“Whatever you think of the Trump administration’s preparations for a pandemic, one set of people who were not ready for such an event were those investors who piled into US equities in 2019 after the Fed starting cutting interest rates,” says Russ Mould, AJ Bell Investment Director. “This is not because they should have seen the viral outbreak coming but because they bid US equities up to valuation levels which left little or no room for earnings disappointment of any kind, whatever the reason. As a result, the S&P 500 has already lost $5.3 trillion of value and counting.

“The way in which US equities were trading at lofty valuations can be seen in two ways, both of which have stood the test of time.

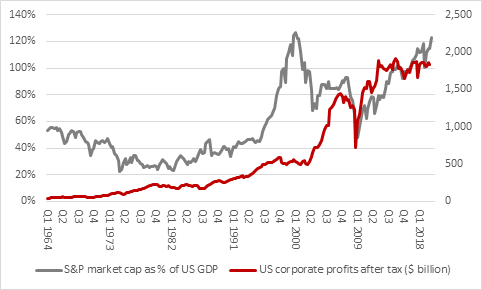

“First, the S&P 500’s market valuation as a percentage of US GDP soared above the 120% mark in late 2019, a level last seen at the peak of the tech bubble in early 2000. Worse, the index made its 30% gain last year even though US corporate profits barely grew, so investors needed earnings to start to advance sharply in 2020 simply to support last year’s big advance.

“In fact, US corporate profits have barely grown for four or five years, according to Federal Reserve data, certainly once you take out fripperies such as stock buybacks and other forms of financial engineering. Looked at from that perspective, US equities have been trading on the never-never for some time and any form of profit disappointment was going to leave them facing to a potential setback.

“You can also bet your bottom dollar than companies will now cut back on the buybacks, even though their shares are now cheaper and better value (which is when you should be buying, rather than at the top), as they look to preserve cash in the face of greater economic uncertainty.

Source: Refinitiv data, FRED – US Federal Reserve data

“Second, Professor Robert Shiller’s cyclically adjusted price earnings (CAPE) ratio has long since suggested US equities were expensive. Rather than valuing US stocks off one-year forward or two-year forward forecasts for earnings (as those forecasts can prove too conservative or too aggressive), the Shiller method look at the last ten years on a rolling basis.

“Using this approach, US stocks had only been as expensive twice before, in 1929 and 2000, and neither of those episodes ended well for investors at all.

Source: http://www.econ.yale.edu/~shiller/data.htm

“Valuation is not a great tool for timing markets – as Shiller’s work proves, as it has implied that US stocks have been expensive for some time – but it does show when greed has overtaken fear and investors’ only concern in the fear of missing out. These are the times that are most dangerous for markets as it leaves little downside protection should anything unexpectedly go wrong.

“This does not mean we are destined for a 1929 or 2000-style smash but it helps to explain why the US market has fallen so far quite so quickly.

“If the S&P loses just 33 more points and hits 2,709 then the index will slide into a bear market and end the bull run that began in March 2009. It would also be the fastest bear market fall in since the Second World War for the S&P 500, at just 21 calendar days from the high of 19 February.”

|

S&P 500 bear markets since 1950 |

|||||

|

Start |

Finish |

Duration (days) |

Start |

Finish |

Decline |

|

03-Aug-56 |

22-Oct-57 |

445 |

50 |

39 |

(22.0%) |

|

13-Dec-61 |

26-Jun-62 |

195 |

73 |

52 |

(28.8%) |

|

14-Feb-66 |

07-Oct-66 |

235 |

94 |

73 |

(22.3%) |

|

29-Nov-68 |

26-May-70 |

543 |

108 |

69 |

(36.1%) |

|

11-Jan-73 |

04-Oct-74 |

631 |

120 |

62 |

(48.3%) |

|

28-Nov-80 |

12-Aug-82 |

622 |

141 |

102 |

(27.7%) |

|

25-Aug-87 |

19-Oct-87 |

55 |

337 |

225 |

(33.2%) |

|

16-Jul-90 |

11-Oct-90 |

87 |

369 |

295 |

(20.1%) |

|

24-Mar-00 |

09-Oct-02 |

929 |

1,527 |

777 |

(49.1%) |

|

09-Oct-07 |

09-Mar-09 |

517 |

1,565 |

677 |

(56.7%) |

|

Average |

|

426 |

|

|

(34.4%) |

Source: Refinitiv data