• Chancellor Sajid Javid has confirmed a consultation on the future of the Retail Prices Index (RPI) measure of inflation will be published in the March Budget (https://www.parliament.uk/documents/lords-committees/economic-affairs/Letter%20from%20CofX%20to%20Chairman%204%20Sept%202019.pdf)

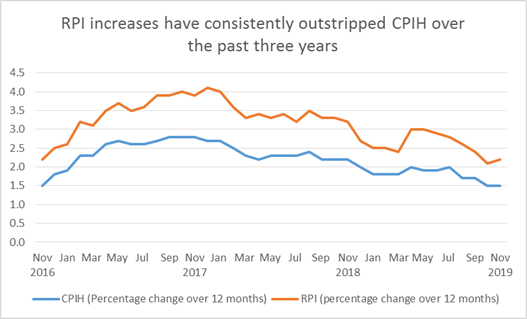

• Review expected to establish timetable for abolishing RPI and replacing it with CPIH, which tends to be lower

• Shift could have significant implications for pensions, investments and people’s day-to-day finances

Tom Selby, senior analyst at AJ Bell, comments: “RPI has been widely lamented as an inflation measure by statisticians and politicians alike, so it is no surprise the Government has faced calls to jettison it in favour of a more accurate measure – most likely CPIH - at the earliest possible opportunity.

“However, such a move could have far-reaching implications for savers, investors and consumers.”

Pensions and index-linked gilts

“There are, for example, defined benefit schemes where scheme rules mandate members’ retirement incomes rise in line with RPI. If these contracts were ripped up and RPI replaced with CPIH – which tend to be lower – it would effectively represent a stealth cut to people’s hard-earned pensions.

“Conversely, companies sponsoring DB schemes with RPI-linked increases would likely be able to downgrade their pension liabilities and potentially slash billions from aggregate pension deficits. However, anyone invested in index-linked gilts - including individuals and pension funds - would see the value of their holdings tumble if the Government applied a blanket overnight switch from RPI to CPIH.

“The big question the Government needs to answer is the extent to which it will mitigate any negative impact on people with pensions and investments explicitly linked to RPI. One option in this regard would be to maintain a notional RPI which these contracts could then adopt, although this might mean RPI remains part of the system for decades.”

Student loans and rail fares

“Ditching RPI could be good news for young people and commuters, however. The Government has doggedly, and some would say cynically, continued to link things like rail fare increases and student loan repayments to RPI, ensuring a quiet and creeping boost to Treasury coffers.

“Conversely, the state pension, benefit payments and tax thresholds have been linked to the lower CPI measure, leading to accusations of ‘index shopping’ by successive administrations.

“Moving away from RPI to CPIH could precipitate an end to this approach and provide a much-needed boost for indebted students and rail passengers.”

Source: ONS