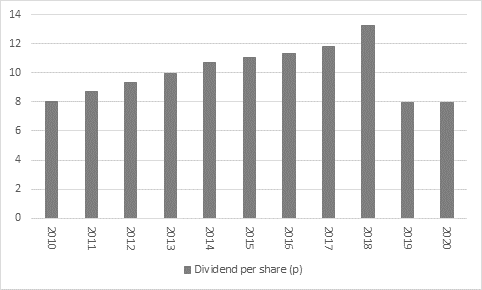

“It is all a far cry from last May, when Vodafone CEO Nick Read sanctioned the first dividend cut in Vodafone’s history, as the telco’s shares are rallying on an unchanged full-year payment of €0.09 a share,” says Russ Mould, AJ Bell Investment Director. “Such is investors’ thirst for income after dividend cuts, suspensions, deferrals or cancellations from 43 FTSE 100 members – including Land Securities and Morrisons today – that Vodafone’s shares are up strongly in early trading, thanks to the 6.5%-plus dividend yield they offer.

Source: Company accounts

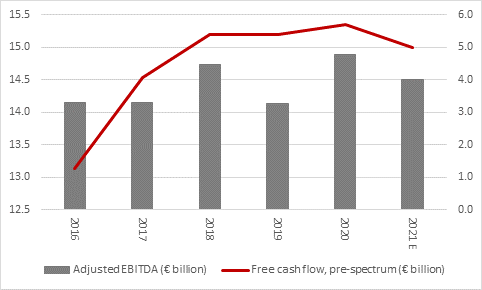

“Vodafone’s ability to hold the (reduced) dividend rests upon its cash flow, where there was a marked improvement in performance in the year to March 2020. Free cash flow – after the payment of taxes and interest, investment in the business and the acquisition of spectrum for its mobile telecoms operations – jumped strongly as the company optimised its portfolio of assets, cut costs and benefited from ever-growing data and video consumption by consumers via their mobile devices.

|

€ million |

2016 |

2017 |

2018 |

2019 |

2020 |

|

|

|

|

|

|

|

|

Operating profit |

1,320 |

3,725 |

4,298 |

(951) |

4,099 |

|

Depreciation & amortisation & impairments |

11,724 |

12,086 |

10,884 |

13,320 |

15,859 |

|

Net working capital |

(496) |

(48) |

(858) |

577 |

(70) |

|

Capital expenditure |

(10,561) |

(7,675) |

(7,321) |

(8,151) |

(7,605) |

|

Operating Cash Flow |

1,987 |

8,088 |

7,003 |

4,795 |

12,283 |

|

OpFcF from discontinued operations |

1,645 |

1,203 |

858 |

(372) |

0 |

|

Operating Cash Flow |

3,632 |

9,291 |

7,861 |

4,423 |

12,283 |

|

|

|

|

|

|

|

|

Tax |

(738) |

(761) |

(1,010) |

(1,131) |

(930) |

|

Interest / leases |

(982) |

(830) |

(753) |

(2,088) |

(3,549) |

|

Pension contribution |

0 |

0 |

0 |

0 |

0 |

|

Licensing and spectrum spend |

(3,182) |

(474) |

(1,123) |

(181) |

(837) |

|

Free Cash Flow |

(1,270) |

7,226 |

4,975 |

1,023 |

6,967 |

|

|

|

|

|

|

|

|

Dividend |

(4,188) |

(3,714) |

(3,920) |

(4,064) |

(2,296) |

|

Remaining free cash flow |

(3,921) |

2,783 |

1,320 |

(2,488) |

5,508 |

|

Free cash flow cover |

(0.30x) |

1.95 x |

1.27 x |

0.25 x |

3.03 x |

Source: Company accounts

“This will be an enormous source of relief to those who invest in Vodafone directly or indirectly through an income fund or a tracker fund designed to follow the FTSE 100, since the telco is the thirteenth biggest company in the UK’s premier index by market cap and its ninth biggest payer in cash dividend terms, based on their last full-year payment.

|

|

|

2019 |

2019 |

2020 ? |

|

|

|

Dividend (£ million) |

% of FTSE total payment |

|

|

1 |

Royal Dutch Shell |

11,612 |

15.7% |

Cut Q1 |

|

2 |

BP |

6,491 |

8.8% |

Held Q1 |

|

3 |

British American Tobacco |

4,826 |

6.5% |

Holding pay-out ratio |

|

4 |

HSBC |

4,755 |

6.4% |

Passed Q1 |

|

5 |

GlaxoSmithKline |

3,991 |

5.4% |

Held Q1 |

|

6 |

Rio Tinto |

3,729 |

5.0% |

|

|

7 |

AstraZeneca |

2,866 |

3.9% |

Paid H2 2019 |

|

8 |

BHP Group |

2,190 |

3.0% |

|

|

9 |

Vodafone |

2,032 |

3.2% |

Paying H2 2019 |

|

10 |

Imperial Brands |

1,955 |

2.6% |

|

|

11 |

National Grid |

1,710 |

2.3% |

|

|

12 |

Unilever |

1,668 |

2.3% |

Paying Q1 2020 |

|

13 |

Diageo |

1,628 |

2.2% |

Paid H1 2020 |

|

14 |

Reckitt Benckiser |

1,239 |

1.7% |

|

|

15 |

Anglo American |

1,168 |

1.6% |

Paid H2 2019 |

|

16 |

Legal and General |

1,048 |

1.4% |

Paying 2019 H2 |

|

17 |

Prudential |

939 |

1.3% |

Paying 2019 H2 |

|

18 |

Tesco |

896 |

1.2% |

Increased H2 2019 |

|

19 |

RELX |

886 |

1.2% |

Paying 2019 H2 |

|

20 |

Evraz |

845 |

1.1% |

|

Source: Company accounts

“However, shareholders must stay on their guard. Vodafone’s outlook statement warns of a possible hit to income from roamed, cross-border calls and data use thanks to the collapse in international travel and also the danger that some customers may find it harder to pay their bills, if they have been furloughed or lost their job. In addition, key markets such as Germany, Italy, Spain and the UK remain fiercely competitive and – in theory – the UK is due to hold its spectrum auction of 5G mobile services in the second half of this year, which could be a further drain on cash, especially as prior European auctions drew bids that were higher than expected.

“As a result, Vodafone is steering expectations gently lower for its preferred performance metrics of adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) and its definition of free cash flow, before spectrum costs.

Source: Company accounts, company outlook statement in full-year 2020 results. Financial year to March.

“Vodafone also has a huge debt pile of some €42 billion, on an adjusted basis, something which is looking to tackle through asset disposals and the proposed spin-off of its European tower masts business, as well management of capital spending through network infrastructure sharing deals for 5G services. Yet as Shell has made clear, asset disposals and capex optimisation can only take you so far when it comes to paying a dividend and it still feels as if Vodafone is having to work hard to generate sufficient cash to keep the dividend truly comfortable. The UK’s 5G auction, whenever it happens, could be the next key test.

“Growth prospects for the payment feel limited as a result and history shows that over the long term it is those companies which prove capable of consistently providing dividend increases that provide the best share price performance and total returns, rather than those that have to fight hard to defend an already fat pay-out. Vodafone’s unchanged dividend is a clear source of relief for investors today but whether it translates into a sustained rally in the shares from 12-year lows remains to be seen.”