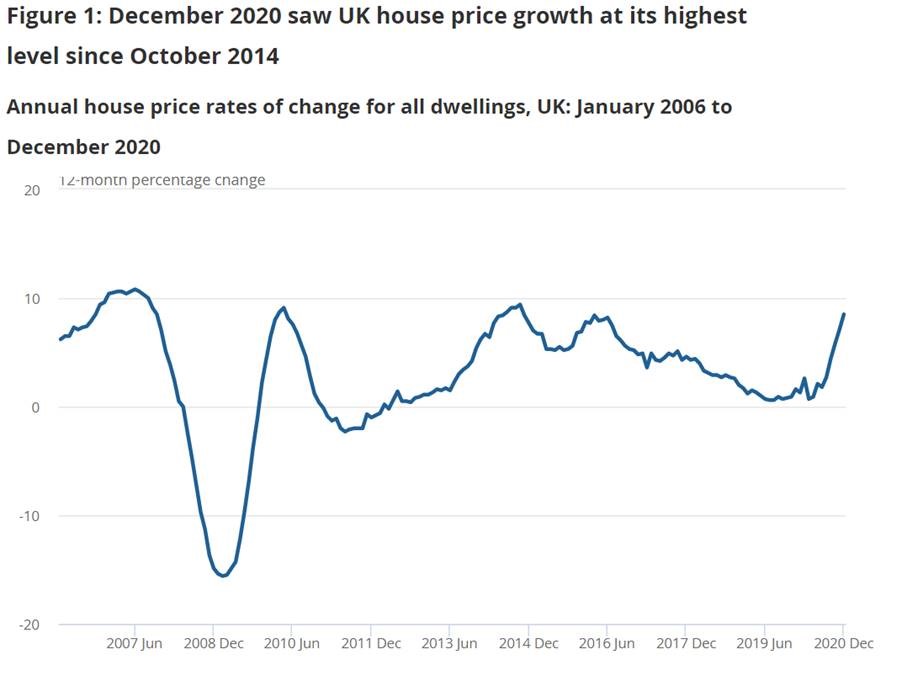

• UK average house prices rose to a record £252,000 last year

• Help to Buy ISA can only be used on properties up to £250,000 outside London

• It might be time for savers to consider switching to a LISA

Danni Hewson, financial analyst at AJ Bell, comments:

“Pent up demand coupled with government intervention has seen house prices rocket and the market shows no signs of cooling down. Figures from the ONS showed average house prices grew by 8.5% to December 2020* to stand at a record high of £252,000, in England that figure rises to £269,000. Changes to our working patterns during the pandemic have seen people reassess their housing needs, in some cases rethinking where they want to buy, a change which could come at a premium.

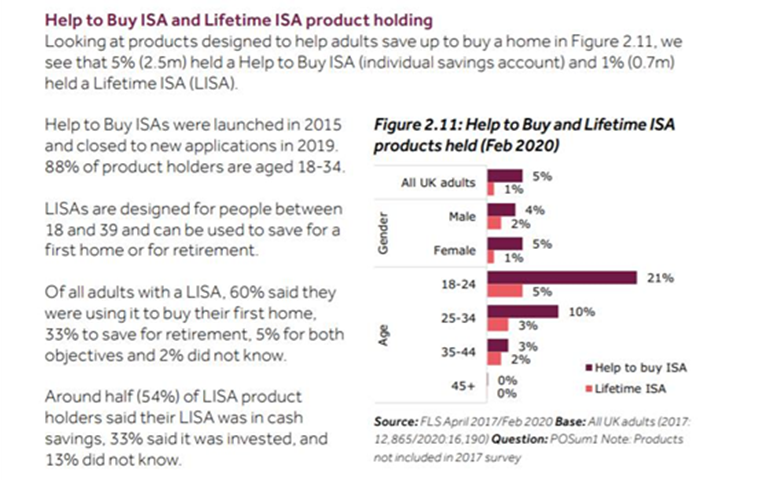

“For some first-time buyers that might mean their savings plan needs an overhaul. Though phased out in November 2019 the Help to Buy ISA is still operating for existing holders. It offers a government bonus of 25% for every £200 saved up to a value of £12,000. It was a popular choice for 18-39-year olds looking to get a foot onto the housing ladder. In fact, the latest financial lives survey carried out by the FCA last year found 2.5 million adults saving to buy a home were invested in the scheme**.

“With a price cap set at £250,000 for properties outside London the 2021 market might present a problem, and it could fuel frustration as the increased availability of government backed, 95% mortgages seems to make higher house prices more affordable to first time buyers.

“By contrast the Lifetime ISA, brought in as the successor to the Help to Buy ISA, allows would-be homeowners to purchase property up to the value of £450,000 whether that property is in London or elsewhere. You also have the option to save more each year and so benefit from a bigger potential Government bonus.

“With interest rates still at historically low levels the potential to earn £1,000 every year if you put in the maximum £4,000 allowance is nothing to sniff at, but you must be aware it does contribute towards your annual ISA limit.

“As with the Help to buy version you can also team up with a partner to buy a property and both tap into the bonus if you each have a LISA. Additionally, the LISA bonus is paid monthly so you’ll get the money in time for exchange on the property so it can be used towards any deposit requirements. By contrast the Help to Buy ISA needs to be claimed between exchange and completion.

“Converting might seem like a smart move right now and for some it might make financial sense to do so, but there are two major drawbacks. Transferring would require you to wait 12 months after you’ve made your first payment before you can use your savings and the associated bonus for a house purchase. That’s bad news if you’d hope to take advantage of the extension of the stamp duty holiday. The other hitch is that you can only transfer £4,000 a year, so if you’ve been saving for a while, switching might delay your house purchase.”

Doing the transfer sums

“If you’ve been saving £200 a month in a Help to Buy ISA for two years, you’ll have amassed a pot of £4,800, not taking into account any interest earned. If you start a LISA before 5 April you can transfer in £4,000 for this current tax year and the remaining £800 after the start of the new financial year (as long as you don’t have another ISA that you are paying into). You’ll then be able to save at the same rate of £200 a month plus an additional £800 in that tax year. By April 2022 you’d have a total of £10,000 in your LISA once the £2,000 government bonus has been added and that’s not taking into account any potential investment growth achieved over that time. You would then be able to use your LISA to buy a house up to the value of £450k no matter where you are in the country. Staying in your Help to Buy product would give you slightly less money over the year as you’d only be able to save £7,200, but you’d have greater flexibility to buy at any time over the next 12 months as long as the property was under £250,000 outside London.

“If you’ve got more than £8,000 in your Help to Buy pot the length of time it will take for you to transfer your pot over will take longer as you’ll have to stretch it over three or more years. Figures from HMRC show the average purchase price of a property using the scheme up to September 2020 was £174,281 with Yorkshire and the North West having the most completions. But it’s in the North West that average property prices have seen the biggest increase over the past year. Without the government stepping in to change the Help-to-Buy limit for properties outside London, if prices continue to overheat, you might have to make some difficult decisions about your house purchase.

“There are other reasons a Lifetime ISA might not be the right move for you. If you decide to use the funds for something other than to purchase your first home, you could face penalties unless you leave it until after your 60th birthday.”

The lowdown on LISAs

Up to £33,000 of free money. Like the Help to Buy ISA the Lifetime ISA gives you a 25% Government bonus, but with the former it is limited to the first £12,000 saved – meaning a maximum bonus of £3,000. The Lifetime ISA offers up to £1,000 a year in Government bonus. So, if you open it at 18 and invest the maximum £4,000 a year until you turn 50, that will give you the maximum Government bonus of £33,000.

You can save more. Up to £4,000 a year can be saved into the Lifetime ISA and you can pay in one or more lump sums or as a regular monthly saving. Comparatively, with the Help to Buy ISA, you are limited to saying up to £200 a month, plus an extra £1,200 in the first month of opening the account. If you miss a month you cannot pay double in the next month.

You need to save for 12 months. You must have the Lifetime ISA open and have made your first contribution 12 months before you can use the money to buy your first home. This means if you plan to buy in the next year you don’t want to be looking at switching from your Help to Buy ISA, which doesn’t have this restriction.

You can also invest. With interest rates still at historic lows investors in a Lifetime ISA could choose to bypass cash in favour of investing in funds, shares, investment trusts and ready-made portfolios. This means if you are saving your money for longer you have the potential to generate greater returns by investing.

You can buy a more expensive property Unlike the Help to Buy ISA one of the LISAs most desirable difference for buyers right now is the ability to use the Lifetime ISA on properties worth up to £450,000 no matter where in the UK you are buying. The Help to Buy ISA has a limit of £250,000 unless you are buying in London when the limit is £450,000.

You can use the bonus for the deposit. Whilst the Help to Buy ISA’s Government bonus is only issued after you have exchanged on a property, the Lifetime ISA bonus is paid monthly so can be used for the initial deposit, which has to be handed over at exchange.

You must be under 40. Even if you started your Help to Buy ISA before you celebrated that milestone the option to transfer is no longer available once you turn 40.

You need to consider the charges if you don’t buy a home. With the Help to Buy ISA, if you change your mind or want to make a withdrawal, for something other than buying your first home, you can redeem your money. As the Government bonus will not have been paid into the account, you don’t need to return any money. With the Lifetime ISA, if you want to withdraw money for anything other than buying a first home, retirement, or if you have a terminal illness, you will pay an exit fee. The exit fee reverts to 25% on 6 April 2021 (currently it is 20% as a temporary COVID-19 measure). The exit fee is intended to claw back the 25% Government bonus, but it actually results in you losing the Government bonus and paying £6.25 for every £100 you withdraw.

For example, if you invest £4,000, you’ll get the 25% government top-up and have £5,000 in total. If you withdraw this not for a first home or retirement, you’ll be charged 25%, which equates to £1,250. This means you have £3,750 left, £250 less than your initial investment.

* Source ONS House Price Index December 2020

**Source FCA Financial Lives Survey