“The Bank of England will be pleased that its emergency half-point cut in interest rates got a warmer welcome from financial markets than the US Federal Reserve did at the start of the month, as the FTSE 100 has gone up in response, but the initial glow already seems to be wearing off,” says Russ Mould, AJ Bell investment director.

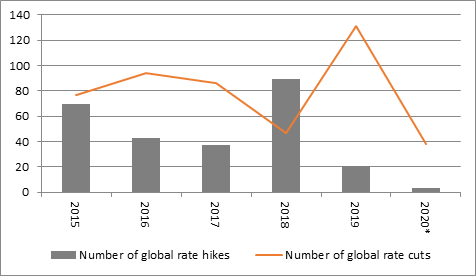

“This may be partly because investors are now awaiting the Budget from new Chancellor of the Exchequer Rishi Sunak; partly because some form of policy response from the Bank of England was already expected, given that today’s rate cuts in the UK and Iceland take the global total to 38 this year against just three increases; and partly because frantic rate-cutting cycles in 2000-03 and 2007-09 failed to stave off a recession and a bear equity market.

Source: www.cbrates.com. *2020 to 11 March

“The Bank of England’s willingness to be seen to be doing something is understandable, especially as so many of its global peers have already acted. As Yogi Berra once said of his professional sport, ‘Baseball is 90% psychological, the other half is physical’ and the same applies to recessions – it is very easy for Governments, corporates and consumers to talk themselves into one, as they take fright, cut costs and spending accordingly and unwittingly start a vicious circle of more fear and further retrenchment to the point whereby confidence ebbs away and economic activity starts to shrink.

“In addition, lower rates have frequently been the spark for improved confidence in the financial markets, too.

“Over the 12 rate-cutting cycles since the inception of the FTSE All-Share in the early 1960s, the index has gained after the first decrease in borrowing costs on a three-, six-, 12- and 24-month view.

“Yet the hit rate over the first three months is patchy (six gains, six losses) and the last two really big rate-cutting cycles – excluding the 0.25% cut in response to the EU referendum result in 2016 - started disastrously for buyers, with losses over a two-year period as recessions bit hard, earnings disappointed and equity valuations proved unsustainable.

|

Rate cutting cycle |

FTSE All Share response after rate cut |

||||||

|

From |

To |

From |

To |

3 months |

6 Months |

1 Year |

2 years |

|

03-Jun-65 |

04-May-67 |

7.00% |

5.50% |

(3.5%) |

6.1% |

12.1% |

3.9% |

|

21-Mar-68 |

02-Sep-71 |

8.00% |

5.00% |

19.1% |

30.7% |

26.4% |

10.5% |

|

07-Jan-74 |

08-Mar-76 |

13.00% |

9.00% |

(16.6%) |

(30.3%) |

(57.3%) |

10.5% |

|

19-Nov-76 |

17-Oct-77 |

15.00% |

5.00% |

25.4% |

46.8% |

64.1% |

64.1% |

|

03-Jul-80 |

29-Jun-84 |

17.00% |

8.88% |

6.7% |

7.2% |

17.9% |

16.6% |

|

20-Mar-85 |

17-May-88 |

13.88% |

7.38% |

(1.9%) |

0.3% |

30.2% |

59.9% |

|

08-Oct-90 |

08-Feb-94 |

14.88% |

5.13% |

(4.5%) |

15.8% |

18.5% |

13.3% |

|

13-Dec-95 |

06-Jun-96 |

6.63% |

5.69% |

1.4% |

5.7% |

9.0% |

33.0% |

|

08-Oct-98 |

10-Jun-99 |

7.50% |

5.00% |

27.8% |

35.5% |

33.0% |

40.8% |

|

08-Feb-01 |

10-Jul-03 |

6.00% |

3.50% |

(5.1%) |

(11.7%) |

(17.3%) |

(42.0%) |

|

06-Dec-07 |

05-Mar-09 |

5.75% |

0.50% |

(10.1%) |

(8.6%) |

(38.8%) |

(19.8%) |

|

04-Aug-16 |

02-Nov-17 |

0.50% |

0.25% |

(0.5%) |

6.8% |

12.4% |

14.9% |

|

11-Mar-20 |

00-Jan-00 |

0.75% |

? |

|

|

|

|

|

AVERAGE |

|

|

|

3.2% |

8.7% |

9.2% |

17.1% |

Source: Refinitiv data, Bank of England

“It is therefore those two cycles which may be nagging investors now. Thankfully UK equity valuations do not feel as extended now as they did in 2000 but the danger of earnings downgrades and dividend cuts in the event of a recession is one that is clearly at the forefront of investors’ minds right now.

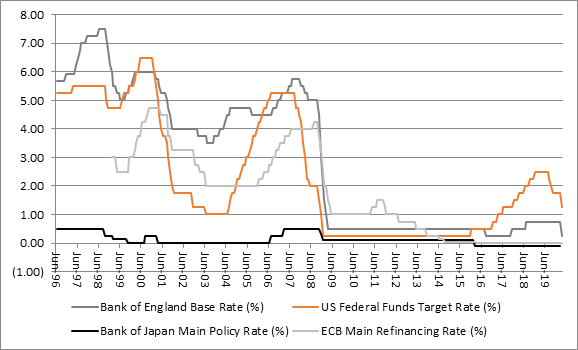

“And if the global economy does tip into a recession very quickly, despite 12 years of extraordinarily loose policy, this begs the question of where central banks turn next. If markets really turn down and the economy does so too, that would make central banks’ promises that their post-crisis policies would be just emergency measures look pretty threadbare.

“Trying to solve a debt crisis by encouraging more borrowing (global debt is up more than 60% since 2007 to $255 trillion, according to the Institute of International Finance) has perhaps kept the plates spinning for a bit longer but it has not provided a sustainable base for the real economy or financial markets.

“In the real world, efforts to raise rates and ‘normalise’ policy have quickly foundered and the trend looks to be inexorably lower, with negative rates, more QE and perhaps even helicopter money the next ‘unorthodox’ or ‘extraordinary’ policies to come out of the central banks’ toolkit.

Source: Refinitiv data

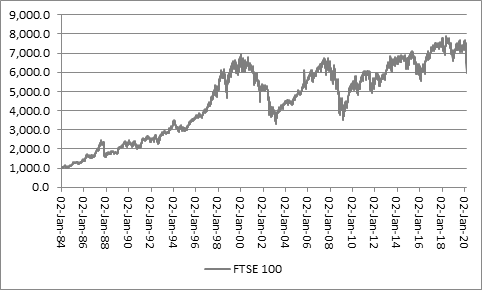

“From the narrower perspective of the financial markets, the FTSE 100 stands at around the 6,000 mark. That is 11% below is 2007 high of 6,732 and 14% below its 1999 peak of 6,930 and means the benchmark is back at a level it first crossed on 1 April 1998 – twenty-two years ago.

“If central banks have been trying to support stock markets, it is hard to argue that they have succeeded, looking at those numbers, and it may be that the latest rate cut means the Bank of England is simply attempting the impossible and trying to push custard uphill.”

Source: Refinitiv data