• Some £2.5 billion was withdrawn flexibly from pensions in the first 3 months of 2020, up 19% from £2.1 billion a year earlier

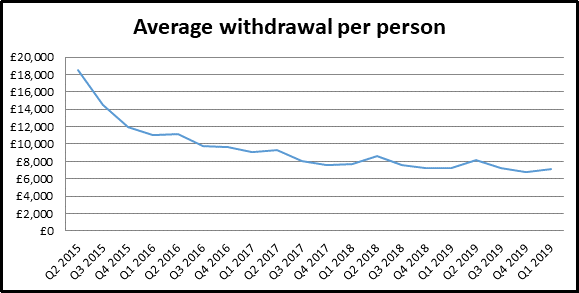

• Average withdrawals per person were £7,100 during the quarter, down from £7,300 in Q1 2019

• COVID-19 likely to affect behaviour in the next quarter and beyond, with some needing to access cash to plug an income gap and others potentially deferring to avoid ‘selling on the dip’

• AJ Bell research suggests 1 in 10 have accelerated plans to access their pension as a result of the pandemic

Tom Selby, senior analyst at AJ Bell, comments:

“While the latest figures show total pension freedoms withdrawals continued to march higher to £35 billion, average per person withdrawals dropped from £7,300 in Q1 2019 to £7,100 this year.

“In fact, average per person withdrawals have fallen steadily since April 2015, suggesting people are generally using the reforms sensibly to take a steady income rather than splurging their hard-earned retirement pot in one go.

“It’s worth noting the Q1 2020 figures mostly relate to the months before lockdown hit, and so are unlikely to capture any substantive shift in behaviour resulting from COVID-19. Given the dramatic impact the pandemic has had on markets and people’s incomes, it will inevitably drive the pension access decisions many people make in Q2 2020 and beyond.

“Independent research commissioned by AJ Bell suggests 1 in 10 over 55s have already accelerated plans to access their pension as a result of COVID-19. Anyone going down this route needs to think carefully about the sustainability of their retirement income strategy.

“Others will be considering deferring retirement or reducing their withdrawals in order to avoid ‘selling on the dip’ and to ensure they don’t risk running out of money in later life.

“In both cases the key message to investors is to stay calm and make sure you understand the long-term impact of the decisions you are taking today.”

Source: HMRC quarterly data