Russ Mould, investment director at AJ Bell, comments:

“The dominant post-referendum trading theme since last summer has been “pound down, stocks up,” with overseas plays and dollar earners leading the way and domestic plays lagging. If sterling does continue to rally, investors may choose to focus on those sectors that have been neglected since the Brexit vote because of their reliance on the UK economy – namely general retailers, food retailers and the real estate plays.

General Retailers and Food Retailers have suffered because the weaker pound has been seen as a contributor to inflation, which has a two-fold negative effect upon them. First its increases their costs when it comes to importing raw materials and goods from overseas, forcing them to either take a margin hit or raise prices. Second, rising inflation crimps consumer spending power, especially if wage increases do not keep pace.

Next, Dunelm and Mothercare are all retailers who have flagged their need to hike prices this year to compensate for increased raw material costs, so any sustained gains in the pound (still by no means a certainty) could help them both financially and in terms of sentiment toward their share prices.

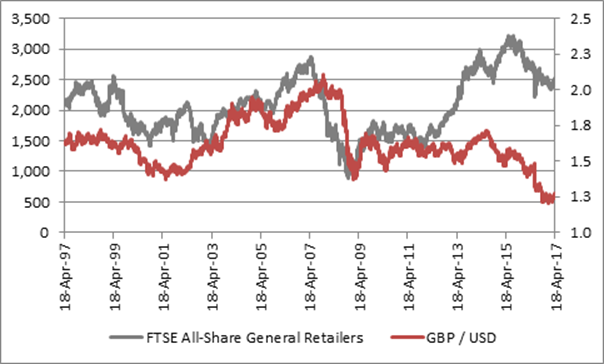

The chart below shows there is an inverse correlation between the FTSE All-Share General Retailers index and the sterling/dollar cross rate – so the lower the pound goes the worse the sector does and higher pound goes against the greenback the better it does.

Source: Thomson Reuters Datastream

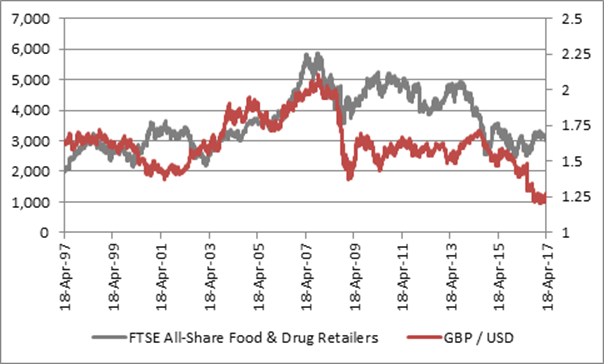

A similar pattern can be seen with regard to the UK Food & Drug Retailers sector, where Tesco, Sainsbury and Morrisons are the key quoted players.

Source: Thomson Reuters Datastream

This is not to say long-term issues such as competition from the internet and the battle between bricks and clicks, let alone the challenges to general retailers posed by unhelpful demographics and the concept of “peak stuff,” have gone away. But in the short-term the noise created by the currency markets may tempt traders into action and trump long-term considerations.

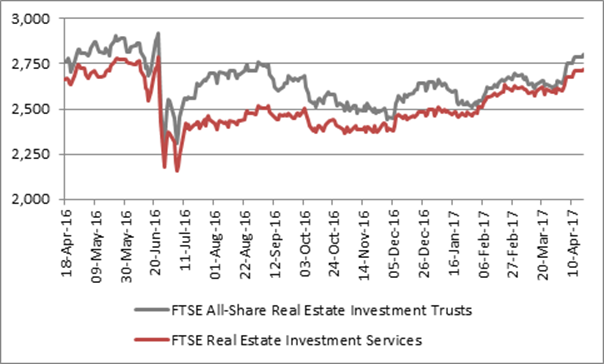

The Real Estate Investment Trusts (REITs) and Real Estate Investment Services sectors both took a drumming on the back of the referendum result last year and – unlike the house builders for example – they have yet to recapture the lost ground.

If the market decides to start looking for domestic value plays, both areas may therefore come onto traders’ radars, especially as they have already started to run:

Source: Thomson Reuters Datastream

Besides a focus on the pound (and the prospect that its rally may cool inflation and even further delay any increases in interest rates from the Bank of England) there are three other possible reasons REITs in particular could be starting to make a comeback:

1. Falling bond yields. A fresh plunge in UK Government bond yields may be serving to highlight the REITs’ income attractions, as no fewer than nine of them offer a dividend yield of more than 4% for 2017, based on consensus analysts’ forecasts. By contrast, the Bank of England’s reticence over raising interest rates and doubts over the sustainability of the spring surge in inflation have combined to drag the UK 10-year Gilt yield from a February peak above 1.4% back to barely 1.05%.

| 2017E Dividend Yield |

Newriver | 6.4% |

INTU | 4.9% |

Londonmetric Property | 4.9% |

British Land | 4.7% |

Hammerson | 4.4% |

TRITAX Big Box | 4.3% |

Hansteen | 4.2% |

Town Centre Securities | 4.1% |

Big Yellow | 4.0% |

Land Securities | 3.5% |

SEGRO | 3.4% |

Safestore | 3.3% |

CLS | 3.1% |

Workspace | 3.1% |

Derwent London | 1.9% |

Shaftesbury | 1.6% |

Great Portland Estates | 1.5% |

Capital & Counties | 0.5% |

Source: Digital Look, consensus analysts’ forecasts, Thomson Reuters Datastream

2. Encouraging transaction activity. The full-year reporting season passed without major incident, as net asset values (NAVs) held up well (and certainly much better than the shares did last summer) and the widely-feared collapse in rents in the face of new supply failed to materialise. News flow this spring has also been encouraging. In the past month alone:

FTSE 100 REIT British Land and its joint-venture partner have sold the Leadenhall Building (also known as the ‘Cheesegrater’) in the City for £1.15 billion, compared to a September 2016 valuation of £915 million, for a 24% premium to book value.

CLS Holdings, a FTSE 250 firm, announced the sale of its Vauxhall Square development in London for a net consideration of £144 million, compared to the site’s December 2016 balance sheet valuation of £100 million, providing an uplift to the firm’s stated net asset value of some 70p per share (compared to the last published figure of £19.51).

Capital & Counties, another FTSE 250 REIT, has exchanged and completed on the sale of the events venue Olympia London for £296 million, or £229 million adjusting for debt and transaction costs, in line with previously published valuations. Note that this deal had been postponed last year in the wake of the Brexit vote.

3. Attractive valuations. Many REITs still trade at big discounts to net asset, or book, value, to suggest they may still be too cheap, in light of the deals outlined above.

| Premium / discount to historic NAV per share |

Safestore | 36.0% |

Big Yellow | 28.5% |

Newriver | 20.3% |

Londonmetric Property | 16.8% |

TRITAX Big Box | 14.9% |

Shaftesbury | 7.8% |

Hansteen | 2.3% |

SEGRO | 1.3% |

Capital & Counties | -5.8% |

Workspace | -6.4% |

CLS | -10.7% |

Land Securities | -13.0% |

Hammerson | -14.4% |

Great Portland Estates | -14.9% |

Derwent London | -16.8% |

INTU | -17.7% |

Town Centre Securities | -18.9% |

British Land | -25.4% |

Source: Company accounts (using historic NAV per share), Thomson Reuters Datastream

* Excludes effect of Vauxhall Square sale which will add 3.5% to NAV

In the 1990-92 recession discounts to NAV reached around 40% but the tax rules were different then – property developers paid 20% tax on asset sales whereas the REIT structure is much more tax-efficient (REITs pay no tax so long as at least 90% of net profit is then distributed as dividends to shareholders).

As such the current discounts with no tax bill look similar to the depths of the early 1990s recession and so a lot of bad news has already been priced in – even if that bad news in the form of rising vacancies, falling asset values and falling rents has yet to materialise.

There is a risk that a sudden jump in sterling dampens overseas interest in British assets – all three of the transactions above involved overseas buyers and the takeover bid speculation at Chinatown-owner Shaftesbury involves a Hong Kong-based billionaire. But the UK still offers a rule of law and an independent central bank while a strong (or at least more stable) currency could reaffirm the long-term appeal of UK commercial property to potential buyers.”