“It is a month since the dissolution of Parliament and as voters prepare to head to the ballot box in a week’s time, the UK’s financial markets seem very calm, although there appear to be some subtle changes in market leadership which merit close attention,” says Russ Mould, AJ Bell Investment Director. “Sterling and stocks appear to be taking their lead from the opinion polls and pricing in a victory for the incumbent Conservative Party. This can be seen in the lack of volatility in the market and the absence of panic in the share prices of those firms which could be most dramatically affected by Labour’s manifesto promises, namely the utilities.

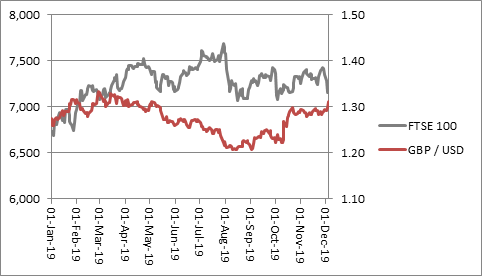

“But sterling’s rise is having knock-on effects. Just as the pound’s post-EU referendum collapse in summer 2016 gave the FTSE 100 a boost, as sterling’s slide increased the value of the overseas raked in the index’s brigade of multi-national megacaps, its recovery to seven-month highs appears to be holding back the benchmark now.

Source: Refinitiv data

“Since the dissolution of Parliament on 6 November, the FTSE 100 is down, whereas the FTSE 250, FTSE Small Cap and FTSE AIM 100 indices are all up.

|

|

Change since 6 November |

|

FTSE 250 |

2.7% |

|

FTSE AIM 100 |

2.2% |

|

FTSE Small Cap |

1.1% |

|

FTSE 100 |

(2.8%) |

Source: Refinitiv data

“The FTSE 250 derives more of its revenues and earnings from the UK, so sterling’s advances does not crimp their earnings power quite so much (once profits are reported in pounds) and it may help in some cases, by reducing imported raw material costs and keeping a lid on inflation, to the benefit of consumers’ real-terms spending power.

“Companies which rely more heavily on their UK than overseas markets for their business may also be drawing encouragement from how all of the major parties are promising to spend more in an attempt to stoke economic growth, in an apparent end to the era of austerity.

“This can also be seen in the type of stocks which are performing best within the major indices.

“The ‘quality’ and ‘growth’ plays which have dominated not just for much of 2019 but most of the last decade are largely notable by their absence from the list of leading performers in the FTSE 100 since the dissolution of Parliament – Halma being the notable exception that proves the rule.

“These firms have been highly sought after and prized for their ability to generate consistent profit and dividend growth almost whatever the economic weather. But if the combination of higher Government spending and some form of resolution for Brexit comes to pass – and that remains an ‘if’ – then cyclical growth could be easier to come by here and frankly cheaper to buy on a valuation basis here in the UK.

“This may explain why house builder Persimmon, hotelier Whitbread, broadcaster ITV and high street bank Lloyds all rank among the FTSE 100’s ten best performers since the race to 10 Downing Street began last month.

“By contrast, ‘quality’ names like Compass, DCC and Johnson Matthey are lagging, as are dollar earners like BP, Shell and Fresnillo, even if they have issues relating to commodity price weakness or disappointing production figures hanging over them too.

|

Change since 6 November: FTSE 100 |

||||

|

Top 10 |

|

|

Bottom 10 |

|

|

Persimmon |

11.6% |

|

BP |

(8.0%) |

|

Centrica |

11.0% |

|

Shell |

(8.2%) |

|

Halma |

9.4% |

|

3i |

(8.4%) |

|

AVEVA |

9.1% |

|

Rolls-Royce |

(9.2%) |

|

Flutter |

8.2% |

|

Compass |

(9.7%) |

|

Whitbread |

6.9% |

|

Pearson |

(10.6%) |

|

ITV |

6.7% |

|

Vodafone |

(10.8%) |

|

Spirex-Sarco |

6.3% |

|

DCC |

(11.9%) |

|

Coca-Cola HBC |

5.9% |

|

Johnson Matthey |

(13.1%) |

|

Lloyds |

5.7% |

|

Fresnillo |

(21.2%) |

Source: Refinitiv data

“The search for value in long-neglected names like ITV and Centrica also points to a possible shift in market mood. Centrica’s good showing over the past month is another indication that investors seem to think, rightly or wrongly, that the election will not lead to a Labour government.

“Similar trends can be seen across the FTSE 350 too.

“Firms with a strong UK focus, such as retailers Dunelm, Games Workshop and Pets At Home, leisure specialist Rank, and Countryside Properties are all doing well. Half of CLS Holdings’ real estate assets are in the UK, while digital transformation expert Kainos’ shares are responding to talk of higher Government investment, especially in the NHS.

“The presence of two banks in the FTSE 350’s top 20 – Virgin Money UK and One Savings Bank – also points to a return to favour, temporarily at least, of domestic stocks, although both of these firms could sit in the ‘value’ bucket too, alongside TI Fluid Systems, for example.

|

Change since 6 November: FTSE 350 |

||||

|

Top 20 |

|

|

Bottom 20 |

|

|

Dunelm |

28.2% |

|

BP |

(8.0%) |

|

Games Workshop |

27.3% |

|

Shell |

(8.2%) |

|

Kainos |

24.8% |

|

3i |

(8.4%) |

|

FDM |

24.5% |

|

Moneysupermarket |

(8.9%) |

|

Finablr |

23.9% |

|

FirstGroup |

(9.1%) |

|

Pets At Home |

21.8% |

|

Electrocomponents |

(9.2%) |

|

CLS Holdings |

21.0% |

|

Rolls-Royce |

(9.2%) |

|

Aston Martin Lagonda |

20.3% |

|

Card Factory |

(9.6%) |

|

Countryside Properties |

20.1% |

|

Compass |

(9.7%) |

|

Sanne |

19.4% |

|

Euromoney |

(9.6%) |

|

Airtel Africa |

19.2% |

|

Pearson |

(10.6%) |

|

Virgin Money UK |

18.4% |

|

Vodafone |

(10.8%) |

|

TI Fluid Systems |

16.4% |

|

Riverstone Energy |

(11.1%) |

|

Rank |

14.3% |

|

DCC |

(11.9%) |

|

Greggs |

13.9% |

|

Equiniti |

(13.0%) |

|

Morgan Advanced |

13.1% |

|

Johnson Matthey |

(13.1%) |

|

Bodycote |

13.0% |

|

Signature Aviation |

(13.8%) |

|

Oxford Instruments |

12.8% |

|

Hochschild Mining |

(20.1%) |

|

Polypipe |

12.3% |

|

Fresnillo |

(21.2%) |

|

OneSavings Bank |

12.2% |

|

Tullow Oil |

(33.9%) |

Source: Refinitiv data

“The laggards feature dollar earners aplenty, notably the oils (where the soggy price of crude is also taking its toll), Pearson and Vodafone. Relatively-highly-valued ‘quality’ names such as Electrocomponents, Moneysupermarket, Euromoney, Johnson Matthey and DCC are also finding the going a lot tougher.

“Whether the market is right to price in a clear-cut Conservative Party win and speedy Brexit resolution remains to be seen and the picture could look very different come Friday 13th if Labour enjoys a final-week surge in the polls to match that of 2017, when Theresa May ultimately found herself hobbled by her lack of a Parliamentary majority.

“But the trends of the last month could be an interesting taster if that scenario plays out, especially as it can be argued that sterling, the UK market more generally and domestic plays more specifically are all cheap, relative to their history and overseas alternatives, after a long period out of investors’ favour.”