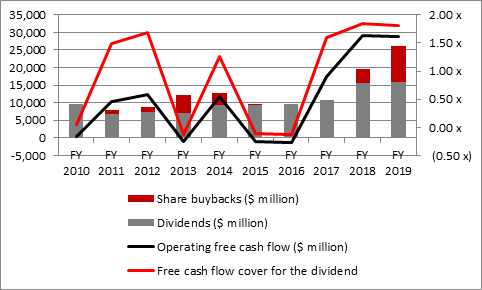

“The good news from Shell’s results is that free cash flow covered the full-year dividend of $15.9 billion by 1.8 times, enough to reassure income-hungry shareholders that the $1.88-a-share dividend (around 145p) looks safe, to give a dividend yield of more than 7%. An additional £7.5 billion in share buybacks boosts the total cash return to around 12% of the current market cap,” says Russ Mould, AJ Bell Investment Director.

Source: Company accounts

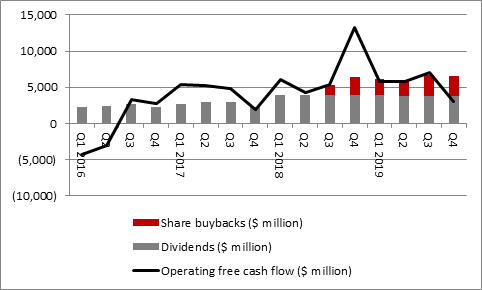

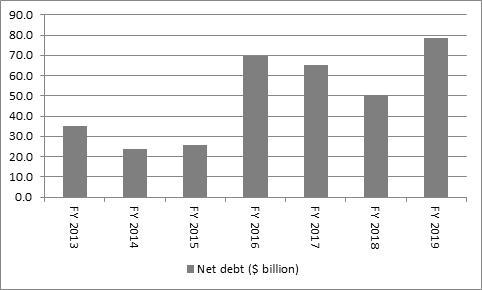

“The bad news is that cash flow did not cover the fourth-quarter dividend at all. In Q4, free cash flow fell to its lowest level since Q2 2016, as oil and gas prices sagged, and net debt jumped by $28 billion across 2019 as a whole, so the buyback largesse was really funded by borrowing, not internally generated funds.

Source: Company accounts

“This is not a great concern when interest rates are rock-bottom, but the gathering debt pile could yet haunt Shell if interest rates ever start rising at speed, or oil and gas prices fall sharply, especially as many investors will be looking to the company to rebalance its portfolio of assets away from hydrocarbons and further toward renewable source of energy.

Source: Company accounts

“Shell already owns substantial amounts of solar power capacity; a stake in solar panel manufacturer SunPower; NewMotion, an operator of more than 40,000 home-based charge points for electric vehicles across the UK, France, Germany and the Netherlands; and battery expert Saft.

“Moreover, Shell has committed 10% of its research and development (R&D) budget to renewable energy and around a quarter of development spending on low-carbon initiatives.

“However, that does mean that some 90% of R&D is still focused on non-renewables and the company is still exposed to swings in the oil and gas price when it comes to near-term profitability, for all of the cost efficiencies and reductions seen in capital investment since the oil price crash of 2015-16.

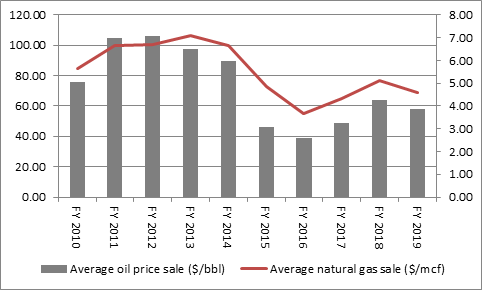

“Profits fell at each of the upstream (oil production and exploration), downstream (refining and petrol stations) and integrated gas operations in 2019, thanks to weak pricing. On average. Shell got $57.76 a barrel for its oil in 2019, down 10% on the year before, and $4.57 for every million cubic feet of natural gas, down 11% on 2018.

Source: Company accounts

“The acquisition of BG in 2016 has helped to galvanise Shell’s output of liquefied natural gas but production of traditional hydrocarbons is flat-lining.

|

|

Shell: Annual production |

|||||||||

|

|

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Liquids |

1,709 |

1,666 |

1,633 |

1,541 |

1,484 |

1,509 |

1,838 |

1,825 |

1,803 |

1,876 |

|

Natural gas |

9,305 |

8,986 |

9,449 |

9,616 |

9,259 |

8,380 |

10,613 |

10,668 |

10,805 |

10,377 |

|

Total hydrocarbons |

3,314 |

3,215 |

3,262 |

3,199 |

3,080 |

2,954 |

3,668 |

3,664 |

3,666 |

3,665 |

|

LNG liquefaction |

16.76 |

18.83 |

20.20 |

19.64 |

23.97 |

22.62 |

30.88 |

33.24 |

34.32 |

35.55 |

|

LNG sales volumes |

|

|

|

30.54 |

39.47 |

39.24 |

57.11 |

66.04 |

71.21 |

74.45 |

Source: Company accounts. Liquids = million of barrels per day (mbpd). Natural gas = million cubic feet per day (mmcf/d). Total hydrocarbons = millions of barrels of oil equivalent per day (mboe/d). LNG volumes in millions of tonnes.

“Investors may therefore wonder whether the cash flow (or perhaps debt) ear-marked for the $25 billion share buyback programme could be better deployed in investment in the company’s operations, given the current challenges that face it, in terms of low prices and political and consumer pressure to move toward a carbon-neutral world. Equally, some shareholders will be grateful the combined yield offered by the buybacks and dividend and simply be content to take the money and run, given the dreadful rates of return currently available from cash and bonds.”

|

|

Shell: Average price received |

|||||||||

|

|

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

|

Liquids ($/bbl) |

75.49 |

105.05 |

106.03 |

97.64 |

89.59 |

46.46 |

38.64 |

49.00 |

63.85 |

57.76 |

|

Gas ($/mcf) |

5.64 |

6.65 |

6.71 |

7.08 |

6.66 |

4.85 |

3.65 |

4.33 |

5.13 |

4.57 |

Source: Company accounts