This comes after an update on longevity trends published by influential academic Sir Michael Marmot in July 2017 suggested average life expectancy increases had “more or less ground to a halt”.

The latest warning of slowing life expectancy improvements is likely to stir controversy because the Government is preparing to accelerate increases in the state pension age. The state pension age for men and women is set to rise to 66 for men and women by 2020, before increasing to 67 by 2028 and 68 by 2039 – seven years earlier than under previous plans.

Labour, meanwhile, has promised to halt any increases in the state pension age beyond age 66 and commission a new review of the state pension age, “specifically tasked with developing a flexible retirement policy to reflect both the contributions made by people, the wide variations in life expectancy, and the arduous conditions of some work”.

Tom Selby, senior analyst at AJ Bell, comments:

“This latest report of stagnating improvements in UK average life expectancy will inevitably add fuel to the fire of the debate around raising the state pension age. Nobody wants to be told they are going to have to work for longer, particularly if they have a physically demanding or stressful job.

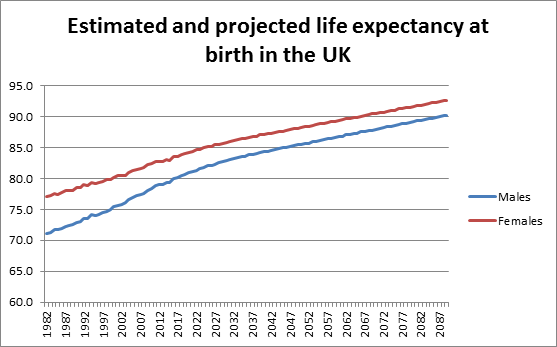

“However, the reality is the Government’s decision to increase the state pension age has been decades in the making and anyone desperately hoping for a Government U-turn shouldn’t hold their breath. When the modern state pension was introduced just after the Second World War, a 65 year old could expect to spend just over 13 years in receipt of it. By 2017, this figure had risen to almost 23 years.

“Furthermore, the latest official projections from the Office for National Statistics suggest the number of people over state pension age will grow by a third between 2017 and 2042 – although clearly these predictions are subject to revision.

“Anyone saving for retirement today needs to assume the state pension age will be pushed back and plan accordingly. Indeed, workers in their 20s and 30s probably need to prepare for a state pension age of 70 or even older by saving as much as they can, as early as they can, taking advantage of tax relief and matched contributions from their workplace scheme.”

Separately, the Office for National Statistics (ONS) has set out vast differences in the life expectancy of different groups in society. The data shows that the least deprived males at birth in 2014 to 2016 could expect to live almost a decade longer than the most deprived. For females the gap was just over seven years.

Selby comments: “The huge differences in life expectancy for different parts of society represent a massive challenge to policymakers and the UK pensions system more widely. Unfortunately, there are no easy answers. There is evidence a range of factors from wealth to lifestyle and geographic location have a bearing on how long someone might live in retirement, and how much they might receive from the state as a result.

“It is important we have an open and frank debate about the balance between simplicity and fairness in the state pension. Allowing people to access the state pension early at a reduced rate could help mitigate the disadvantage currently experienced by those with lower life expectancies, while the Government could also potentially allow unreduced access to the state pension after a set number of years’ National Insurance contributions. Both of these measures are worth considering, although neither is a silver bullet to end pension inequality overnight.”

Source: Office for National Statistics https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationprojections/compendium/nationalpopulationprojections/2015-10-29/mortalityassumptions