“For well over a year, analysts have been arguing that rising interest rates would be good for the banks’ net interest margins and profits by allowing them to increase the cost of loans, keep funding costs low and pocket the difference. But the share prices of the five FTSE 100 banks do not seem to be listening as they have all fallen more rapidly than the headline index,” says Russ Mould, AJ Bell investment director.

Source: Refinitiv data

“After an 18.5% fall in the year-to-date, the FTSE All-Share Banks sector is only the 35th best performer out of the 39 industrial groupings which make up the FTSE All-Share.

“RBS has been the best of a bad lot, with Standard Chartered, perhaps weighed down by concerns over its emerging markets, the worst of the FTSE 100’s Big Five, in share price terms.

“It will offer little consolation to investors but at least the UK’s banks are not outliers. The banking sector has done badly on a worldwide basis in 2018.

|

|

Performance, year to date |

|

|

Performance, year to date |

|

Royal Bank of Scotland |

(13.8%) |

|

US Banks |

(3.6%) |

|

Lloyds |

(15.8%) |

|

Emerging Market Banks |

(10.9%) |

|

HSBC |

(18.6%) |

|

Global Banks |

(12.7%) |

|

Barclays |

(18.8%) |

|

Japanese Banks |

(11.3%) |

|

Standard Chartered |

(28.2%) |

|

UK Banks |

(18.5%) |

|

|

|

|

|

|

|

FTSE All-Share |

(8.1%) |

|

|

|

Source: Refinitiv data

“This rotten showing does not sit well with the long-running equity bull market, given the banks’ important role in financial markets and the wider economy. It is to be hoped that this is not a subtle warning from Mr Market that there is something wrong with the financial markets’ plumbing or that the combination of record-high global debts, rising interest rates and a diminishing amount of monetary stimulus in the form of Quantitative Easing means the economic upturn is more fragile than we realise.

“In the specific case of the UK, the banking market is tightly regulated, mature and competitive. The arrival of savings bank Marcus is just one example of how challenger banks are nipping at the heels of the established players with its 1.5% easy-access account savings rate.

“Competition for deposits is driving cash savings rates (and therefore banks’ costs) up just as the variable mortgage market remains as cut-throat as ever, so it is possible that net interest margins are not going to expand as analysts had hoped, or perhaps at least not as quickly.

“The third-quarter updates due from the five FTSE 100 banks, starting with Barclays on Wednesday 24 October and ending with Standard Chartered on 31 October, will focus a lot on net interest margins, but analysts and investors will be interested in two other sets of figures.

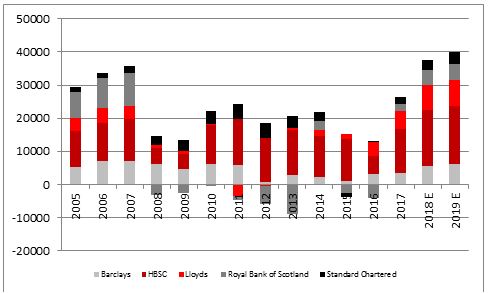

“The first is the headline earnings number. For 2018 as a whole, analysts expect the Big Five to make a combined pre-tax profit that exceeds 2007’s pre-crisis peak of £35.8 billion.

Source: Company accounts, Digital Look, analysts’ consensus forecasts

“Analysts have admittedly been forecasting a return to that former peak for several years without any notable success. At least profit estimates for the big lenders are currently rising, not falling. In June, analysts expected the big five to rack up aggregate pre-tax profits of £36.4 billion and that figure has now reached £37.5 billion.

“However, it is in the second half of the year, and especially the fourth quarter, that the banks tend to book the bulk of any bad loans, asset write-downs, regulatory costs and restructuring charges so nothing can be taken for granted just yet.

“And this is when analysts will start to switch from looking at earnings quantity to earnings quality.

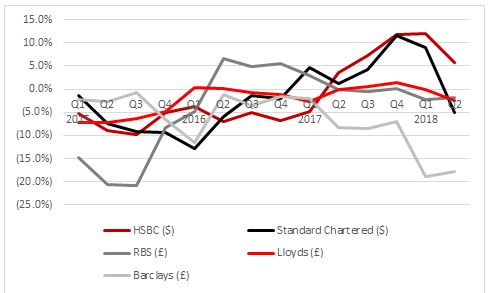

“They will want to assess the momentum in loan growth. The banks have spent much of this decade nursing themselves back to health by shrinking and simplifying their businesses and it will now be interesting to see if they start to take more risk again in an attempt to grow profits by increasing revenues, not just cutting costs.

“Loan growth will therefore be important. It looked as if momentum was building as we entered 2018 but even HSBC and Standard Chartered showed a lower rate of loan growth in Q2 than they did in Q1. It must be noted that Barclays’ deconsolidation of its African operations explains a lot of the year-on-year drop in the size the bank’s total loan book.

Source: Company accounts. Shows year-on-year growth in advances and loans to customers in the reporting currency of each bank.

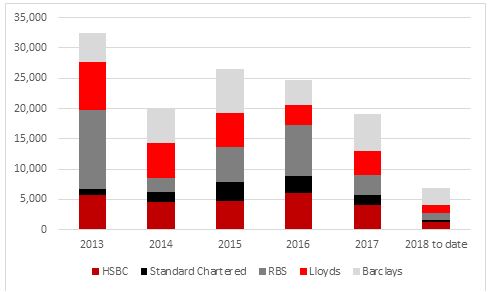

“Finally, attention will switch to loan loss and impairment charges, restructuring costs and also litigation and conduct provisions relating to things like protection payment insurance, or PPI.

“The total cost of these items since 2013 has been some £123 billion at the Big Five, compared to stated pre-tax profits of £80.6 billion and aggregate dividend payments of £48.9 billion over the same period. In sum, if the banks can keep their noses clean and themselves out of trouble, these costs could fall and profits advance sharply.

“Recent trends are encouraging but the imminent 2019 claims deadline for PPI in the UK remains a concern.”

Source: Company accounts. Shows total costs for loan losses and impairments, asset impairments, restructuring costs and litigation and conduct costs in sterling terms.