“The US Federal Reserve meets for the second time this year on Wednesday 16th March and markets are busily dialling back their expectations for how far and fast it will take headline borrowing costs in America this year,” says AJ Bell Investment Director Russ Mould. “This is not because inflation expectations are moving down - quite the opposite. But it may be because of concerns that higher fuel and energy prices, will hit economic growth. It may also factor in any worries over financial market volatility, although the Fed’s mandate covers jobs and inflation and not share prices – and it would be a bad look for the central bank to make a big thing about supporting financial markets at a time when many in society are getting hit hard by inflation and the Fed is mired in an insider trading scandal.

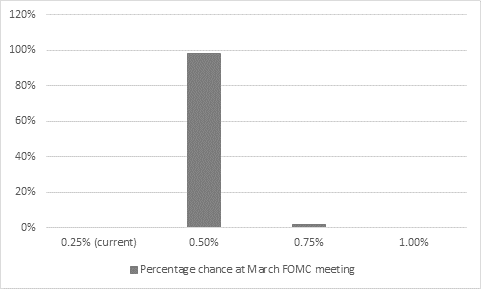

“According to the CME Fedwatch tool, markets are now putting barely a 2% chance on a half-percentage-point rate rise at the next meeting of the Federal Open Markets Committee. That compares to a 33% chance just a week ago and 50% and more in early February.

“Russia’s invasion of Ukraine, its impact on global energy prices, potential to fuel inflation and possible hit to economic growth as economic sanctions take effect is clearly prompting a shift in investors’ expectations.

“Markets now expect a quarter-point increase to 0.50%.

Source: CME Fedwatch, as of 2 March 2022

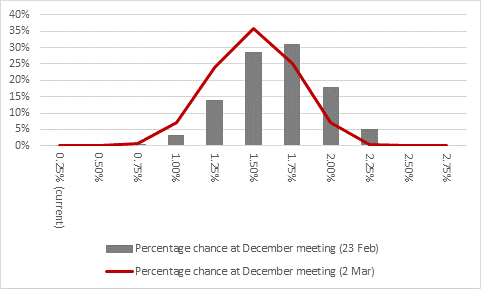

“Expectations have also started to ratchet back for the year-end interest rate in the US. Fed-watchers., economists and investors had got as far as pricing in a 50% chance of seven interest rate increases in 2022, effectively a quarter-point increase at each of this year’s remaining FOMC meetings, all the way up to 2%.

“Consensus now expects a maximum of five rate rises, up to 1.50% and there is a one-in-eight chance being put on just three one-quarter-point hikes to 1.00%.

Source: CME Fedwatch, as of 23 February and 2 March 2022

“Central banks may therefore find themselves a bit between a rock and a hard place, in higher energy prices mean inflation runs higher for longer than expected but the economy starts to slow down. The former calls for tighter monetary policy, the latter less so, although policymakers may take the view that an economic slowdown could do some of their work for them and lessen demand for goods and services and thus take some of the heat out of inflation.

“Where a less aggressive monetary policy would leave financial markets is an interesting question.

“The prospect of quick-fire rate rises to cool inflation has hit bond prices hard and begun to take its toll on stock markets, too, especially in some of the more speculative areas, such as meme stocks, SPACs and IPOs, as well on those stocks that carried lofty valuations thanks to the perception that they were capable of generating long-term secular growth almost whatever the economic conditions. This can be seen most spectacularly in the ongoing collapse of the ARK Innovations ETF and the share prices of a lot of its biggest holdings – even Tesla is down 28% in 2022 to date.

“Intriguingly, Tesla is up 13% from its lows and ARK Innovations ETF by 18%. This may reflect the reset in interest rate expectations.

“This is because perceived secular growth stocks like Tesla are often valued on a discounted cash flow (DCF) basis – the humble price/earnings (PE) ratio is a just a short-hand version.

“A key part of the DCF is the interest rate that is used to discount back future earnings to provide the net present value (NPV) of the equity. The lower the interest rate, the higher the NPV and the lower the theoretical value of the company and thus potentially its share price.

“It may be that a further burst of inflation forces the Fed’s hand on higher rates, whether its officials or investors like it or not, but this is just a further, if perhaps less obvious example, of how the war in Ukraine could prompt volatile moves in financial markets.”