“The idea is that bonds are a safe investment. The investor buys the bond at issue, receives the interest payments (or coupons) over the lifetime of the bond and then gets back their initial investment (or principal) upon maturity of the loan,” says AJ Bell Investment Director Russ Mould.

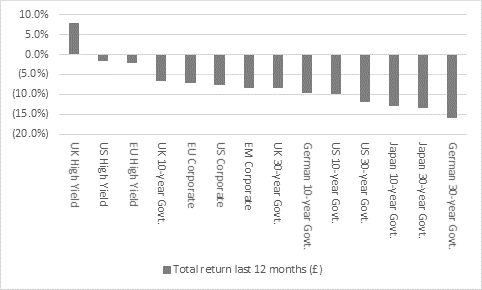

“But over the past year investors have generally lost money on their bond holdings as inflation has reared its head and central banks have had to think about halting Quantitative Easing and even raising interest rates. Portfolio-builders now need to reassess fixed income as an asset class and decide whether what is in theory one of the safest options now offers more risk than is does potential reward.

Source: Refinitiv data

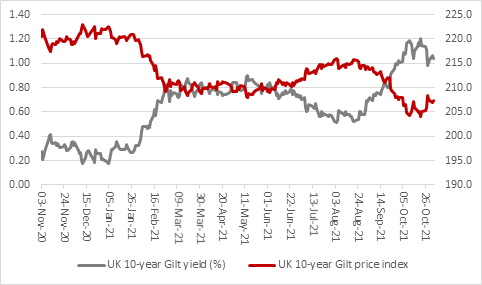

“On Budget day last month, the yield on the benchmark ten-year UK Government bond, or Gilt, plunged in one trading session from 1.11% to 0.985%. That equated to a 1.3% one-day gain in the paper’s price (since bond yields move inversely to price, just as is the case with shares) as the Budget document itself revealed a big drop in the amount of Gilts that the Bank of England intended to sell for fiscal 2021-22, in response to downward revisions to estimates for Government borrowing.

“But that was the first bit of good news holders of UK Government debt had had for a while.

“As inflation has picked up pace, so bond yields have surged and prices tumbled. From its year low of 0.18% on 4 January, the benchmark ten-year Gilt yield rose to a peak of 1.20% on 21 October. That equated to an 8% drop in the price of the paper – so anyone who bought at the yield low (and price peak) lost the equivalent of 44.4 years’ worth of interest.

Source: Refinitiv data

“Hand on heart, it is pretty hard to describe as ‘safe’ an asset whose price is starting to whipsaw around and where even minor price changes can swiftly eliminate the portfolio benefits of the yield on offer.

“And there are four clear risks to owning bonds, especially when the potential rewards (yields) remain relatively skinny.

• Credit, issuer, or default risk. Western Government defaults are rare (because they can just print more money to foot the bill) and such paper is therefore used as a benchmark, ‘risk-free’ rate. Any other bonds – corporate, emerging market and so on – of similar duration should offer a premium return to compensate the holder for the greater risk that the borrower gets into trouble and cannot make the interest payments or return principal.

• Inflation risk. If the rate of inflation exceeds the coupon or yield on the bond, then the investor is effectively locking in a guaranteed real-terms loss.

• Interest rate, or market, risk. In inflation becomes entrenched and interest rates rise then a further risk comes into play since bond prices could fall as holders sell existing positions to buy new positions in new issuance, which will have to come with higher coupons to compensate for advances in headline borrowing costs. Price declines could erase a chunk of the income accrued.

• Liquidity risk. It is important to make sure the bond's issue size will be large enough so it can be easily bought and sold in the secondary market. The less liquid the paper, the higher the coupon should be to compensate the holder.

“The coupon is always fixed and is based upon the issue price of the paper (usually 100). The yield will change according to the price, just as it would for a share.

“As coupons get lower, or yields become thinner, the buffer against any potential capital loss in the event interest rates rise gets progressively smaller. This is where duration comes into play.

• Macaulay duration measures the average weighted time to maturity of all coupon and principal payments

• Modified duration quantifies interest rate risk and how much a bond or portfolio of bonds will move in price relative to a 1% shift in borrowing costs.

“Note again how that one percentage point rise in the UK ten-year Gilt yield between January and October translated into an 8% price decline.

“The issue therefore is not whether Government bonds are risky or not, but whether the rewards on offer, in the form of the coupon or the running yield, compensate the holder for the risks involved.

• If inflation becomes entrenched and stays elevated, the answer may well be ‘no’.

• If an investor believes the storm will blow over and deflationary forces will reassert themselves, then the answer may be ‘yes,’ especially after the recent sell-off.

Investors can also build a portfolio of bonds to help manage the risks:

• Longer-dated bonds have longer durations, as the returns are more back-end loaded, so they will be more volatile, or sensitive to interest rate movements. Perpetual bonds, with no maturity date, are the most volatile bonds of all.

• Lower-coupon bonds also have longer durations, and therefore be more volatile, as again the returns are more back-end loaded. Zero-coupon bonds have a duration that is the same as their maturity.

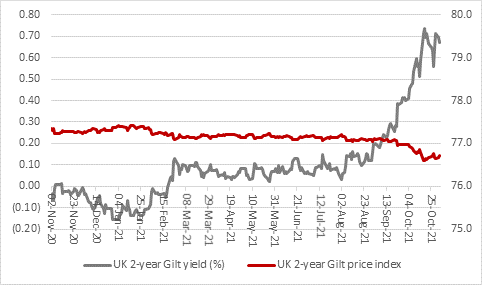

• The opposite also applies: the shorter the life of the bond, or the higher the yield, the shorter the duration and the less the degree to which prices will move relative to interest rate changes. The UK two-year Gilt lost just 1% in price while the ten-year lost 8% in that January-to-October market swoon.

Source: Refinitiv data

“Investors can also use bond funds to mitigate the dangers. They can own a range of them or pick a flexible bond funds that can put money to work across a wide range of fixed-income asset classes and not just one and therefore use its mandate to to tackle – and even benefit from – duration.

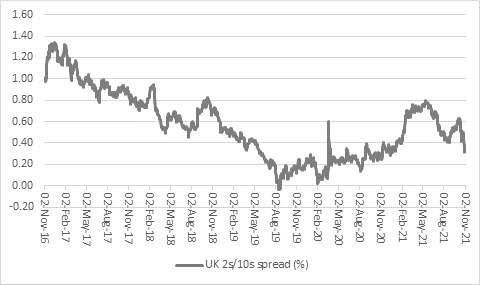

“One tool that investors can use to measure whether inflation or deflation is coming, is the spread between the two- and ten-year Gilt. If the market thinks a recovery and inflation is coming (and that central banks will actually raise interest rates in response), the spread may widen, and the yield curve steepen as rate rises are priced in. If it thinks a downturn or deflation are coming, then it may flatten as rate cuts are priced in.

Source: Refinitiv data

“At the moment, the yield curve is flattening, even as inflation rises. Central bank manipulation of bond markets via Quantitative Easing could mean we are getting a false signal. But it could mean the Gilt market is warning of the middle ground, the worst outcome of all – stagflation.”