• The UK state pension is set to increase by 3.1% in 2022/23, in line with September’s Consumer Prices Index (CPI) inflation figure

o Basic state pension set to rise by £4.25, from £137.60 per week to £141.85 per week*

o Flat-rate state pension set to rise by £5.55, from £179.60 per week to £185.15 per week*

• If the earnings element of the triple-lock had been retained, the state pension could have increased by 8.3% next year**

o This would have increased the basic state pension to £149 per week and the flat-rate state pension to £194.50 per week*

o Decision to suspend the earnings element of the triple-lock for 2022/23 will therefore ‘cost’ retirees in receipt of the full flat-rate state pension £9.35 per week

o The Treasury will save around £4.5 billion as a result

Tom Selby, head of retirement policy at AJ Bell, comments: “The good news for retirees is the state pension is set to increase by 3.1% next year, boosting the incomes of those in receipt of the full flat-rate benefit by £5.55 a week. The basic state pension, meanwhile, is set to rise by £4.25 to £141.85 per week.

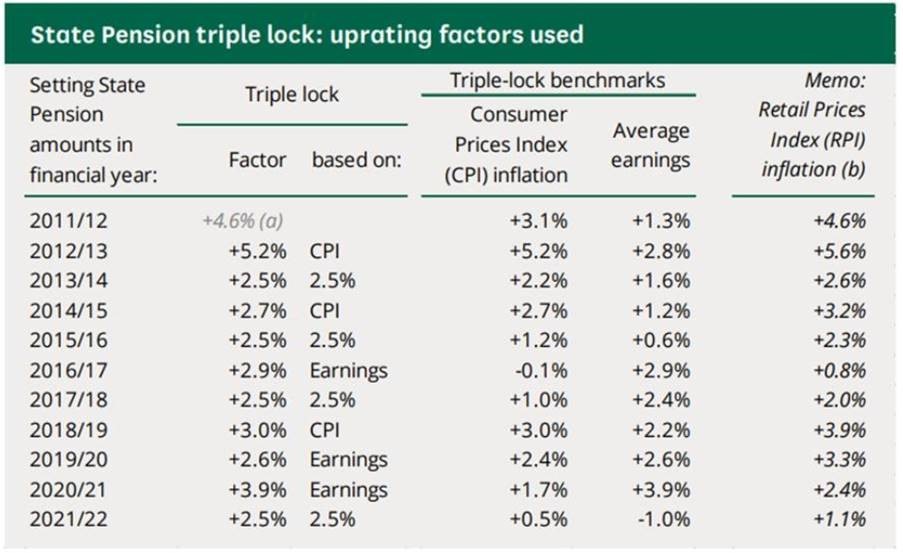

“However, the Government’s decision to suspend the earnings element of the state pension triple-lock means retirees will miss out on a blockbuster 8.3% increase.

“This decision will ‘cost’ someone in receipt of the full flat-rate state pension £9.35 a week in retirement income – or £486.20 over the course of the year.

“Each 1 percentage point increase in the state pension costs the Exchequer an estimated £900 million, meaning the Treasury is likely to save around £4.5 billion as a result of the move.***

“For savers, the decision to ditch the triple-lock was another reminder that the state pension, while valuable as a retirement income foundation, remains uncertain and subject to the whims of politicians.

“Indeed, both the amount you receive and the age you receive it has been subject to significant reform over the last decade.

“It is therefore crucial anyone wanting control over their retirement and a standard of living above the basic minimum covered by the state pension saves as much as they can as early as they can, taking advantage of matched contributions and tax relief and allowing compound growth to work its magic over the long-term.”

*All state pension increases rounded to the nearest 5p

**In line with average earnings growth for the three months to July 2021

***Source: Office for Budget Responsibility