“At Wednesday’s close of 26,116 the Dow had recorded a gain of 31.7% since President Trump’s inauguration date of 20 January 2017.

“Since Harry S. Truman’s accession to power in January 1949 only Barack Obama, in his first term, has been welcomed by a better return during a President’s first year in office.

Inauguration | President | Party | Year 1 |

|

|

|

|

20-Jan-49 | Harry S. Truman | Democrat | 13.6% |

20-Jan-53 | Dwight D. Eisenhower | Republican | 0.4% |

20-Jan-57 | Dwight D. Eisenhower | Republican | (6.3%) |

20-Jan-61 | John F. Kennedy * | Democrat | 10.5% |

20-Jan-65 | Lyndon B. Johnson | Democrat | 10.3% |

20-Jan-69 | Richard M. Nixon | Republican | (16.5%) |

20-Jan-73 | Richard M. Nixon ** | Republican | (16.6%) |

20-Jan-77 | Jimmy Carter | Democrat | (19.0%) |

20-Jan-81 | Ronald Reagan | Republican | (11.0%) |

20-Jan-85 | Ronald Reagan | Republican | 24.6% |

20-Jan-89 | George H. W. Bush | Republican | 19.8% |

20-Jan-93 | Bill Clinton | Democrat | 20.0% |

20-Jan-97 | Bill Clinton | Democrat | 15.0% |

20-Jan-01 | George W. Bush | Republican | (7.7%) |

20-Jan-05 | George W. Bush | Republican | 1.9% |

20-Jan-09 | Barack Obama | Democrat | 33.4% |

20-Jan-13 | Barack Obama | Democrat | 20.6% |

20-Jan-17 | Donald J. Trump *** | Republican | 31.7% |

|

|

|

|

Average | 6.9% | ||

Average - Democrat | 13.1% | ||

Average - Republican | 2.0% | ||

Average - Republican excl. Trump | (1.3%) | ||

Source: Thomson Reuters Datastream

* John F. Kennedy assassinated in November 1963 and replaced by Lyndon B. Johnson

** Richard M. Nixon resigned August 1974 and replaced by Gerald R. Ford

*** Trump data as of 17 January 2018

“Such a dazzling gain in the Dow breaks one big hoo-doo, namely how badly the index has tended to perform during the first-year of Republican Presidencies.

“Quite why the Grand Old Party has historically received such a cool welcome is a bit of a mystery, though perhaps it has been perceived as more prone to hair-shirt fiscal orthodoxy, at least relative to the Democrats, who may be seen as more spendthrift.

“Even Reagan saw the Dow struggle during his first 18 months in office, even though his tax cuts, military spending and deregulation package quickly drove US GDP growth to around 8% on an annualised basis.

“Perhaps Trump is getting a warmer reception because he has embraced fiscal stimulus with the Tax Cuts and Jobs Act, which finally became law in December and hopes are clearly high that he will galvanise the US economy in a manner similar to Reagan.

“The stock market under the current President is also enjoying conditions which are much more helpful than prevailed under many of his predecessors.

“Inflation is low, interest rates are low and bond yields are low (even after five increases from the US Federal Reserve since December 2015) and Congress seems happy to let the Federal deficit rise above 100% of GDP, while corporate merger and acquisition and share buyback activity is giving equities a further lift.

“Yet the picture could change. Debt has never been higher, inflation could move higher if low unemployment finally feeds through to wage growth, interest rates could go higher and the Fed is now looking to withdraw Quantitative Easing. All could make life more difficult for US stocks and parallels with Reagan in particular need careful consideration.

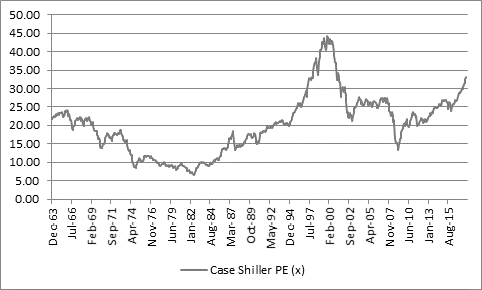

“Granted, the Dow rose by 29% in The Gipper’s first term and 82% during his second, but he took over as interest rates and inflation were falling, not rising. But the Dow fell by 25% in 1981-82 as Fed chair Paul Volcker jacked up interest rates and that left US stocks, using the broader S&P 500 as a benchmark, on a lowly cyclical adjusted price earnings (CAPE) ratio of just eight times according to Professor Robert Shiller’s research.

“Shiller’s work suggests the equivalent valuation multiple today is 33 to suggest US stocks are a lot more expensive now and already factoring in a lot of good news so investors still need to be careful, even if the outlook is rosy at the moment.”

Source: www.econ.yale.edu/~shiller/data/ie_data.xls, Thomson Reuters Datastream