“The majors’ own cost-cutting and efficiency drives meant they were profitable in the third quarter with oil averaging barely $50 and both BP and Shell generated enough cash to pay their dividends even after tax and capital investment, so further gains in crude should further underpin their still-plump dividend yields.

“The question to address now is whether oil can keep the gains it has made since its low of $28 in early 2016 and the good news is that three factors do seem to be working in its favour. There is, however, a rogue potential fourth element which needs to be watched carefully, especially as it is the most unpredictable factor of all.

“The three positives are a stabilisation in global rig activity, falling American stockpiles and the weaker dollar. The potential negative is that futures markets show that traders and speculators have accumulated huge ‘long’ positions, so you do have to wonder what might happen if they start to sell so they can lock in a profit (or to cover losses suffered elsewhere).”

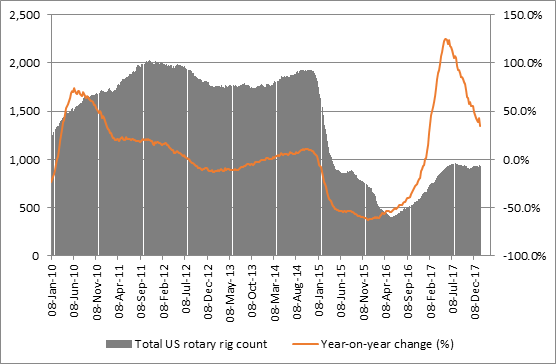

Positive factor #1: Stabilising global rig activity

“After a huge initial rally from its spring 2016 lows near 400, the US active oil rig count looks to be stabilising around the 930 mark (below last summer’s peak of 958, according to data from Baker Hughes). US shale output has been a huge swing factor in global oil supply but the rig count is flattening out here, too with the result that supply is not growing as quickly as it did in 2013-14, for example.

Source: Baker Hughes

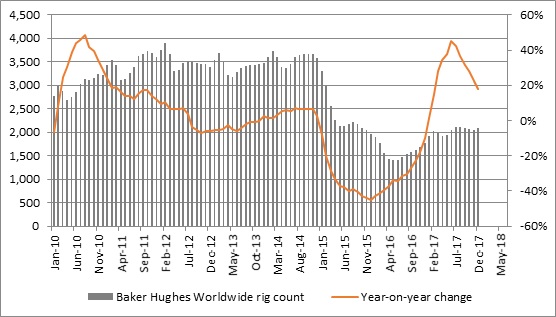

“The worldwide rig count is still growing but it is doing so more slowly now and this suggests that OPEC and non-OPEC members are still pretty much sticking to the 1.5 million-barrel-a-day production cut that was first agreed upon in November 2016 and has since been extended twice, out to December 2018. The figures also imply that the quoted global oil majors are sticking to their capital disciplines too.”

Source: Baker Hughes

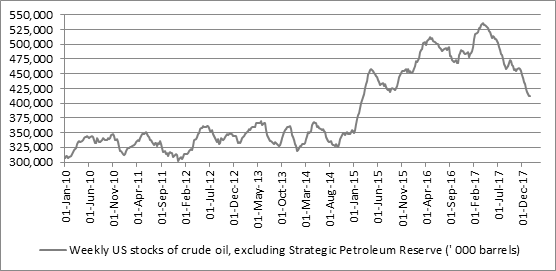

Positive factor #2: Falling American stockpiles

“The Energy Information Administration (EIA) releases data on American oil stockpiles every Wednesday. Steady shale output, solid economic growth and consistent increases in global demand, as per OPEC data, mean that US inventories of oil continue to drop, lessening the overhang which has previously helped to subdue oil prices.”

Source: US Energy Information Administration

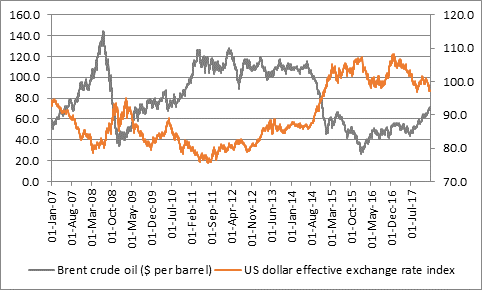

Positive factor #3: The weak dollar

“In theory a weak dollar is helpful for oil prices as it means crude is cheaper to buy for those nations whose currency is not pegged to the greenback. While the past is no guaranteed to repeat itself, prior marked spells of dollar weakness in 2007-08, 2010-11 and 2015-16 did see sharp coincided with sharp spikes in oil prices, while gains in the buck in 2008-09, 2012 and 2014 coincided with a slide in crude. This time around oil’s gains do seem to have accelerated since the summer of 2017 when the dollar really began to hit reverse gear.”

Source: Thomson Reuters Datastream

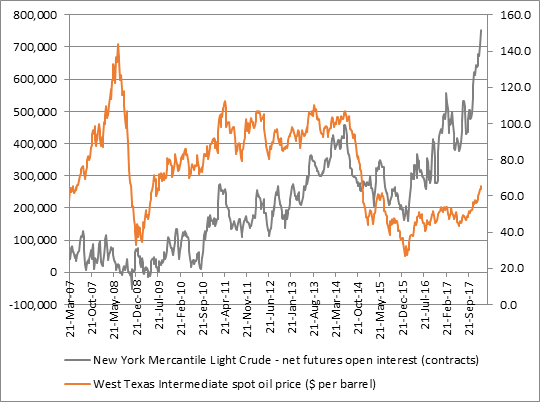

One negative factor: speculative positioning

“While the wild swings seen in oil over the past decade mean it is rarely sensible to be too dogmatic, the fundamentals of the market currently seem supportive to the price of crude, even if any renewed acceleration in US shale output or a breakdown in the OPEC truce remain potential danger signs.

“A less tangible, but very real, danger to the oil price is the skewed nature of oil traders’ current positions. Fundamentals always matter in the end but markets can be driven by positioning in the near term, especially if leverage (margin debt) is involved.

“US futures markets show that traders have been huge buyers of oil with the result that their net long positions are the highest in a decade. If speculators and financial buyers start to liquidate these positions then that could weigh on the price of crude and they may want to sell to lock in a profit or be forced to sell if their funds suddenly need liquidity if they have taken a loss elsewhere.”

Source: US Commodities Futures Trading Commission, Thomson Reuters Datastream