• Fewer than 1-in-6 (15%) voters would support increasing National Insurance rates to fund social care reforms, new research reveals*

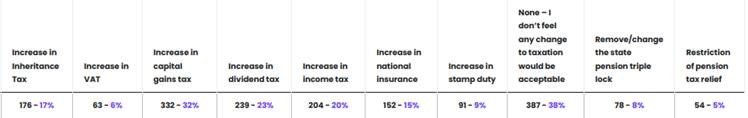

• An independent, nationally representative survey commissioned by AJ Bell asked which of nine money raising options people would find most acceptable

• Increasing capital gains tax (32%), dividend tax (23%), income tax (20%) and inheritance tax (17%) were the most acceptable options

• Changing the state pension triple-lock was backed by just 8% of respondents

• The most common answer was that no increase in taxation would be acceptable (38%)

Tom Selby, head of retirement policy at AJ Bell, comments:

“Prime Minister Boris Johnson and Chancellor Rishi Sunak will be taking a huge gamble if they push ahead with rumoured plans to increase National Insurance rates and scrap the state pension triple-lock to fund social care reforms.

“Fewer than 1-in-6 (15%) people backed increasing NI to pay for the plans when presented with it alongside eight other money-raising options, while just 8% supported changes to the state pension triple-lock. A national insurance increase is particularly unpopular with younger generations with just one in ten 18 – 44 year olds supporting a rise.

“Both measures represent a clear breach of the Conservative manifesto and so would undoubtedly prove hugely controversial.

“Increasing capital gains tax, dividend tax and inheritance tax were all more palatable, perhaps in part because they affect fewer people.

“Interestingly, more people supported increasing income tax than NI rates – although the Government appears to have already decided this is not an option it wants to pursue.

“Perhaps tellingly, the most popular response was that no change in taxation would be acceptable, suggesting that any solution will almost certainly come at a political price.

“The Government will be hoping that by paying for social care reforms through a combination of a rise in National Insurance rates and ditching the triple-lock – possibly temporarily - they will avoid accusations of intergenerational unfairness.

“The big political risk is that in attempting to ensure both younger and older people pay for the reforms, they will simply anger everyone.”

*Based on a nationally representative sample of 1,028 people who took part in a findoutnow survey conducted on 6 September 2021.

Respondents were asked: The Government is reportedly looking to increase taxes to help pay for social care for those in need. Which changes in taxation would you find most acceptable in order to help pay for social care?

The full breakdown of results was as follows:

How does the social care system work at the moment?

In England and Northern Ireland, anyone with total assets worth £23,250 has to cover all their own care costs.

This £23,250 ‘capital limit’ includes things like pensions and savings. If you receive care at home then the value of your property will not be included in the means-test, although if you move into a residential care home then it will be included. Your property will also not be included if your spouse or civil partner continues to live there.

There is no cap on the care costs someone can face down to this point, meaning individuals could face bills of tens of thousands or even hundreds of thousands of pounds. Once assets fall below £14,250 the local authority will pick up the entire care tab, but not before this point.

Those with assets between £14,250 and £23,250 receive some means-tested support.

What are National Insurance rates in the UK?

Both employers and employees pay National Insurance contributions, with the rate depending on the salary of the employee.

The rates that apply to most people are known as ‘Class 1’ contributions. For 2021/22, the Class 1 rates for both employers and employees are:

• 12% on earnings between £797 a month and £4,189 a month

• 2% on earnings above £4,189 a month

That is the state pension triple-lock?

The state pension triple-lock increases the value of the basic state pension and flat-rate state pension by the highest of average earnings, inflation or 2.5%.