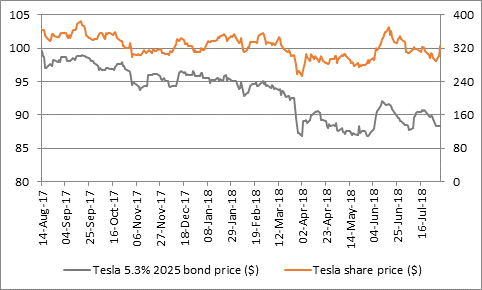

“The Tesla bond, which pays a 5.3% annual coupon and trades in Berlin on the Deutsche Boerse, was issued a year ago at $100 and it has not once traded above par since, to reflect concerns among fixed-income investors over Tesla’s cash flow.

Source: Thomson Reuters Datastream

“The company has also issued a number of convertible bonds, which are due to mature in November 2018, March 2019, November 2019 and then 2020, 2021 and 2022 respectively.

“They are still trading above par ($100) but they all mature before the 2025 bond and thus have a first claim on Tesla’s dwindling cash pile. If Tesla’s shares do not reach a certain level then the convertibles may not convert into shares and stay as debt – which Tesla will then have to repay. At $326 Tesla’s shares are not high enough to tempt the convertible bond holders to convert the debt into shares rather than demand their money back.

Maturity Date | Coupon | Amount | Conversion price |

Nov-2018 | 2.75% | $230m | $560.5 |

Mar-2019 | 0.25% | $920m | $359.9 |

Nov-2019 | 1.625% | $566m | $759.4 |

Dec-2020 | 0.00% | $113m | $300.0 |

Mar-2021 | 1.25% | $1,380m | $359.9 |

Mar-2022 | 2.375% | $977.5m | $327.5 |

Source: Company accounts

“This could be a key drain on Tesla’s resources and could yet confound CEO Elon Musk’s flat-out denials that the company needs – or has plans – to raise extra capital and gives management every incentive to talk a bullish story to boost the shares.

“If the 2025 bond price starts to go back toward 100 – or even above it – then the company’s finances really will be improving and shareholders will be able to draw comfort from that.

“But if the company’s losses remain heavy and its cash burn intense, it is hard to see how the firm could avoid raising cash: Tesla has just $2.3 billion in cash, cash burn in Q2 was $130 million and capital investment was $610 million on top of that, with potentially $1.1 billion more flowing out of the door if the November 2018 and March 2019 convertibles mature and have to be repaid.

The bull case for Tesla: time to burn rubber

Car volume production is growing fast. Tesla produced a record 53,339 vehicles in Q2 and over half of those (28,578) were Model 3’s as the company finally reached its target of producing 5,000 of this version a week. Elon Musk has forecast the production of 50,000 to 55,000 Model 3s alone for Q3, alongside a total of 100,000 Model S and X cars for the year as a whole.

Increased production is already leading to increased margins. Gross margin rose to 15.5% in Q2, the best figure in a year, and as car production and sales continue to rise, the firm should start to erase its spiralling losses and, according to Mr Musk, record a profit in Q3 and Q4.

A move into profit will in turn boost cash flow and erase any concerns that shareholders or bond holders may have about the company’s finances and the need for a further cash raising.

The bear case on Tesla: still burning too much cash

Doubters (and seemingly bond holders) will point out that Tesla has developed a bad habit of missing Mr Musk’s (self-imposed) production targets, so nothing should be taken for granted for Q3 and beyond. In addition, the gap between cars produced and cars sold in a quarter has opened up, to perhaps suggest that Tesla has been straining to meet its public output goals to assuage nervous owners of its debt and equity.

The company’s cash resources are dwindling and the potential convertible maturities could place additional pressure on Tesla’s finances, obliging the firm to raise either fresh equity, debt or both. The firm has a big debt pile and the combination of high operational gearing (major changes in profit relative to small change in sales) and high financial gearing (debt) can be powerful in a good way when profits are rising but very damaging if earnings fail to develop as planned or even fall.

The biggest risk to shareholders may still be Tesla’s huge market capitalisation. At $50 billion, this is only a fraction below GM’s $52 billion market value, even though Tesla sells only a fraction of the number of cars. There is therefore the danger that Tesla delivers everything that is hopes of it and yet the shares still do badly from here, because the good news is already priced in – something which investors in tech, media and telecoms stocks experienced to their cost after the bubble burst in early 2000.