“While 12 months is not a fair time period by which to judge any strategy, it is clear that a combination of Debenhams’ historic reliance on its ‘Blue Cross’ price promotions, excess floor space and a web offering that needs more work are combining to confound the Bucher plan.

“Even though digital sales showed a welcome 9.7% year-on-year increase in the first six months of the financial year, group-wide like-for-like sales still fell 2.2%, forcing the group to go back to its old discounting ways. As a result, first-half gross margin fell by 160 basis points (1.6%), in excess of the 150-basis-point drop for the whole year forecast by management as part of January’s profit warning.

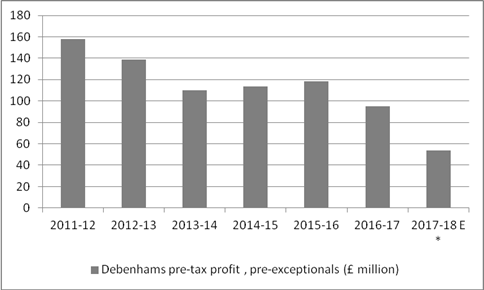

“The combination of weak sales and lower margins means Mr Bucher now expects pre-tax profit to come in toward the bottom end of the consensus forecast range of £50 million to £61 million, which suggests a mild profit warning, given prior management guidance of £55 million to £65 million range – and that excludes the £28.7 million in additional costs and charges relating to the acceleration of the Redesigned strategy.

“This latest drop in annual profits will only add to a grim sequence of declines which makes it clear just how serious Debenhams’ competitive position really is.

Source: Company accounts, Digital Look. *2017-18 based on revised company guidance on 19 April 2018 (assumes lower end of consensus forecast range)

“Unlike Next, Debenhams was slow to adapt to the online world, has previously failed to focus on full-price sales (although Mr Bucher is now trying to fix both of these now) and its large format stores are not sufficiently local or convenient for customers to use them as click-and-collect stops. Again, Mr Bucher is doing what he can to tackle excess floor space. Two stores have been closed and up to eight more may follow while space has been reduced at one site. The company will use 25 lease renewals in the next five years to try and negotiate more favourable terms on rents and is looking at downsizing its footprint at up to 30 more venues.

“However, Debenhams leases average 18 years in length and this does limit the company’s room for manoeuvre and it remains to be seen how much of a dent that any future negotiations with landlords will make in the £4.5 billion lease commitments disclosed in the 2017 annual report and accounts., based on current terms and conditions.

“This is a considerable burden on the company’s profits and cash flow and one casualty has been the dividend payment where the old adage ‘if a yield looks too good to true, then it usually is’ has claimed its latest victim.

“Prior to today Debenhams had been offering a dividend yield of nearly 15%, assuming an unchanged full-year figure of 3.425p per share on a share price of 23p. This was an absurd figure when interest rates on cash are so low and when 10-year Government bonds yield 1.44% and Mr. Bucher has wisely bowed to the inevitable with a 51% cut in the interim payment to 0.5p.

A similar cut to the full-year payment to around 1.7p would still leave the shares on a yield of more than 7%, based on last night’s close, so even that looks open to question, especially if the company accelerates near-term investment, depressing profits, as part of the turnaround plan.”