“A drop in unemployment to 4.1% may be enough to keep the Fed on track to raise interest rates in December, for the fifth time in this up-cycle, to 1.25%-1.50%, but further increases are expected to come gradually at best, with markets putting only a 7% chance on the three increases for 2018 targeted by the central bank’s so-called ‘dot plot.’

“Although the plans of the central bank’s new chair, Jay Powell, have yet to be confirmed, the Fed has consistently stated that wage growth is a key potential trigger for policy shifts. As such, low wage growth could help restrain interest rates to the benefit of financial markets which doubtless seek to bask in the tidal wave of liquidity that central banks are providing.

“But this suggests markets must be wary of – and may be ill-prepared for – any spike in inflation. Higher wages would potentially provoke more aggressive rate rises but also test corporate profit margins, in a pincer movement that could hurt.

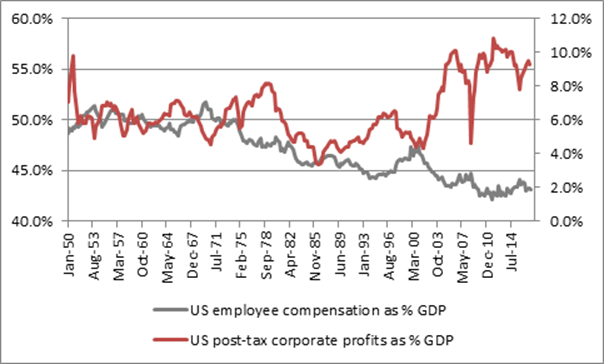

“Federal Reserve data shows that workers’ pay fell to just 43% of GDP in the third quarter on 2017, down from a peak of nearly 52% in the early 1970s. By contrast, corporate profits reached 9.3% of GDP, way above the post-1950 average of 6.4%.

Source: FRED, St. Louis US Federal Reserve database

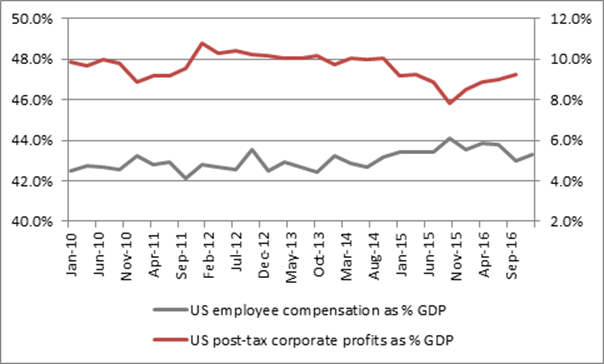

“The US corporate profit share wobbled in 2013-15 but has rallied while workers’ pay share has dropped, despite falling unemployment.

Source: FRED, St. Louis US Federal Reserve database

“This implies there is more slack in the system than meets the eye – given the number of Americans who are working part-time or have multiple jobs who are waiting to come back into full-time work.

“But equally it suggests that both central bankers and investors need to be on their guard if further jobs growth tightens the market and gives employees the whip hand in pay negotiations, even if such a spike looks unlikely at the moment.”