“The US Federal Reserve is expected to leave interest rates unchanged and keep withdrawing Quantitative Easing at a rate of up to $50 billion a month at Thursday’s policy meeting, but Chair Jay Powell is expected to lay the ground work for a fourth rate rise of this year and ninth of this upcycle in December – despite President Trump’s claim that such a move would be ‘loco’,” says Russ Mould, AJ Bell investment director.

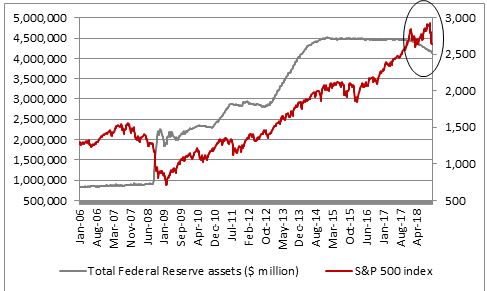

“Fed policy remains one of the key issues for investors to assess right now – it may not be a coincidence that the US central bank has so far shrunk its balance sheet by $351 billion, or 8%, while the S&P 500 is some 7% off its all-time high.

Source: FRED – St. Louis Federal Reserve database, Refinitiv data

“The President’s colourful accusations that his country’s central bankers are ‘going crazy’ articulate a deep-rooted fear in the markets that higher rates and less stimulus could mean lower share prices. The Fed does not seem moved by such talk as yet, but this does beg the question of what might have to happen for the US central bank to stop tightening and even start loosening policy once more.

“Fed chairman Jay Powell’s predecessors Ben Bernanke and Janet Yellen oversaw the launch of all three phases of the Fed’s QE scheme in November 2008, November 2010 and September 2012. All three of those programmes came in the wake of a combination of

• stock market weakness, or at least a loss of upward momentum

• a sell-off in high yield (junk) bonds (as benchmarked by the US-quoted iShares iBoxx High Yield Corporate Bond Exchange-Traded Fund, which has the ticker HYG)

• A flattening in the yield curve (a decline in the premium yield offered by US 10-year Treasuries relative to two-year ones)

“Yet Powell seems to have a different outlook, given both his 2017 quote that ‘it’s not the Fed’s job to stop people losing money’ and the US central bank’s suggestions that the yield curve is not as reliable an indicator as it once was.

“If financial market indicators will not sway Mr Powell and colleagues, then perhaps investors will have to look to real-world, economic ones.

“AJ Bell has therefore trawled through a substantial batch of US data to see which items may have influenced Fed thinking under Mr Bernanke and Ms Yellen.

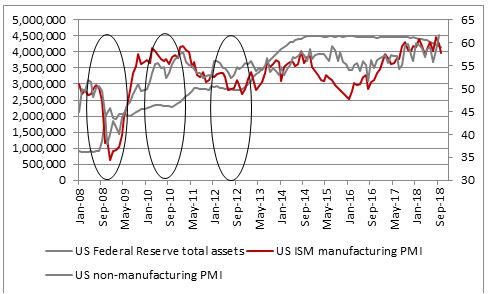

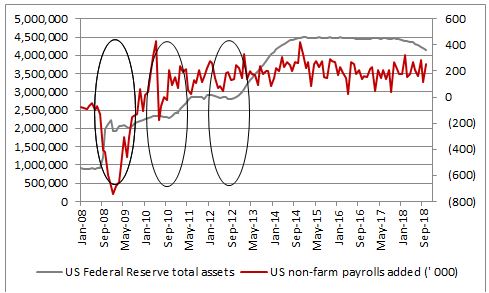

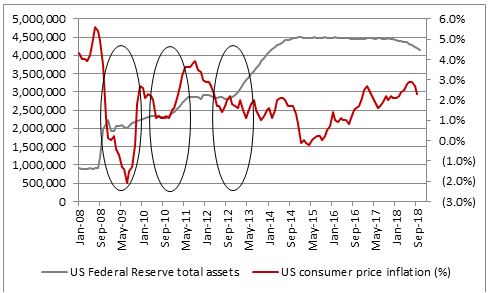

“Of the real-world ones, three in particular seem to have tempted the US central bank to pull the monetary stimulus trigger in the past (the rings show when QE1, QE2 and QE3 were launched).

• Weakness in the Institute for Supply Management’s (ISM) manufacturing purchasing managers’ index (PMI)

Source: Refinitiv data

• Weakness in the non-farm payroll data and a loss of momentum in job creation

Source: Refinitiv data

• A slackening in the rate of inflation

Source: Refinitiv data

“This makes sense, since the Fed has a twin mandate of employment and inflation.

"Inflation has ebbed a little and the PMI has pulled back slightly from its peak but neither really has done so to the degree seen ahead of QE2 or QE3. Moreover, US job creation is still strong, judging by the 250,000 new non-farm payrolls added in October and 3.1% wage growth.

“Under such circumstances, the Fed seems unlikely to be deflected off course by increased asset price volatility alone. Financial markets are on their own.

“It is now for investors to decide whether momentum in earnings, cash flows and dividends are sufficient to justify prevailing valuations and compensate them for the specific risks that come with individual asset classes and geographic regions, because there is no longer enough cheap money around to lift all prices on a tide of liquidity.”