“However, the shares are largely shrugging off the news and may instead be focusing on how Unilever is exchanging pricing power for volume growth, in a move which may suggest that 18 months after the fact we are now finding out who was the winner in the spat between Tesco and Unilever over the price of Marmite – and it may not be Unilever.

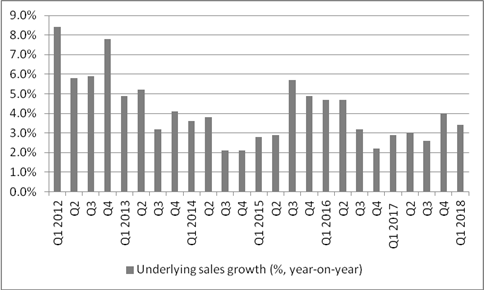

“First quarter sales growth of 3.4% year-on-year on an underlying basis did represent a slight slow down from the 4.0% advance in the fourth quarter, but it was still better than all of the other three-month periods since Q2 2016.

Source: Company accounts

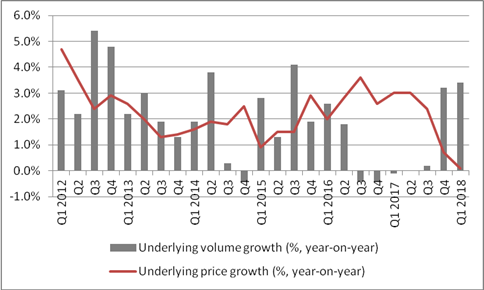

“However, the mix of that sales growth is interesting.

“Volumes rose 3.4% and prices just 0.1%. This is a marked reversal of the trend seen until Q3 2016, when Unilever was driving sales growth through price. But it was at this point that Tesco rebelled over the price of Marmite and threatened to stop stocking to consumer staple and it is noticeable that since then Unilever has throttled back on price increases to drive volumes.

“That may be good news for shoppers and possibly for Tesco, although its implications for Unilever may be less immediately clear, despite the benefits of the additional volumes, as the real secret to Unilever’s high-teens operating margins (and boss Paul Polman is targeting 20% by 2020) is its brands and the pricing power that names such as Hellman’s, Persil, Liptons and Dove confer.

Source: Company accounts

“If investors have any cause to question that pricing power then they may start to wonder about Unilever’s margin targets and the valuation attributed to the stock, since the shares, at roughly 19 forward earnings, trade on a big premium to the FTSE 100, which trades at 14 times to 15 times.

“That premium is merited owing to the high margins and returns on capital which come from the company’s brands and their pricing power – but that premium could be eroded, to the detriment of the share price, regardless of any share buyback activity, if investors start to fret that Unilever is losing some of its brand and price power.

“It is too early to tell now but this is a trend which investor will be watching closely from here onwards.”