• Savers have withdrawn almost £33billion from their retirement pots since the pension freedoms were introduced in April 2015, latest HMRC data reveals (https://www.gov.uk/government/statistics/flexible-payments-from-pensions)

• 327,000 people withdrew £2.2billion flexibly from their pensions in the final quarter of 2019

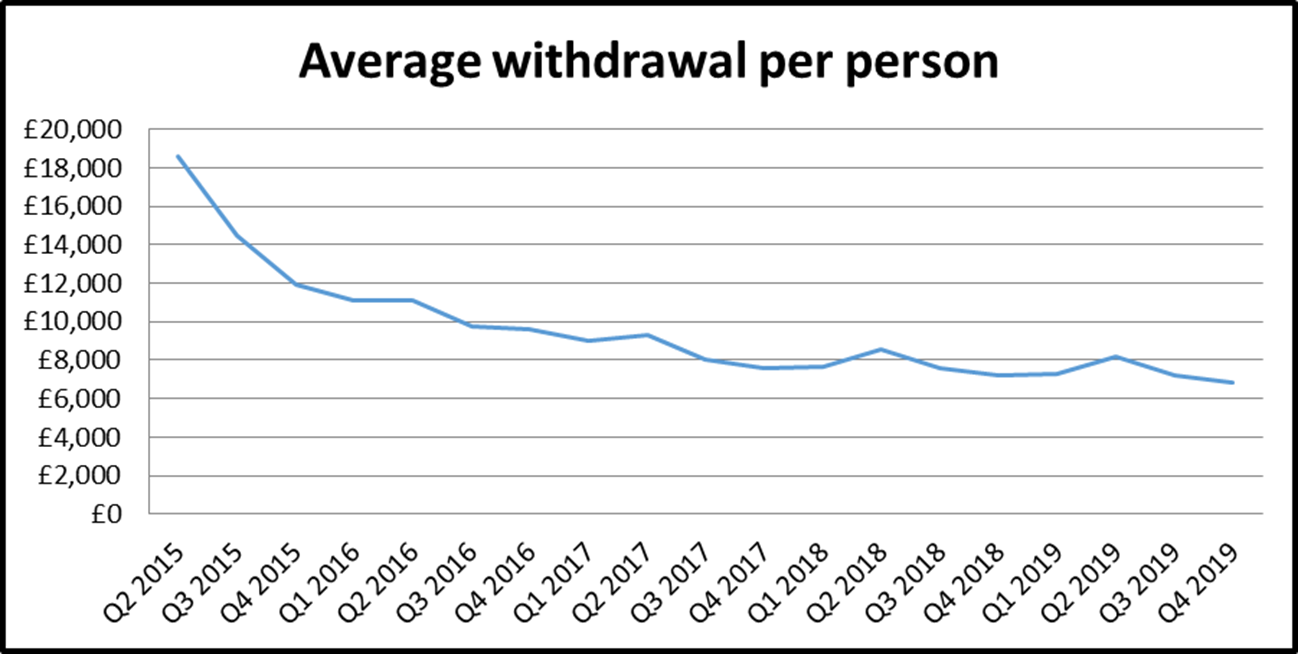

• Average per person withdrawals were £6,800 in Q4 2019, down 5% from £7,200 in Q4 2018 and the lowest figure recorded so far

• Government urged to review pension tax rules as rising numbers trigger the £4,000 money purchase annual allowance (MPAA)

Tom Selby, senior analyst at AJ Bell, comments:

“It’s taken nearly 5 years but we are finally getting an idea of what ‘normal’ looks like in a world where people can spend their pension pot as they wish from age 55.

“The average person withdrew under £7,000 flexibly during the latest quarter, a figure which has been trending downwards as more people take a steady income from their fund.

“We know from FCA data that over 350,000 pension pots were fully withdrawn at the first time of access in 2018/19, potentially skewing the average per person withdrawal figures upwards. Nine in 10 of these total withdrawals were made by people with relatively small pots worth £30,000 or less*.

“While it’s hard to draw firm conclusions about the pension freedoms without knowing people’s other assets, income sources and individual circumstances, nothing we have seen suggests savers are broadly behaving in anything but a responsible manner.”

Source: HMRC statistics

Pension tax and the need for a rethink

“While the pension freedoms might be working well, the same cannot be said of the pension tax system. Over a million* people have accessed their pension for the first time since the pension freedoms launched almost 5 years ago, in the process triggering a cut in their annual allowance from £40,000 to just £4,000.

“This draconian measure runs counter to both the pension freedoms and wider shifts in working patterns, with many people now choosing to continue employment after they have accessed their retirement pot.

“The MPAA risks creating particular difficulties for those who access a relatively small fund for a specific purpose – perhaps to help a child on the housing ladder or pay for long-term care for a relative – and need to rebuild their retirement savings afterwards.

“Furthermore, it is poorly understood and creates more complexity in the already too complex pension tax system.

“With the Budget now 6 weeks away, we urge the Chancellor to initiate a fundamental review of the pension tax framework, with the aim of simplifying and encouraging more people to save for retirement. The most obvious starting point for such a review would be to scrap both the annual allowance taper, which has caused severe difficulties for the NHS in particular, and the MPAA.”