Source: Thomson Reuters Datastream

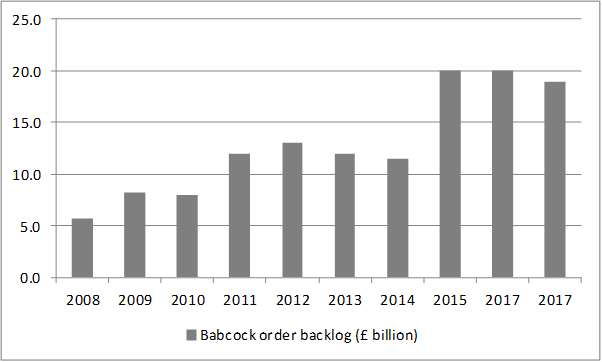

“Chief executive Archie Bethel noted that the backlog had stabilised at £19 billion, enough to provide visibility of 82% of this year’s forecast revenues and 55% for next.

Source: Thomson Reuters Datastream

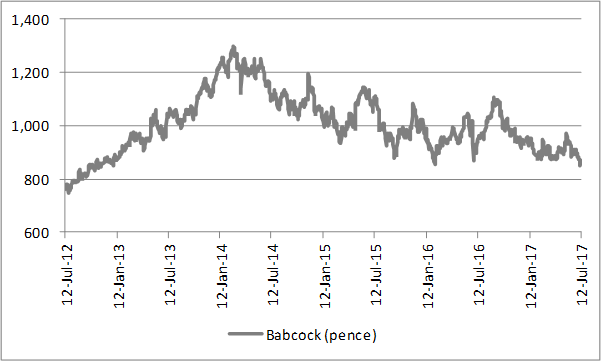

“Such visibility, coupled with the streak of annual dividend increases which goes back to 2003, should appeal to investors but they seem wary of a stock that has yet to regain its sparkle under Bethel, who took the reins from longstanding boss Peter Rogers last August.

“There appear to be three issues hanging over the stock which could explain the poor share price performance:

“Support services firms have been out of favour for some time, especially those where the UK Government is a key customer, as a result of the bad press generated by the Serco and G4S overcharging scandals and austerity and profit warnings from Mitie and Capita. This week’s profits cataclysm at Carillion is a further blow to sentiment while the hung parliament delivered by June’s General Election is an additional complication, as this may muddy the Government’s spending plans and delay the contract award process.

“Babcock is a big player in the nuclear industry, for both power and submarines, and that remains fiendishly complex area for political and economic reasons. The company also suffered the termination of a £6 billion-plus Magnox decommissioning project after five years rather than the scheduled 14 owing to what looks like a Government error in the tendering process

“The stock had become one of those “expensive defensives” where the earnings and dividend forecasts looked solid enough but that relative predictability was baked into a lofty valuation.

“Strong order intake and fresh increases in the order backlog may be needed to tackle the first two issues but the third may have largely taken care of itself already, given the grinding share price decline.

“At the £13 peak in 2014, Babcock was trading on nearly 19 times forward earnings with a dividend yield of 1.8% - a big premium and a big discount to the wider UK market respectively.

“After that slide to 874p the shares now trade on barely 11 times earnings with a 3.2% dividend yield, based on consensus analysts’ forecasts – much cheaper than other dependable defensives like Bunzl or Unilever, for example.”