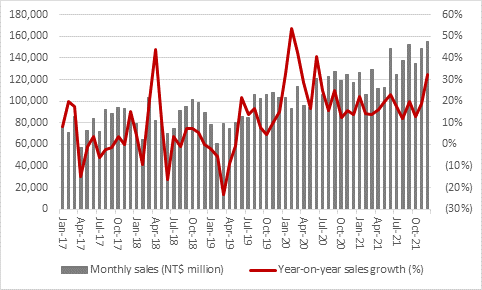

“If the December sales figures from the world’s biggest producer of silicon chips on an outsourced – or foundry – basis are anything to go by, demand for semiconductors is as strong as ever. Revenue growth at Taiwan Semiconductor Manufacturing Company (TSMC) jumped to 35% year-on-year in the final month of 2021, the fastest rate of increase of any month in the year,” says AJ Bell Investment Director Russ Mould. “Attention will now switch to the full-year results from TSMC that are due on Thursday, when analysts and shareholders will look not just to 2021’s figures but any guidance for 2022 on sales growth, pricing and volumes, and also capital expenditure, to see if there is any read-through for the wider global economy.

Source: Company accounts

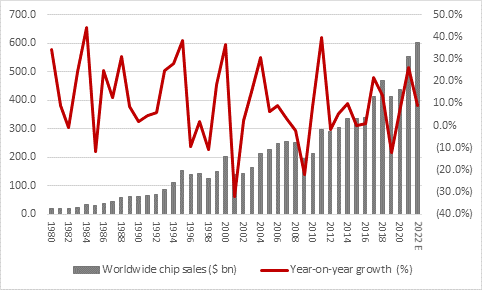

“Silicon chips are a terrific proxy for the global economy because they are everywhere, from your car to your smart phone, from your laptop to your smart meter and from industrial robots to games consoles. Industry estimates reckon that total semiconductor sales rose by more than quarter in 2021 to a record $553 billion – and such rapid growth does make you wonder whether the scramble for chips means the problem is actually excess demand (thanks to Government and central bank largesse, in the form of fiscal and monetary stimulus) rather than too little supply, if the highest-ever revenue figure from the industry is not enough to keep up.

Source: WSTS, SIA

“The silicon chip industry has grown its sales at a compound annual rate of 8% a year since 1980, a phenomenal rate which is testimony to the growth in demand for electronic devices and the increased silicon content per unit as everything from cars to mobile devices to computers and servers become ever more powerful and complex.

“However, it also has a boom-and-bust history. There were epic revenue surges in 1983-84, 1993-95, 1999-2000, 2003-04, 2011, 2017 and now 2021 and sharp downturns in 1985, 1996-98, 2001 and 2009 when either the global economy rolled over or manufacturers added too much capacity and produced excess supply.

“This is why TSMC’s full-year results on Thursday will be so important. Last year’s sales growth of 18.5% is impressive but 2021’s total revenue figure represents a 48% jump on the pre-pandemic year of 2019, something which again raises the issue of whether over-stimulated worldwide demand is the issue right now rather than lack of supply.

|

TMSC |

Sales (NT$ million) |

Year-on-year sales growth |

Two-year sales growth |

|

2006 |

317,407 |

|

|

|

2007 |

322,630 |

1.6% |

|

|

2008 |

333,158 |

3.3% |

5.0% |

|

2009 |

295,742 |

(11.2%) |

(8.3%) |

|

2010 |

419,538 |

41.9% |

25.9% |

|

2011 |

427,081 |

1.8% |

44.4% |

|

2012 |

506,249 |

18.5% |

20.7% |

|

2013 |

597,024 |

17.9% |

39.8% |

|

2014 |

762,806 |

27.8% |

50.7% |

|

2015 |

843,497 |

10.6% |

41.3% |

|

2016 |

947,938 |

12.4% |

24.3% |

|

2017 |

977,447 |

3.1% |

15.9% |

|

2018 |

1,031,474 |

5.5% |

8.8% |

|

2019 |

1,069,985 |

3.7% |

9.5% |

|

2020 |

1,339,255 |

25.2% |

29.8% |

|

2021 |

1,587,415 |

18.5% |

48.4% |

Source: Company accounts

“Analysts will pore over the key numbers for 2021 but their attentions will quickly switch to any guidance from 2022, as they seek to judge whether the silicon chip boom will continue, demand patterns will start to normalise or supply start to catch up.

“Using an exchange rate of 27.65 Taiwanese dollars to the US dollar, the analysts’ consensus is looking for the following headline figures for 2021 and 2022.

|

|

|

NT$ million |

|

|

Year-on-year growth |

|

|

|

2020 |

2021E |

2022E |

|

2021E |

2022E |

|

Sales |

1,339,255 |

1,587,415 |

1,902,417 |

|

19% |

20% |

|

Operating profit |

566,784 |

645,906 |

796,905 |

|

14% |

23% |

|

Earnings per share (NT$) |

20.00 |

22.80 |

27.60 |

|

14% |

21% |

|

Capital expenditure |

507,239 |

845,138 |

1,004,121 |

|

67% |

19% |

|

|

|

|

|

|

|

|

|

|

|

US$ million |

|

|

Year-on-year growth |

|

|

|

2020 |

2021E |

2022E |

|

2021E |

2022E |

|

Sales |

45,567 |

57,411 |

68,804 |

|

26% |

20% |

|

Operating profit |

19,289 |

23,360 |

28,821 |

|

21% |

23% |

|

Earnings per share (US$) |

0.68 |

0.82 |

1.00 |

|

21% |

21% |

|

Capital expenditure |

17,436 |

30,566 |

36,315 |

|

75% |

19% |

Source: Company accounts, Marketscreener, consensus analysts' forecasts.

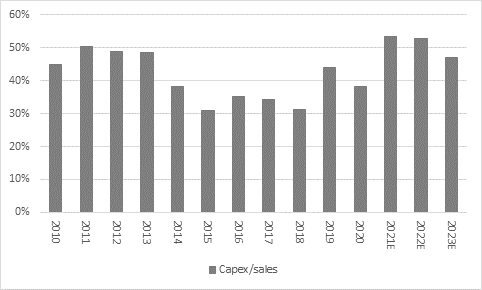

“Any guidance on price and volume trends will be welcomed, and capital expenditure will also be an important figure, especially if anyone is worried that another bust is coming as capital investment ramps up. TSMC is expected to have increased capex by two-thirds in 2021 and to follow that up with a further one-fifth increase in 2022. That will take the capex/sales ratio over 50% in 2021 and keep it there in 2022.

Source: Company accounts, Marketscreener, consensus analysts' forecasts.

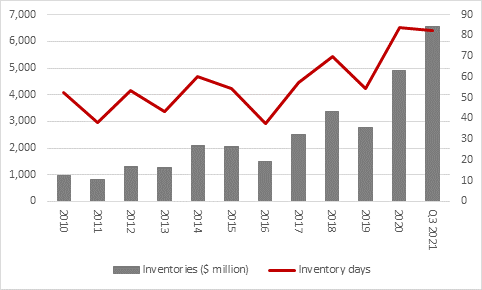

“If capex/sales ratios are one early-warning signal that analysts will use to detect whether the semiconductor cycle is about to tip over, another is inventories, so TSMC’s balance sheet will be important on Thursday, too.

“A surge in inventory days can be a sign that a silicon chip maker is seeing a slowdown in end demand, as it keeps on producing flat out but customers start to slow, delay or even cancel orders. That seems unlikely in the current environment, but that would make any unexpected jump in stocks all the more eye-catching.

Source: Company accounts

“Inventory days jumped hugely in the pandemic-disrupted year of 2020 and they stayed high in the first three-quarters of 2021, so any shift in that trend in Q4 could be telling. A further increase may be bad news, a decrease could point to normalising supply chains and ongoing strong demand.”