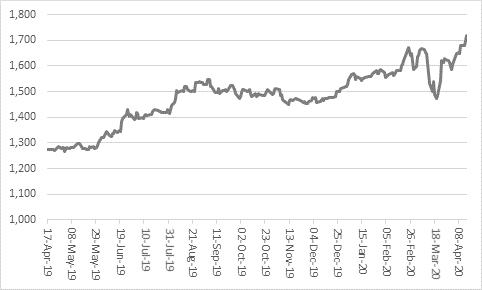

“After a huge rally, America’s S&P 500 index is up 23% from its lows and therefore back in bull market territory but it is those investors who have faith in gold (and gold miners) who are really starting to coin it,” says Russ Mould, AJ Bell Investment Director. “The precious metal has gone back above the $1,700-an-ounce mark, to recapture all of the ground it lost during the initial broad market meltdown and more and perhaps lay the groundwork for a return to the all-time high of $1,900 reached in autumn 2011.

Source: Refinitiv data

“Stock market investors have not missed the metal’s surge. Gold and the NYSE Gold Bugs index have both stormed higher to record substantial gains, even as major benchmark indices have stumbled thanks to the COVID-19 crisis and concerns over what the after-effects upon the global economy may be.

|

|

S&P 500 |

Gold |

HUI Gold Bugs Index |

FTSE 100 |

|

Change over past 12 months in $ |

(4.8%) |

35.0% |

52.5% |

(25.1%) |

|

Change over past 12 months in £ |

(0.6%) |

37.8% |

59.1% |

(21.8%) |

Source: Refinitiv data

“This can be seen on a stock-by-stock basis, too. In the FTSE 100, Russian gold miner Polymetal is the best individual performing stock over the past 12 months and in 2020 to date, while Newmont Goldcorp is the second-best performer over both time horizons within the S&P 500 index. Polymetal has even shot to new all-time highs.

|

Top 10 performing stocks in the FTSE 100 |

||||

|

Over last 12 months |

Price change |

|

To date in 2020 |

Price change |

|

Polymetal |

96.9% |

|

Polymetal |

33.5% |

|

London Stock Exchange |

49.4% |

|

Fresnillo |

16.7% |

|

Pennon |

48.7% |

|

Hikma |

14.7% |

|

Hikma |

30.2% |

|

Ocado |

8.7% |

|

AstraZeneca |

25.2% |

|

Scottish Mortgage |

6.5% |

|

Flutter Entertainment |

22.1% |

|

Pennon |

5.8% |

|

SEGRO |

20.5% |

|

Reckitt Benckiser |

3.3% |

|

Scottish Mortgage |

16.9% |

|

AstraZeneca |

(1.5%) |

|

Severn Trent |

16.5% |

|

Unilever |

(4.1%) |

|

Halma |

14.4% |

|

National Grid |

(4.4%) |

|

FTSE 100 |

(21.8%) |

|

FTSE 100 |

(23.0%) |

|

|

|

|

|

|

|

Top 10 performing stocks in the S&P 500 |

||||

|

Over last 12 months |

Price change |

|

To date in 2020 |

Price change |

|

Advanced Micro Devices |

82.9% |

|

Regeneron Pharma |

37.7% |

|

Newmont Goldcorp |

65.0% |

|

Newmont Goldcorp |

37.6% |

|

ResMed |

53.9% |

|

Citrix |

26.2% |

|

NVIDIA |

42.0% |

|

Netflix |

22.6% |

|

MSCI |

42.0% |

|

Clorox |

20.8% |

|

Equinix |

41.8% |

|

SBA Communications |

19.9% |

|

SBA Communications |

41.5% |

|

MSCI |

19.9% |

|

Dollar General |

40.2% |

|

Digital Realty |

17.4% |

|

Vertex Pharmaceuticals |

38.0% |

|

Amazon.com |

17.4% |

|

Biogen |

37.7% |

|

Gilead Sciences |

15.9% |

|

S&P 500 |

(4.8%) |

|

S&P 500 |

(14.5%) |

Source: Refinitiv data

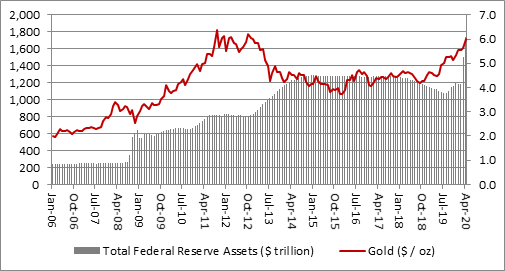

“The reason for gold’s resurgence seems to lie with central bank’s policy response to the viral outbreak – more interest rate cuts and above all a return to Quantitative Easing (QE).

• The Bank of England is targeting a £200 billion extension to its £445 billion QE programme that dates back to 2009 (and reopening the ‘Ways and Means’ overdraft scheme for the Government, which could be (mis)construed as blatant money printing and monetary financing of fiscal policy if it goes on for long)

• The European Central Bank is adding €750 billion to its QE scheme that already totals €2.1 trillion

• The US Federal Reserve had added $1.4 trillion to its balance sheet in the last three weeks alone, thanks to a laundry list of purchases that ranges from government bonds to investment-grade corporate debt to high-yield (junk) bonds, short-term commercial paper and asset-backed debt securities.

Source: Refinitiv data, FRED – St. Louis Federal Reserve database

“This ultra-loose monetary policy is persuading some investors to seek out what they consider to be stores of value and assets where supply is growing much more slowly than the supply of money or credit. That seems to be gold. The metal surged when the Fed launched QE1 back in late 2008 and gold surged all the through to its $1,900-an-ounce peak in 2011, only losing momentum as growth in the Fed’s balance sheet began to finally slow as the US economy gathered some sustained momentum.

Source: Refinitiv data, FRED - St. Louis Federal Reserve database

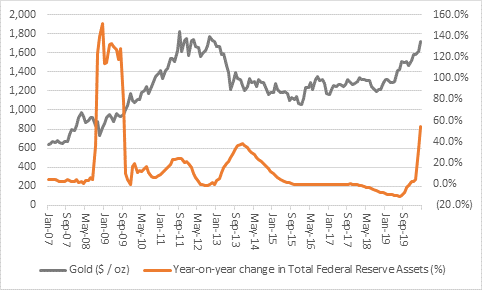

“The question now, therefore, is how loose will the Fed run monetary policy and for how long. The longer and looser it runs, in response to sustained economic weakness or financial market volatility, then the higher gold could go, at least if history is any guide.

“Equally, if the Fed is able to rein in policy fairly quickly that could provide reassurance to markets that it is on top of the situation and the US economy is primed to smartly bounce back. The Fed added ‘only’ $271 billion to its balance sheet in the week to 8 April (after $557 billion, $586 billion and $356 billion in the preceding three weeks) and if the pace slows markedly that could put a lid on gold.

“Should gold keep rising, however, then the miners’ gearing into those price gains mean their profits should rise much quicker, assuming costs are well managed. That is why the NYSE HUI Gold Bugs index has outperformed gold in dollar and pounds over the past year. The opposite also holds true – if gold prices drop back, as investors regain confidence in their policies and the global economic outlook, then that could again pressure the miners’ profits and cash flows and hit their share prices harder.”