Russ Mould, investment director at AJ Bell, comments:

“Today’s initial share price slide leaves Whitbread down by some 30% from its spring 2015 peaks to again remind investors that the best portfolio protection comes from paying a lowly valuation.

“In April 2015, when the shares touched £54.40, the stock was trading on around 23 times forward earnings (based on a consensus earnings per share estimate of 232p for the year to February 2016).

“At £37.72, Whitbread has since de-rated to 14.6 times earnings (based on a consensus earnings per share estimate of 257p for the year to February 2018) as concerns have grown over growth.

“After three years of strong double-digit earnings increases in 2013, 2014 and 2015 profits are now seen rising at a mid-single digit clip going forward. This is partly due to increased competition in an increasingly saturated UK coffee market, concerns over the UK economy and the law of large numbers when it comes to the Premier Inn estate’s growth.

Source: Company accounts, Digital Look, analysts' consensus estimates for fiscal year ending February

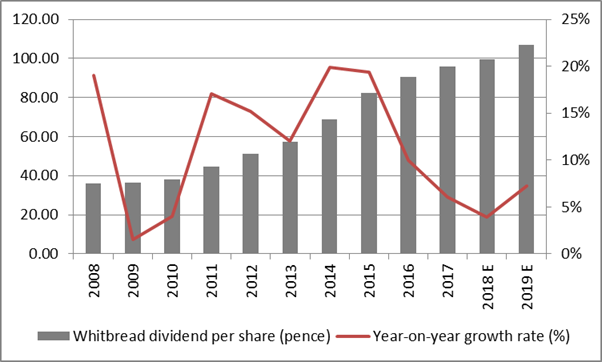

“Yet the grinding 30-month share price fall means Whitbread may be looking more like value again. It trades on a slight discount to the FTSE 100 on a forwards earnings multiple for this calendar year, even though the company can point to a strong historic earnings record and an unbroken streak of increased annual dividends that stretches back to 2004 – a run is likely to be extended this year, judging by the 5% increase in the interim payment to 31.4p:

“Although the forward yield of 2.5% represents a discount to the 3.9% available from the FTSE 100 overall for 2017, Whitbread offers far superior dividend cover at 2.6 times compared to the skinny 1.6 to 1.7 times across the whole of the index – and history shows it is the companies which consistently increase their dividends which offer investors the best total returns over time (see data on page 3 of AJ Bell’s Dividend Dashboard).

Source: Company accounts, Digital Look, analysts' consensus estimates for fiscal year ending February

“For the shares to spark back into life, the company will need to capitalise upon the growth potential of its moves into the German hotel and Chinese coffee markets and deliver on the (still somewhat nebulous) £150 million efficiency plan while proving that Costa can cope with a competitive UK coffee market and any near-term slowdown in UK activity will not hobble Premier Inn’s long-term earnings power.”