1. The $4.9 billion fine could have been worse. Some estimates suggested the potential bill could have been $10 billion or more, although the $7.2 billion fine given to Deutsche Bank in January 2017 and the $5.3 billion settlement demanded of Credit Suisse by the US Department of Justice in January 2018 were both lower than originally expected, so this had offered some hope to RBS.

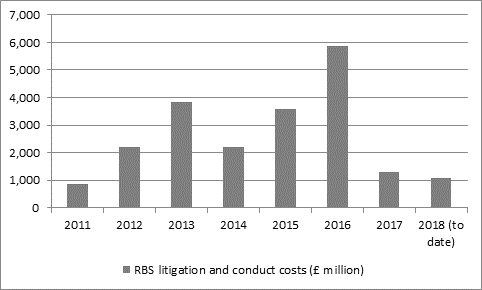

2. RBS has already taken $3.5 billion in provisions to cover this cost, so the second quarter of this year will see “only” $1.4 billion, or £1.1 billion, in extra litigation costs in the bank’s profit and loss account. That will take RBS’s total litigation, fines and conduct bill, including PPI claims, to £20.9 billion since 2011, a figure which compares to its current market capitalisation of £33 billion and equates to 174p per share, so the damage suffered by investors has been enormous.

Source: RBS accounts

3. The damage to RBS’ net asset value (NAV) per share could therefore have been worse, at 9p per share. NAV per share came to 292p at the end of the first quarter and the combination of April’s pension deficit contribution plan and the American fine reduces this figure to 274p. At 285p, RBS’ shares trade at only a small premium to NAV, which some investors may view as a value opportunity if profits finally replace a decade of losses as that will serve to grow NAV rather than shrink it, although both Barclays and Standard Chartered trade at a discount to book value, to suggest they may be cheaper still.

|

| 2018E |

|

|

| P/E | Price/NAV | Dividend yield | Dividend cover |

Standard Chartered | 14.3 x | 0.83 x | 2.4% | 2.9 x |

Barclays | 10.6 x | 0.85 x | 3.1% | 3.1 x |

Royal Bank of Scotland | 11.2 x | 1.04 x | 1.9% | 4.7 x |

|

|

|

|

|

Lloyds | 9.2 x | 1.25 x | 5.1% | 2.1 x |

HBSC | 13.8 x | 1.39 x | 5.1% | 1.4 x |

Source: Digital Look, consensus analysts’ forecasts for earnings and dividends. Book value based upon last published fully-diluted, tangible net asset value per share figure, as per company accounts

4. RBS has now, in theory, overcome all of the three key obstacles which were preventing it from returning to the dividend list.

Although it failed to sell or spin-off Williams & Glyn to satisfy EU state-aid and competition rules, RBS has agreed to a £800 million package whereby it will put money into a Capability & Innovation Fund and an Incentivised Switching Scheme, to boost the development of fintech competitors and help business customers find a new lender, should they wish to do so.

RBS reached a $5.5 billion settlement with the us Federal Housing Finance Agency for the alleged mis-selling of mortgage-backed bonds in summer 2017

RBS has now reached, in principle, a $4.9 billion deal with the US Department of Justice over the alleged mis-selling or mortgage-backed securities

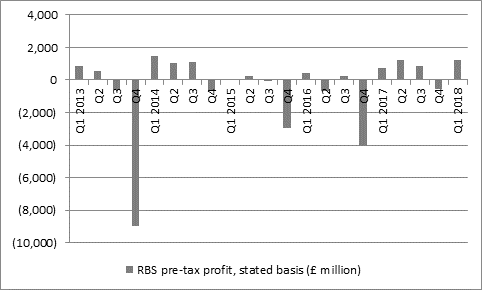

For dividends to start flowing again the bank still needs to prove it can start to record consistent profits. The Q1 2018 states pre-tax profit of £1.2 billion was a good start and RBS will be hoping that the 2019 deadline for PPI claims can help it remove another cost burden from its profits. But the bank still needs to keep its nose clean, manage its loan book effectively and hope that the global economy does not roll over, even if analysts have pencilled in forecast dividend payments of 5.4p a share for 2018 and 12.2p for 2019.

Source: RBS accounts