“The latest purchasing managers’ index reading was still very solid, at 56.3, even if it came in below the consensus forecast of 58.0 and retreated from November’s four-year high reading of 58.2.

“Nevertheless, it may be no coincidence that the reading has dipped a little after the gains made by the pound in the fourth quarter of last year, ahead of November’s first interest rate increase in a decade from the Bank of England.

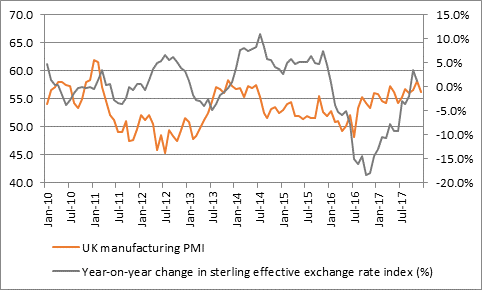

“A study of the year-on-year change in an index of the pound against a basket of other currencies shows how a post-Brexit slump in sterling fuelled an uptick in confidence and activity at British manufacturers.

“The pound actually rose in value on a year-on-year basis in October and November, albeit modestly, and increases in sterling in 2012 and 2014 prompted a dip in the purchasing managers’ index score. While the Bank of England may therefore be happy to see the pound rise on the inflation front, as it could help to dampen cost increases for corporations and consumers, Governor Mark Carney and colleagues will doubtless tread carefully when it comes to any further interest rate increases in 2018, given how a weak pound has helped to support the economy, and especially manufacturing, over the past 18 months.”

Source: CIPS/Markit, Bank of England