to argue that the UK looks attractive on a yield basis, as the FTSE 100 offers a prospective yield of 4.7% based on aggregate consensus analysts’ forecasts for 2019.

“This beats the 0.75% Bank of England base rate pretty handily and also outstrips the 0.77% yield available on the benchmark, 10-year UK Government bond, or Gilt.

“Granted, dividend growth is forecast to slow to just 2% in 2020 and earnings cover for the dividend is still thinner than ideal at 1.69 times, although this is still the best level of cover since 2014.

“There are 33 firms within the FTSE 100 which offer a yield of more than 5.0%.

|

|

|

2020 E |

||

|

|

|

Dividend yield |

Dividend growth |

Dividend cover |

|

1 |

Imperial Brands |

12.2% |

0.6% |

1.32 x |

|

2 |

Taylor Wimpey |

10.6% |

1.7% |

1.11 x |

|

3 |

Evraz |

10.5% |

(29.7%) |

1.55 x |

|

4 |

Persimmon |

9.3% |

0.0% |

1.14 x |

|

5 |

M & G |

8.5% |

56.0% |

2.09 x |

|

6 |

Aviva |

8.2% |

3.8% |

1.84 x |

|

7 |

British American Tobacco |

7.5% |

5.8% |

1.53 x |

|

8 |

Standard Life Aberdeen |

7.1% |

0.0% |

0.87 x |

|

9 |

HSBC |

7.1% |

0.0% |

1.38 x |

|

10 |

Barratt Developments |

7.1% |

1.3% |

1.54 x |

|

11 |

BP |

6.8% |

2.1% |

1.31 x |

|

12 |

Royal Dutch Shell |

6.8% |

0.7% |

1.42 x |

|

13 |

Legal and General |

6.8% |

6.7% |

1.74 x |

|

14 |

BT |

6.5% |

(19.9%) |

1.82 x |

|

15 |

WPP |

6.4% |

0.0% |

1.60 x |

|

16 |

TUI AG |

6.3% |

22.5% |

1.60 x |

|

17 |

Centrica |

6.3% |

1.6% |

1.88 x |

|

18 |

Phoenix Group |

6.3% |

0.0% |

1.09 x |

|

19 |

Rio Tinto |

6.3% |

(12.1%) |

1.59 x |

|

20 |

SSE |

6.2% |

2.8% |

1.23 x |

|

21 |

BHP Group |

6.1% |

(0.0%) |

1.51 x |

|

22 |

Admiral Group |

6.0% |

0.9% |

1.00 x |

|

23 |

Lloyds |

5.8% |

5.1% |

2.00 x |

|

24 |

Barclays |

5.7% |

8.0% |

2.44 x |

|

25 |

National Grid |

5.7% |

2.9% |

1.24 x |

|

26 |

Royal Bank of Scotland |

5.6% |

19.8% |

1.92 x |

|

27 |

ITV |

5.6% |

0.3% |

1.63 x |

|

28 |

Vodafone |

5.4% |

1.2% |

1.09 x |

|

29 |

British Land |

5.4% |

2.5% |

1.05 x |

|

30 |

Glencore |

5.3% |

(6.7%) |

1.53 x |

|

31 |

Kingfisher |

5.3% |

1.9% |

1.90 x |

|

32 |

Land Securities |

5.1% |

2.5% |

1.18 x |

|

33 |

RSA Insurance |

5.0% |

17.1% |

1.71 x |

|

|

FTSE 100 |

4.7% |

1.8% |

1.69x |

Source: Digital Look, Refinitiv data, consensus analysts’ forecasts

“The yield available from those 33 stocks, and the index overall, does at least mean that investors will be compensated at least to some degree for the risk they are taking with UK equities while they patiently wait to see how the negotiations with Brussels ultimately pan out.

“But there is value to be had beyond the confines of the FTSE 100’s multinationals, too, and investors looking to build a portfolio of UK firms could delve down into the FTSE 250 (or below) as well.

Five stock to consider for 2020

Cautious – Severn Trent (SVT)

“The good news for Severn Trent started in January when the water utility gained fast track approval from the regulator Ofwat for its capital investment and pricing plans for the 2020-2025 period. This meant that the FTSE 100 firm could begin to prepare its financing and analysts and shareholders could calculate forecasts for profits, cash flow and above all dividends with greater certainty. A dividend yield of some 4.5%, based on consensus forecasts for the year to March 2021, should therefore prove pretty reliable, even if earnings momentum will be far from exciting, and allow Severn Trent to provide some welcome portfolio ballast.”

Balanced – TI Fluid Systems (TIFS)

“Shares in the automotive components and systems maker are starting to motor, but they still trade below 2017’s 255p IPO price and look decent value, on a forward price earnings multiple of barely 10 times and a with a yield of around 3%. The lowly rating is the result of fears over a slowdown in the global car market, the perceived threat posed by electric vehicles (EVs) to its expertise in fuel tank systems and its private equity background. But TI Fluid Systems could well be a winner as and when electric vehicles gain proper traction, as EVs actually require additional fluid to manage heat. In addition, the company’s new pressurised plastic fuel tank is ideally suited to the increased fuel vapour requirements of hybrid vehicles.”

Adventurous – IP Group (IPO)

“There is a fair chance that the well-documented travails of Neil Woodford will put many investors off investing in early-stage companies for life but for brave, patient contrarians, this represents a potential opportunity. IP Group invests in, and works to commercialise, the intellectual property (IP) developed by British universities.

“Its shares have steadily fallen from 250p over the last five years, hampered in part by Woodford’s hurried disposal of a 13% stake in the FTSE 250 firm this autumn. That leaves the shares trading well below their last stated net asset value figure of 110.6p a share. Such a discount provides some downside protection if some of IP Group’s investments go wrong and upside potential if they unearth a future winner or two, although the absence of a dividend and the risky nature of investing in young companies mean that IP Group is not suitable for widows or orphans.”

Income seekers - Imperial Brands (IMB)

“Normally, any company that comes with a dividend yield of 12% carries a big risk warning, especially when the forward price/earnings ratio is barely six, as such figures can usually be filed in the “too good to be true” category. Throw in the ethical issues that come with smoking, a mild profit warning and autumn’s decision to part company with its chief executive and there are plenty of reasons to give Imperial Brands a wide berth.

“But the valuation prices in a lot of the bad news and ignores how tobacco remains a highly profitable and cash generative business. Imperial’s cash flow still nicely covers the forecast £1.8 billion annual dividend payment, even after capital investment, tax, interest and pension contributions. Price increases help to compensate for falling stick volumes and the sale of the cigar business will further bolster the balance sheet.

“This will feel like a very, very uncomfortable stock to hold – but they are often the best investments. After a calamitous 2019 it will not take much by way of upside surprises to change perception of the stock and the fat yield means that investors are being paid to wait.”

One to avoid - Compass (CPG)

“It may seem foolhardy to pick a fight with a company that is a recognised global leader in its field and can point to an unbroken streak of annual dividend increases that stretches back to 2001. But Compass’ undoubted strengths are well known to the market and priced in by a forward price/earnings ratio of 21 times, while a dividend yield of 2.3% may not provide too much downside support in the event of any unexpected deterioration in trading.

“The full-year results published in November were solid enough on the face of it, although the way in which the catering giant turned a £2 billion increase in sales into a £90 million drop in operating profit, on a stated basis, is a concern. This hints at building cost pressures, perhaps thanks to the worldwide push on minimum wages, where the direction of travel only looks to be going one way. The FTSE 100 firm is embarking on a new efficiency drive to compensate but the unforgiving rating leaves little room for any disappointment.”