“Another so-called ‘unicorn’ stock is leaving investors with sleepless nights as shares in US online mattress retailer Casper are already unravelling, after just three days on the public markets,” says Russ Mould, AJ Bell Investment Director.

“In March 2019, Casper achieved ‘unicorn’ status as a private fundraising gave the loss-making company an implied valuation of $1.1 billion but it has been downhill all the way since then.

“The New York-headquartered firm initially tried to price its initial public offering (IPO) at $17-$19 a share but managed to get shares away at $12 a pop. A first-day rally to nearly $16 looked to spare a few blushes but two days of heavy falls mean Casper shares already change hands for barely $10 apiece, a level that gives the company a market value of just over $300 million.

“That is more than 70% below last March’s valuation, set by a deal that was completed less than a week before the much-hyped stock market debut of loss-making ride-sharing and transport firm Lyft, another unicorn that is yet to help its investors realise their dreams.

“Casper’s attempts to dress up its online retail model as a technology business are already looking pretty threadbare, something which will not come as a big shock to any UK investor who lost out by buying shares in Eve Sleep when it came to market in 2017 at 101p a share. The stock now changes hands at just above 1p.

“Given that Eve has struggled while shipping mattresses around the UK, investors must surely now be asking themselves how Casper will get on in the US, a nation with a land mass more than 40 times bigger.

“Casper has already diversified beyond mattresses to bedding and soft furnishings but they are hardly under-supplied markets and remain fiercely competitive.

“You could argue that Casper did well to get its flotation done at all in the wake of the WeWork fiasco so perhaps investors’ fascination with unicorns is by no means at an end, even though sellers have generally done better than buyers in the recent rush of stock market listings. Zoom Video Communications is relatively rare example of a float that has served investors well and even there the shares have been volatile, soaring from $36 to $100 before dipping to $63 and then dashing back toward $90.

|

|

IPO |

IPO Price |

Share price peak* |

Share price** |

Capital return since IPO |

|

Zoom Video Communications |

17-Apr-19 |

$36.00 |

$102.77 |

$89.67 |

149.1% |

|

Chewy |

13-Jun-19 |

$22.00 |

$31.13 |

$28.05 |

27.5% |

|

|

18-Apr-19 |

$23.75 |

$36.56 |

$24.29 |

2.3% |

|

Peloton |

26-Sep-19 |

$29.00 |

$36.84 |

$28.60 |

(1.4%) |

|

Uber |

13-May-19 |

$45.00 |

$46.38 |

$40.01 |

(11.1%) |

|

Casper |

09-Feb-20 |

$13.00 |

$13.97 |

$9.99 |

(23.2%) |

|

Lyft |

29-Mar-19 |

$72.00 |

$78.29 |

$53.72 |

(25.4%) |

|

Snap |

02-Mar-17 |

$24.00 |

$27.09 |

$17.60 |

(26.7%) |

|

Slack |

20-Jun-19 |

$38.50 |

$37.50 |

$26.54 |

(31.1%) |

|

Smile Direct Club |

11-Sep-19 |

$23.00 |

$19.48 |

$14.38 |

(37.5%) |

Source: Refinitiv data. *Daily closing price. **As of the close 10 February 2020

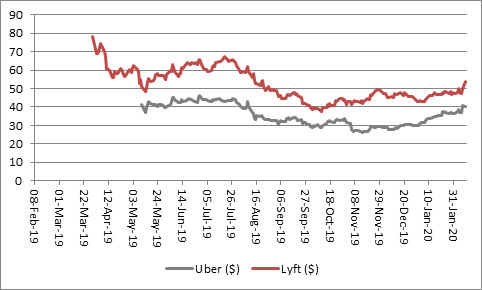

“Perhaps the recent advances we have seen in Uber and Lyft is tempting investors to try their luck again, although whether the ride-sharers’ rally owes more to their operational performance of a wider return of risk-appetite in the wake of central bank interest rate cuts and the Federal Reserve’s decision to flood the interbank funding market with fresh liquidity remains a matter for debate.

Source: Refinitiv data

“After Casper’s nightmare start, it will therefore be interesting to see whether a number of firms that have lofty valuations from private fund raisings decide to come to the public markets in 2020, including Airbnb, Wish, DoorDash, Instacart and Credit Karma.”