“The comedian and magician Tommy Cooper was fond of telling a gag about how he once received a compliment from someone about his driving, because they had stuck a sign that said ‘Parking Fine’ on his windscreen. Shareholders in Metro Bank won’t be smiling about the £5.4m fine from the regulator relating to poor governance and controls but they seem relieved all the same, as the shares are still up,” says AJ Bell Investment Director Russ Mould. “The levy is not a major burden, even though the bank is in loss, and investors will be hoping the regulatory mis-step belongs to a different era, under the old management team, rather than the new one spearheaded by Daniel Frumkin since early 2020.

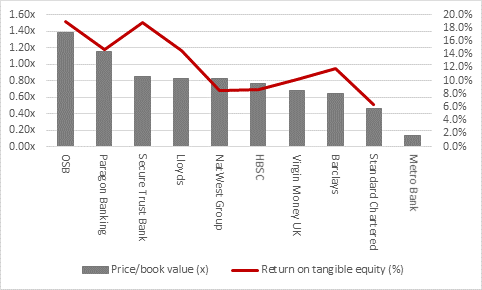

“That may well be the case but investors still seem sceptical as to whether the new broom can really turn Metro Bank around. Valuing the lender is not straightforward as it does not make a profit and does not pay a dividend, so the best benchmark may be price to book, or net asset, value. This can be done on a historic basis, too, so that cuts out some of the educated guesswork that comes with forecasts for future earnings and dividends.

“Based on the first-half shareholders’ funds figure of £1.147 billion, Metro trades on just 0.13x times net asset value, since its market cap is just £152 million (152 dividend by 1147).

“In per share terms, book value of 665.3p of assets compares to a share price of 89p.

“That means Metro is easily the cheapest of the challenger banks on an asset basis and it is way cheaper than any of the FTSE 100 banks too.

Source: Company accounts, London Stock Exchange data. Based on last stated net asset value per share (NAV) figure.

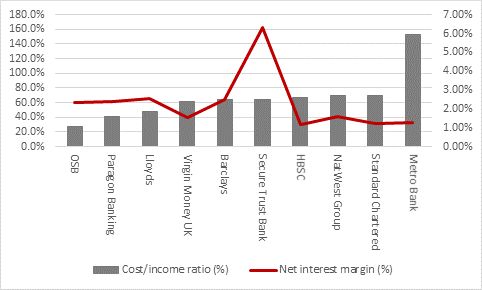

“This is again presumably the legacy of the bank’s record under co-founder and former boss Vernon Hill. Metro Bank is in loss and therefore registers a negative return on equity. These are in turn the result of a low net interest margin and a very high cost-to-income ratio, relative to the FTSE 100 and FTSE 250 peer group. Those figures imply, at least to some degree, that Metro Bank has tried to buy market share with very competitive lending rates and that its branch-based proposition saddles with at least some extra costs, despite the potential benefits it brings in terms of customer services. That said, the integration of Rate Setter brought additional costs and Mr Frumkin and team will be looking for synergies to emerge as the acquisition beds down.

Source: Company accounts, as of last reported set of results

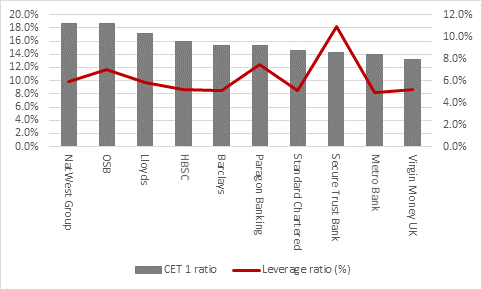

“Equally, the price/book value ratio is so low it almost suggests that analysts fear Metro Bank may never make a profit (since annual losses will erode shareholder funds and thus net asset value per share over time). It is now up to Metro Bank to try and prove the doubters wrong and if they can do so then the shares will look stunningly cheap. If they cannot get Metro Bank into the black then the shares may just be yet another value trap, where the stock looks cheap and stays cheap as nothing happens to unlock the value that may be there, even if the lender looks well capitalised, on the basis of the regulatory capital ratios that are required of it.”

Source: Company accounts, as of last reported set of results