“One of the odd features that characterised the FTSE 100 before the COVID-19 crisis was the number of chief executive (CEO) and chief financial officers (CFOs) leaving their posts. Tesco’s Alan Stewart has now added to this list as he prepares to retire as the grocer’s chief bean-counter on 30 April 2021, the first to plan his departure for next year,” says Russ Mould, AJ Bell Investment Director.

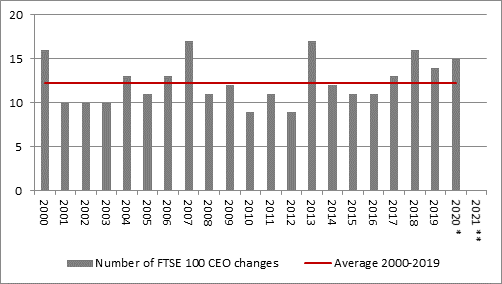

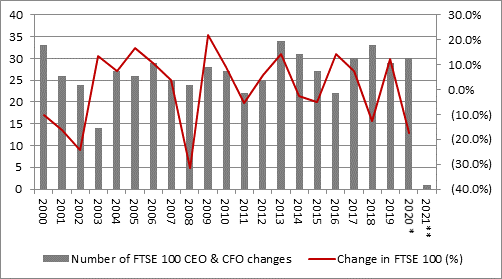

“Since 2000, an average of 12 FTSE 100 firms a year have seen a change in CEO and 15 in CFO. Eleven companies have already welcomed a new boss this year and five more look set to do so before the year end, with Tesco’s Ken Murphy and Imperial Brands’ Stefan Bomhard the next pair due to take the top job, ahead of Luis Gallego at International Consolidated Airlines in September and then whoever is appointed to take the helm at Pearson and Persimmon before the end of the year.

Source: Company accounts. * 2020 changes as already announced or happened. **2021 changes as already announced.

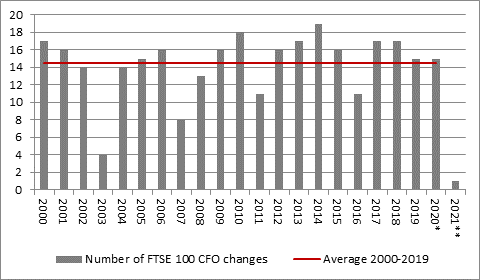

“Fifteen FTSE 100 firms are set to welcome a new CFO in 2020 and Mr Stewart’s announcement is the sixteenth for the year, although his retirement becomes effective in spring 2021.

Source: Company accounts. * 2020 changes as already announced or happened. **2021 changes as already announced.

“Five of those changes have already become effective, at Bunzl, Auto Trader, Reckitt Benckiser, WPP and – when it was still in the FTSE 100 – NMC Health, with new appointments at Rightmove (albeit an interim one in this case) and then BP, DCC, United Utilities, Spirax-Sarco and Smith & Nephew all due to settle in before the end of the summer.

|

|

|

Change in FTSE CFOs |

|

|

|

|

|

2020 |

|

|

|

|

Company |

In |

Out |

When |

|

1 |

Bunzl |

Richard Howes |

Brian May |

01-Jan-20 |

|

2 |

Auto Trader |

Jamie Warner |

Nathan Coe |

01-Mar-20 |

|

3 |

NMC Health |

|

Prasanth Shenoy |

27-Feb-20 |

|

4 |

Reckitt Benckiser |

Jeff Carr |

Adrian Hennah |

09-Apr-20 |

|

5 |

WPP |

John Rogers |

Paul Richardson |

01-May-20 |

|

6 |

Rightmove |

Georgina Hudson (interim) |

Robyn Perriss |

30-Jun-20 |

|

7 |

BP |

Murray Auchinloss |

Brian Gilvary |

01-Jul-20 |

|

8 |

DCC |

TBC |

Fergal O'Dwyer |

17-Jul-20 |

|

9 |

United Utilities |

Phil Aspin |

Russ Houlden |

24-Jul-20 |

|

10 |

Spirax-Sarco Engineering |

Nimesh Patel |

Kevin Boyd |

By 31-Jul-20 |

|

11 |

Smith & Nephew |

Anne-Francoise Nesmes |

Graham Baker |

03-Aug-20 |

|

12 |

London Stock Exchange |

TBC |

David Warren |

By end-2020 |

|

13 |

Pearson |

Sally Johnson |

Coram Williams |

By end-2020 |

|

14 |

easyJet |

TBC |

Andrew Findlay |

By May-2021 |

|

15 |

Mondi |

Mike Powell |

Andrew King |

TBC |

|

|

|

|

|

|

|

|

|

For 2021 |

|

|

|

16 |

Tesco |

TBC |

Alan Stewart |

30-Apr-21 |

Source: Company accounts

“There can be many reasons why a CFO steps down.

• It could simply be retirement, as in the case of WPP’s Paul Richardson, who entered 2020 as the FTSE 100’s second-longest serving finance boss, after DCC’s Fergal O’Dwyer, having taken the job in 1996.

• It could be that there has been a change of CEO and the CFO failed to get the job and decided to leave to chance their arm for the top position somewhere else (or were elbowed out of the way by the successful candidate so they couldn’t make trouble.)

• It could be that there is a change in CEO and the CFO feels that is the right time to go. This could well be the case with Mr Stewart, who started in the role at Tesco on 23 September 2014, just three weeks after Dave Lewis took over at CEO. They seem to have worked well together as a team, selling assets to reduce debt and the complexity of the business, rebuilding momentum in the UK grocery operations both organically and through the acquisition of wholesaler Booker and even reducing the pension deficit. The share price may not have responded as either man would have liked during their six years at the helm – it is flat against a 9% drop in the FTSE over the same time span. But both will feel they can look back at a job well done, even if Mr Lewis at least may be going out on a lower note than hoped, owing to questions over how a final share payment package was calculated and whether Tesco is right to pay out dividends to shareholders with one hand when it is accepting business rates relief with another.

• In more extreme circumstances, it could be that the CFO feels there is trouble ahead and it is time to get out while the going remains good. The combination of CEO and CFO departures running above average in 2018, 2019 and so early in 2020 (even before COVID-19) did raise such suspicions but no CFO, no matter how astute, has second sight and none can have foreseen the pandemic or its effects.

Source: Company accounts. * 2020 changes as already announced or happened. **2021 changes as already announced.

“In this case it is hard to argue that Mr Stewart is hurrying out of the door. By the time he retires in April 2021, he will have been Tesco for just over six-and-half years, compared to the current FTSE 100 average of 5.5 years (and the average for CEOs of 5.1 years) and the lengthy run-in means Tesco has plenty of time to find the right candidate and arrange a smooth succession.”

|

|

Current average tenure in FTSE 100 |

||

|

|

Days |

Months |

Years |

|

CEOs |

1,856 |

61 |

5.1 |

|

CFOs |

2,017 |

168 |

5.5 |

Source: Company accounts