Yet sticky stockpiles of finished goods may both challenge that orthodox view and explain the disappointing Q1 US GDP growth figure.

Russ Mould, investment director at AJ Bell, comments:

“Today’s trio of economic datapoints from the US offers enough to keep both bulls and bears interested.

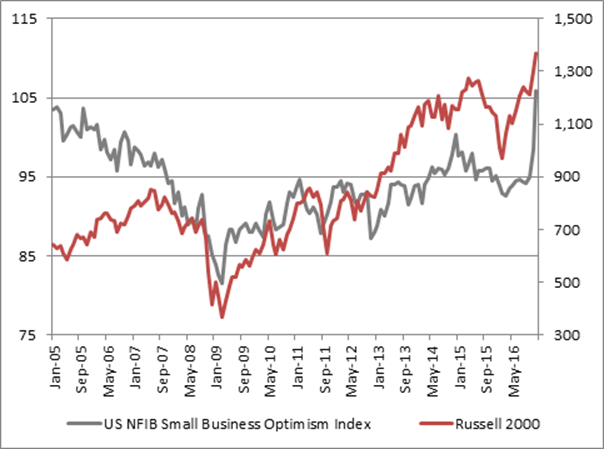

1. First, the latest monthly survey of sentiment across the member of the National Federation of Independent Business (NFIB) suggest that American smaller companies remain in good heart and continue to expect better times ahead under the Trump Presidency.

The latest reading was 104.5, way above the 93.6 of a year ago, although it did represent the third straight minor decline from the multi-year high of 105.9 recorded in December.

Note how the NFIB reading seems to correlate with America’s leading small-cap index, the Russell 2000 which currently trades at all-time highs.

Source: Thomson Reuters Datastream; FRED, St. Louis Federal Reserve database

2. Second, the Federal Job Openings and Labor Turnover (JOLTS) survey revealed a 1% month-on-month increase in openings to 5.74 million.

However, that figure does represent a 1.9% drop from the figure of a year ago and fails to match the 5.97 million high recorded last summer.

Bulls will argue this is a sign the US is reaching full employment, a state which is going to finally trigger the long-awaited spike in wage growth. Sceptics will merely assert that the US economy is both losing momentum and that the bullish sentiment surveys are not turning into actual hiring and investment, setting stocks up for a growth disappointment.

3. Third, wholesale inventories remained stuck at 1.28 months’ sales in February – a level last seen on the way into (and out of) the last recession. The good news is the ratio has been coming down as sales have risen faster than finished goods stockpiles for seven months in a row

This could set the scene for an improved Q2 showing, although it has to be said that the inventory number in dollar terms is growing again, too, just more slowly than sales, and that the overall inventory/sales ratio remains uncomfortably high.

Source: FRED, St. Louis Federal Reserve database

As such the US economy may not be quite in the robust health that the majority of investors seem to think it is, given the 88% chance accorded by the market to a Fed rate rise in June, according to the CME Fedwatch tool, meaning the US central banks will have to tread carefully if it does not want to add further support to the argument of late US economist Rudi Dornbusch who once asserted: “None of the US expansions of the last 40 years died in bed of old age; every one was murdered by the Federal Reserve.”