“The UK energy market can be held up as a further example how price caps can create as many problems as they offer solutions but one firm which looks like it will be able to help stricken consumers, recruit more staff and keep shareholders happy all at the same time is Telecom Plus,” says AJ Bell Investment Director Russ Mould. “The multi-utility, which provides energy, broadband, mobile and insurance to households and small businesses, is profitable, cash generative and has limited debt, so it is no surprise to see the firm attract both new partners who can sell its wares and new customers who are looking for a reliable supplier.

“Telecom Plus’ business model seems robust and is proven over the long term, as it seeks to provide good value to customers and also offers the convenience of a single bill across its range of services. Increased recruitment of partners can only help a business which benefits strongly from word-of-mouth at a time when many households are worried about energy bills, which supplier will fail next and keen to find a utility that can be relied upon for both affordable prices and financial durability.

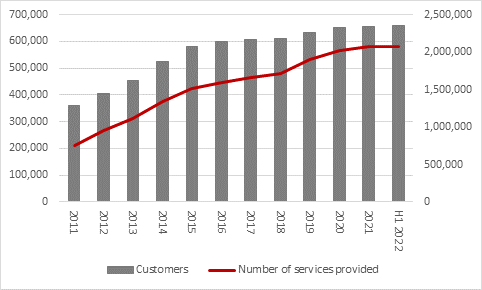

“The interim results will do their bit to reassure on all fronts. Customer numbers rose slightly to 660,700 and the total number of services supplied to just over two million, as customers continue to take multiple services from the utility provider. October alone added another 15,000 customers and Telecom Plus is looking forward to double-digit percentage growth in the second half of the year.

Source: Company accounts. Accounting for fixed-line telephony, line rental and broadband customers restated 2019.

“Better still, churn is low, with just 0.7% of energy customers leaving for another provider in the first half, a figure which has already gone even lower in the second, thanks to the collapse of many rivals who were offering pricing packages that ultimately proved unsustainable

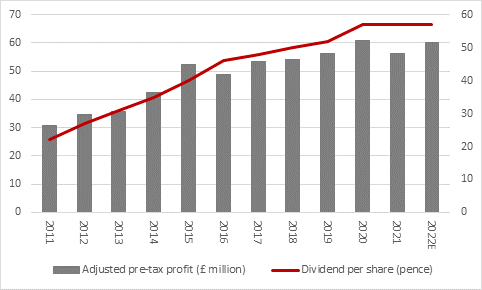

“This all helps to underpin co-chief executive Andrew Lindsay’s guidance for the fiscal year to March 2022 of pre-tax profits of £60 million and a dividend of 57p per share, compared to £56.1 million and 57p in the 12 months to March 2021.

Source: Company accounts, Marketscreener, management guidance for 2022E, consensus analysts' forecasts. Financial year to March. Restated 2013 and 2015.

“A material advance in profits, cash flow and an increase in the dividend are on the cards for March 2023, thanks to higher energy prices and customer growth.

“The combination of financial and operational solidity and a prospective dividend yield in excess of 4% may appeal to income-seekers in particular, especially as the pay-out seems primed to start growing again after two flat years.”